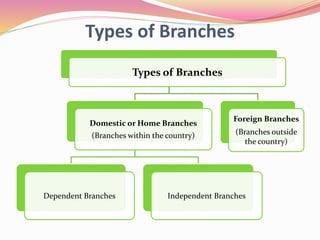

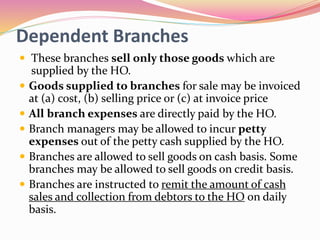

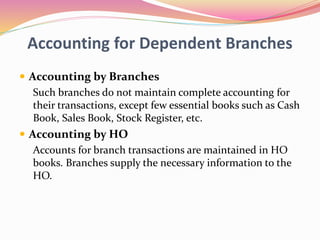

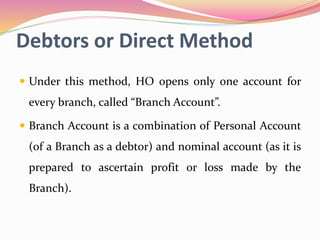

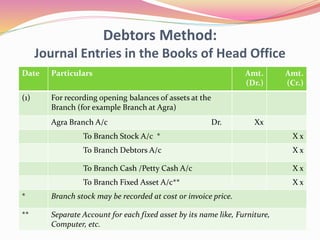

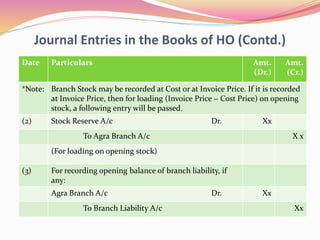

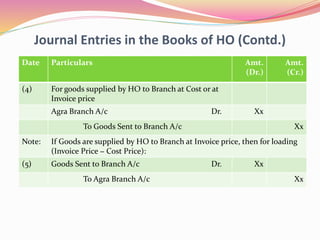

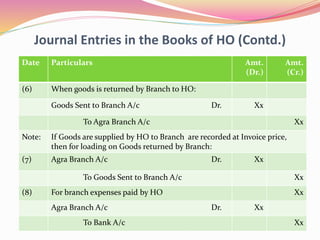

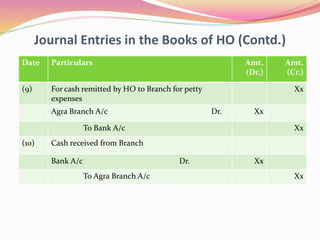

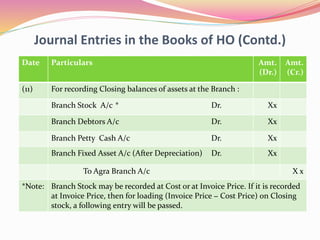

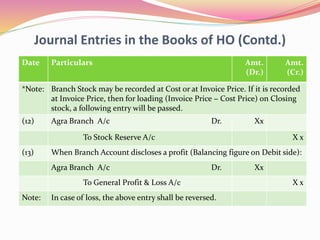

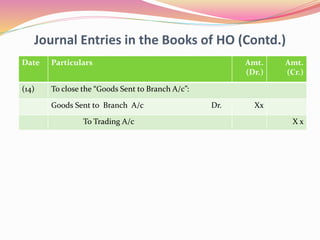

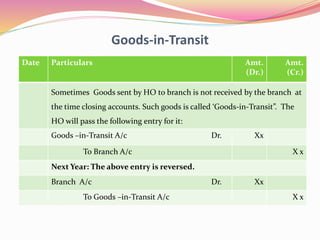

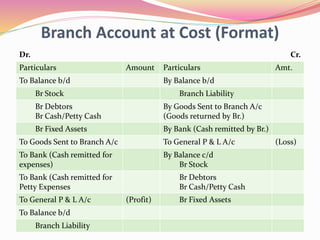

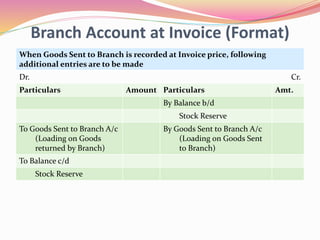

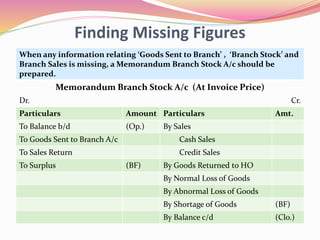

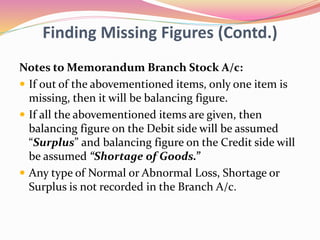

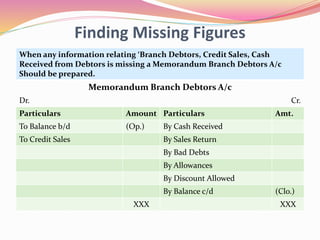

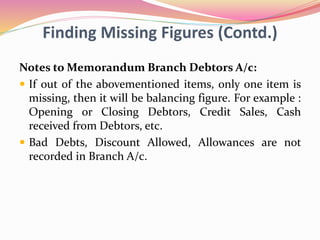

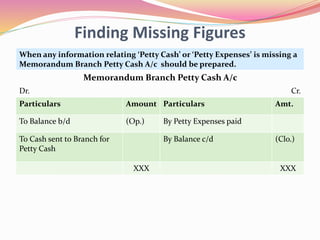

The document discusses branch accounting for business firms, detailing the types of branches, specifically dependent and independent branches, and their transaction processes. It explains the accounting methods used for dependent branches, notably the debtors or direct method, with illustrative journal entries for various transactions involving the head office and branches. Additionally, it covers how to resolve missing figures through memorandum accounts for stock, debtors, and petty cash.