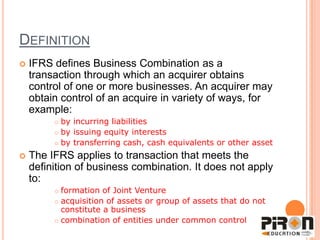

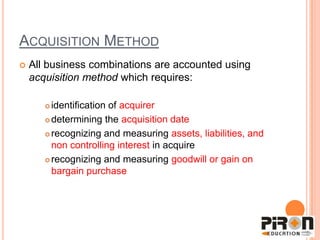

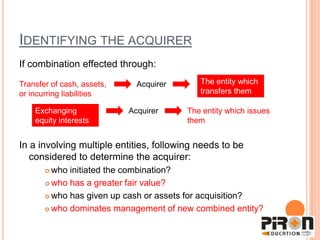

IFRS 3 defines a business combination as a transaction where an acquirer obtains control of one or more businesses, which can occur through various means like incurring liabilities or issuing equity. All business combinations must be accounted for using the acquisition method, which involves identifying the acquirer, determining the acquisition date, and recognizing and measuring assets, liabilities, and goodwill. The recognition of assets and liabilities requires that their future economic benefits or obligations can be reliably measured.