This document discusses financial planning and whether it is better to do it yourself or work with a financial advisor. It outlines what financial planning involves, the benefits of working with an advisor, and what to expect from the financial planning process. Some key points are:

- Financial planning provides direction for financial decisions and considers short and long-term goals. It enables adapting to life changes and feeling more secure goals are on track.

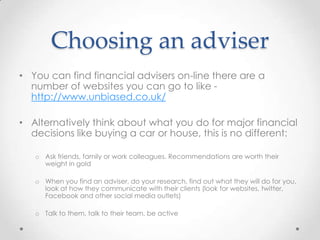

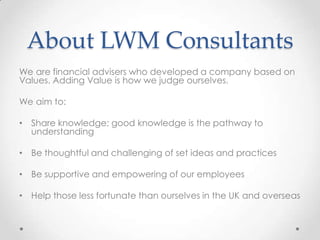

- Doing it yourself risks not considering the whole picture or having the expertise needed. Working with an advisor provides expertise, helps improve finances, and develops a long-term financial plan.

- Working with an advisor involves analyzing current situation and goals, developing recommendations, implementing the plan, and monitoring