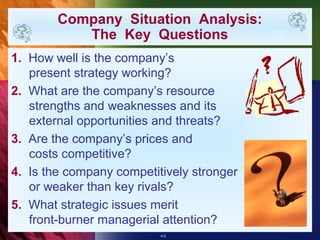

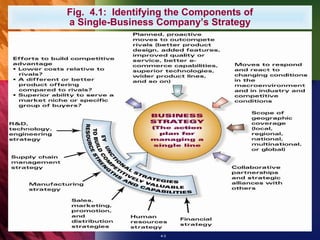

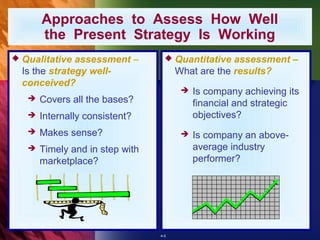

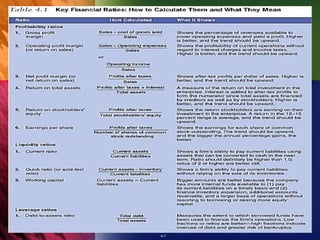

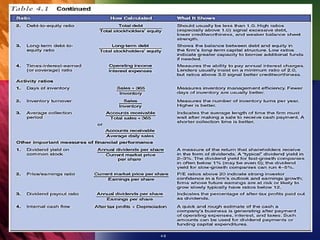

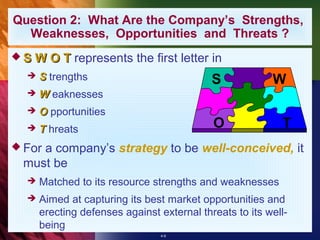

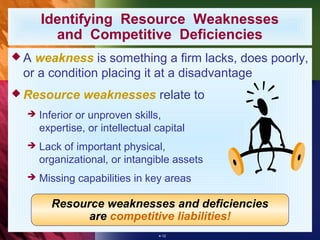

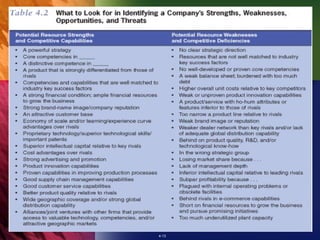

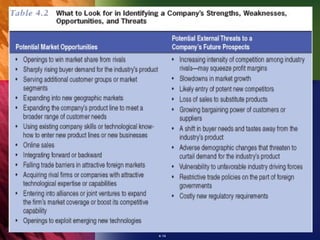

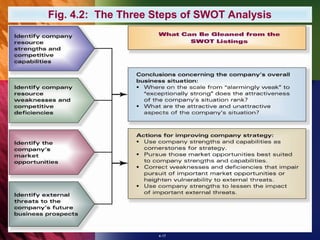

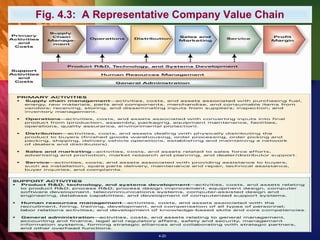

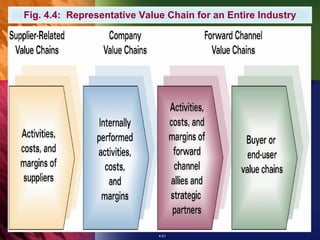

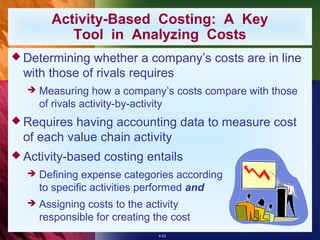

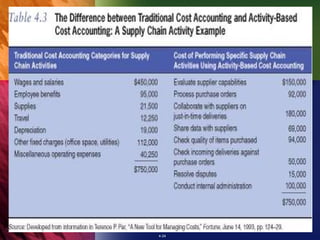

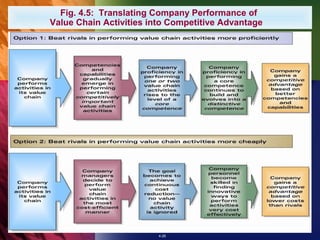

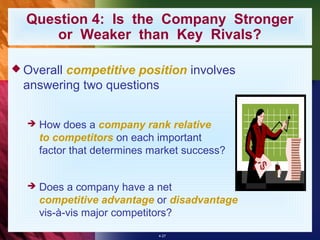

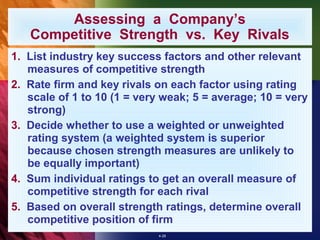

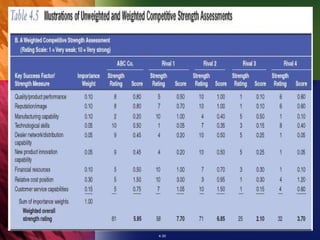

The document discusses evaluating a company's strategy, resources, competitive position, and costs relative to rivals. It provides questions to guide the analysis, including how well the current strategy is working based on qualitative and quantitative assessments, identifying the company's strengths, weaknesses, opportunities, and threats, assessing if prices and costs are competitive using value chain analysis and benchmarking, and determining if the company is stronger or weaker than key rivals by rating them on key success factors. The overall goal is to analyze different components of the company's situation to understand its competitive position.