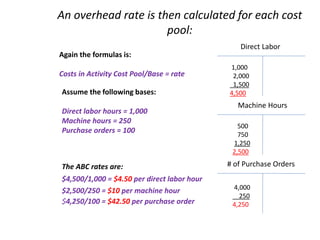

This document discusses traditional costing systems and activity-based costing (ABC). Traditional systems allocate overhead based on a single rate like direct labor hours, which can over- or under-cost complex products. ABC allocates overhead using multiple cost drivers like direct labor hours, machine hours, and purchase orders. It calculates overhead rates for each activity cost pool and allocates costs to products based on their usage of each activity. ABC provides a more accurate allocation of overhead costs than traditional methods when production is complex.