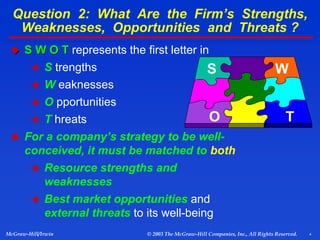

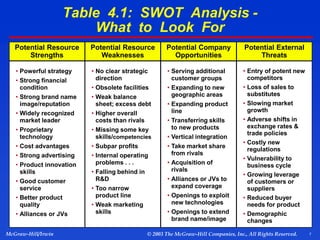

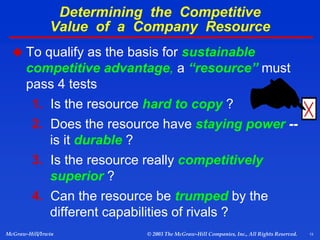

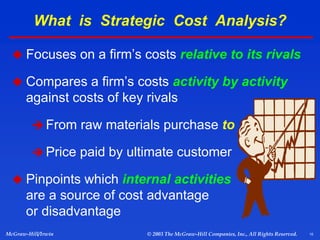

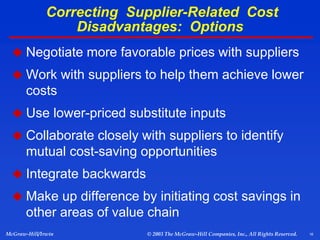

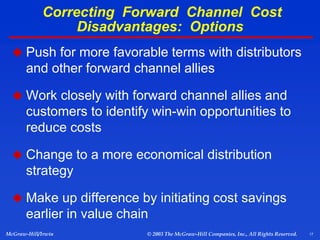

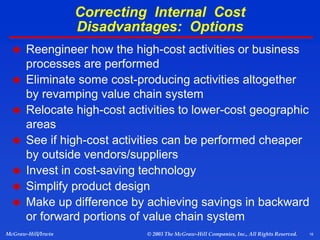

This document discusses evaluating a company's resources, capabilities, and competitive strategy. It covers identifying a company's strengths, weaknesses, opportunities, and threats through a SWOT analysis. Key parts of the analysis include determining core competencies, distinctive competencies, and correcting areas that result in higher costs compared to competitors through various options like negotiating prices, reengineering processes, or investing in cost-saving technology. The overall document provides a framework for assessing a company's internal resources and competitive positioning in the market.