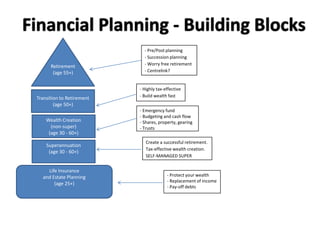

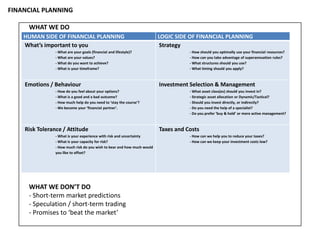

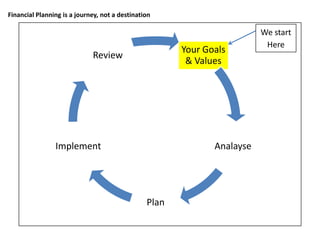

Financial planning involves building wealth for retirement through various strategies across one's lifetime. These include superannuation from age 30-60+, wealth creation such as shares and property from age 30-60+, transition to retirement from age 50+, and life insurance and estate planning from age 25+. Financial planning also considers an individual's goals, values, risk tolerance, taxes, and emotions to develop an optimal strategy for successful retirement and tax-effective wealth creation.