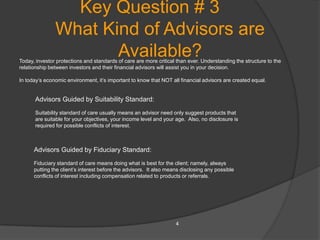

This document discusses 5 key questions to ask when choosing a wealth advisor: 1) What kind of services are needed? 2) What level of service is best - self-directed, professionally managed, or both? 3) What kinds of advisors are available - those guided by suitability standard or fiduciary standard? 4) Is the advisor competent, with experience preferred over just designations? 5) How is the advisor compensated - fee-only, fee-based, fee-plus-commission, or commission-only? The document aims to help individuals understand their options and find an advisor that best fits their needs.