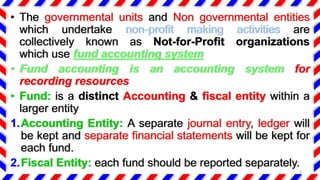

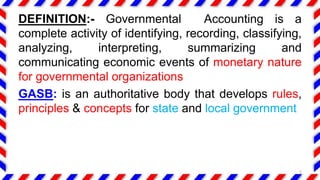

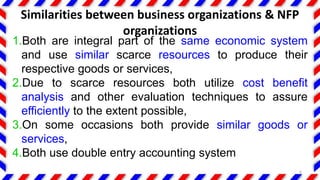

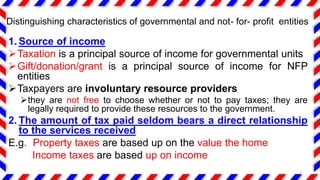

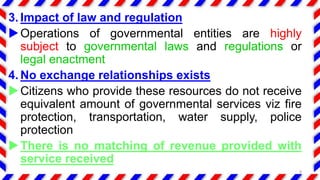

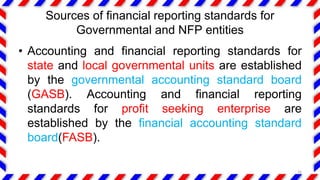

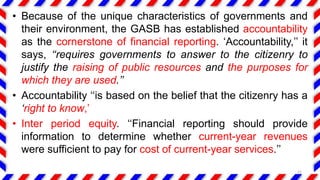

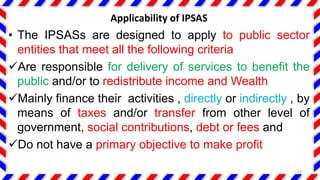

1. The document discusses accounting standards and financial reporting for governmental and non-profit entities. It covers topics such as the objectives of financial reporting, differences between business and non-profit organizations, and accounting standards setting bodies like GASB, FASB, and IPSASB.

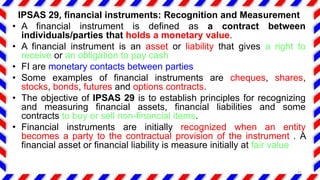

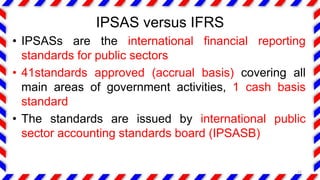

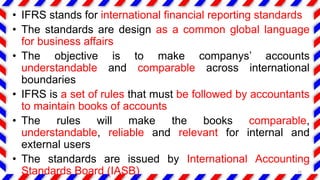

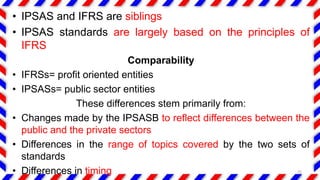

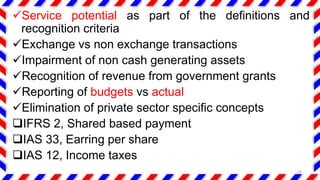

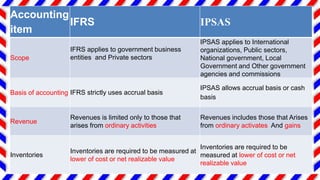

2. Key standards discussed include IPSAS, which are the international standards for public sector accounting, and IFRS which are the standards for private sector companies. The document compares IPSAS and IFRS, noting areas where IPSAS has adapted IFRS principles for the public sector context.

3. Recognition and measurement of assets, revenues and other accounting items are also compared between IPSAS and IFRS standards.

![The Conceptual Framework for Public Sector

Accounting [The IPSASB]

The Conceptual Framework is a body of interrelated

objectives and fundamentals. The objectives identify the

goals and purposes of financial reporting and the

fundamentals are the underlying concepts that help achieve

those objectives. The conceptual framework is composed of a

basic objective, fundamental concepts, and recognition,

measurement, and disclosure concepts.

The objectives of financial reporting by public sector entities

are to provide information about the entity that is useful

to users of GPFRs for accountability purposes and for

decision-making purposes

29](https://image.slidesharecdn.com/govtnfpaccounting-ch1-240404180407-e378dad1/85/Govt-NFP-Accounting-Ch1-pptx-presentation-29-320.jpg)

![The Conceptual Framework for Public Sector

Accounting [The IPSASB]

IPSAS 22, Disclosure of financial information

about the general government sector

• What Is Disclosure? In the financial world,

disclosure refers to the timely release of all

information about a company that may

influence an investor's decision. It reveals both

positive and negative news, data, and operational

details that impact its business.

30](https://image.slidesharecdn.com/govtnfpaccounting-ch1-240404180407-e378dad1/85/Govt-NFP-Accounting-Ch1-pptx-presentation-30-320.jpg)