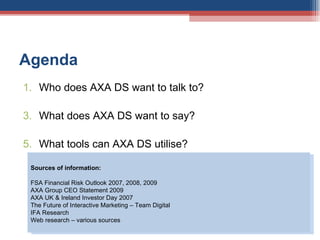

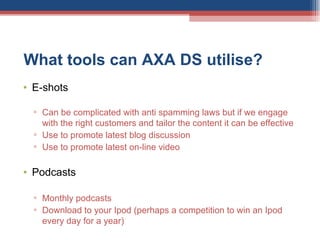

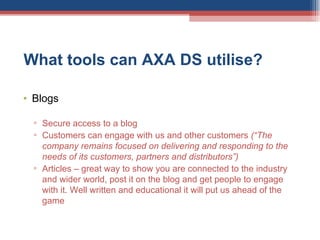

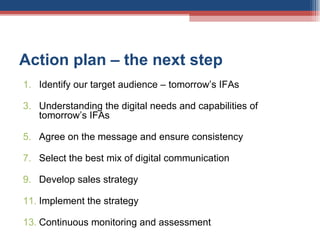

The document discusses how AXA DS can utilize digital communications to engage with insurance and financial advisors (IFAs) in the 21st century. It analyzes who AXA DS wants to target, what messages it wants to convey, and what digital tools it could use. It recommends focusing on smaller, independent IFAs who are open to new opportunities and transforming their businesses. Suggested tools include websites, e-newsletters, podcasts, blogs, and online videos to help IFAs improve client communications and learn about AXA DS's wrap platform in a relevant, engaging manner.