FM CH 4.pptx best presentation for financial management

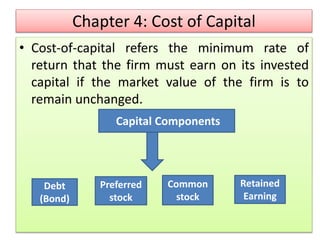

- 1. Chapter 4: Cost of Capital • Cost-of-capital refers the minimum rate of return that the firm must earn on its invested capital if the market value of the firm is to remain unchanged. Debt (Bond) Preferred stock Common stock Retained Earning Capital Components

- 2. CONT’D The cost of each component of capital is called component/specific cost of capital. The overall cost of capital is called weighted average cost of capital which a minimum rate of return that must be earned on the entire investments.

- 3. Specific cost of Debt • Computation of the cost of debt capital is based on the characteristics of bonds. • The computation of the specific cost of debt (bond) involves three steps 1. Determine the net proceeds per bond (Par Value - Selling /flouting costs ) 2. Determine the effective before-tax cost-of- debt (Kd) 3. Compute after-tax specific cost of debt It is computed as T= Tax rate Kd (1-T)

- 4. CONT’D Example : The corporation is to issue a bond with a par value of $ 1000,carries a coupon interest amount of $120 and is expected to mature in 25 years of time as well as the tax rate is 30%.

- 5. The Specific Cost of Preferred Stock • When a business firm sells preferred stock, it expects to pay fixed dividends to investors (preferred stock holders) in the return for their investment. • specific cost of Preferred share(Kps) = Dps= Dividend per share Pn= Net proceed

- 6. Example The firm sells the preferred stock for $ 110 per share and pays a $10 selling (flotation costs) per share. Compute the specific (component) cost of capital of preferred stock. Dividend amount is known to be$ 5

- 7. Specific cost of common stock The specific cost of capital of common stock is the minimum rate of return that the business firm must earn for its common shareholders investment. g=annual compound rate growth of dividend D= Dividend Pn= net proceed Ke = Do (1+g) + g Pn

- 8. Example Assume that the firm is selling common stock to potential investors in the country. The price of the common stock is $ 110 with flotation cost of $ 10. The current dividend of the firm’s common share is $ 10 per year and it is expected to grow at 10 % annual compound rate. Compute the specific cost of capital for common stock

- 9. Specific Cost of Retained Earnings The nature of the retained earnings brings two difficulties to compute the cost of capital Retained earnings are not securities A tendency to equate the specific cost of retained earnings with zero

- 10. CONT’D Kr = Do (1+g) + g g=annual compound rate Po growth of dividend D= Dividend Po= par value

- 11. Example Assume that the firm is selling common stock to potential investors in the country. The price of the common stock is $ 110 with flotation cost of $ 10. The current dividend of the firm’s common share is $ 10 per year and it is expected to grow at 10 % annual compound rate. Compute the specific cost of capital for common stock

- 12. Weighted Average Cost-of-Capital (WACC) A minimum rate of return that must be earned on the entire investments of the firm. WACC is calculated either based on the book values or market values of the sources of capital.

- 13. 1. Book Value Method • This method uses the financial records of the company. • The following three steps are needed to compute WACC based on book value method 1. Find the percentage of each long-term capital provided by each financing source (Book value %). 2. Multiply each capital percentage by its specific (component) cost of capital. 3. Add the products you have computed under step 2.

- 14. Example ABC Company Source of capital Book value Specific cost of capital 9% Bonds, $1000 par $30,000,000 5%, or 0.05 100,000 Shares, $ 100 par $ 10,000,000 8.0%, or 0.080 Preferred Stock Common stock, 800,000 $40,000,000 11.0% or 0.110 Shares, $ 50 par Retained earnings $20,000,000 10 %, or 0.10 $ 100,000,000 Required Compute WACC based on book value method

- 15. 2. Market Value Method WACC in this method reflects the rate of return currently required by investors rather than the historical rate. Example: Consider the previous illustration to compute WACC using Market value method. The market value of the bond is 90% of its book value, the preferred stocks and common stocks are being sold for $110 and $ 80 respectively.

- 16. Marginal Cost of Capital (MCC) When the additional capital comes from more than one source , the weighted average cost of capital of the new fund is called the weighted marginal cost of capital ( WMCC) The cost of capital of the additional fund is called Marginal Cost of Capital (MCC)

- 17. Example XYZ Company Source of capital Book value Specific cost of capital Bonds $30,000,000 7 %, or 7 Common stock $50,000,000 12.0% or 0.12 Retained earnings $20,000,000 11%, or 0.11 $ 100,000,000 Required Suppose the firm plans to raise an additional fund of $50 million to finance its new project: $ 20 million from bond selling, $20 million from common stock and $ 10 million from retained earning. The specific cost of capital for the bond, common stock and retained earning are, 7%, 13% and 12% respectively.

- 18. CONT’D Required Calculate WACC based on Book value method Calculate the WMCC for additional fund Calculate the WACC after acquiring the additional fund

- 19. Exercise XYZ Company Source of capital Book value Specific cost of capital Bonds $30,000,000 6.4%, or 0.064 Common stock $50,000,000 12.0% or 0.12 Retained earnings $20,000,000 11.5%, or 0.115 $ 100,000,000 Required Suppose the firm plans to raise an additional fund of $10 million to finance its new project: $ 3 million from bond selling, $5 million from common stock and $ 2 million from retained earning keeping the specific cost of capital constant.

- 20. CONT’D Required Calculate WACC based on Book value method Calculate the WMCC for additional fund Calculate the WACC after acquiring the additional fund

- 21. End of Chapter 4