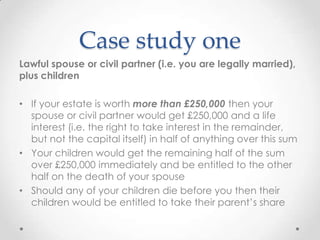

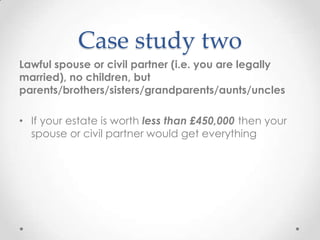

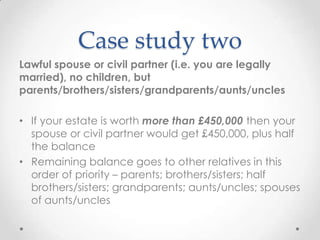

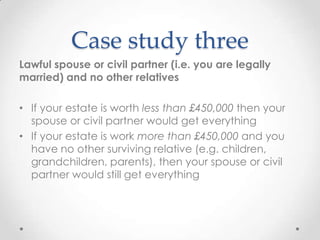

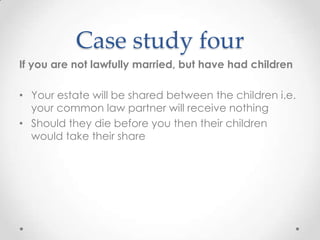

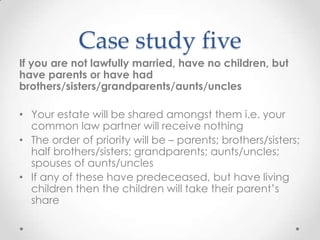

This document discusses intestacy rules and the importance of having a will. It provides 6 case studies that show how one's estate would be distributed without a will based on their marital status and whether they have children or other relatives. The document recommends making a will so one can choose who receives their money and assets. It addresses common reasons for not having a will, such as being too young or that it is too expensive, and provides options for creating an inexpensive will.