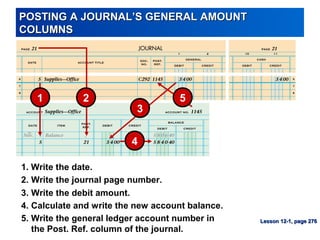

This document provides an overview of posting transactions to general and subsidiary ledgers. It defines key terms like subsidiary ledger, accounts payable ledger, and controlling account. It also provides examples of how to post transactions to the general ledger, accounts payable ledger, and accounts receivable ledger. Specifically, it shows how to record debits, credits, balances, and journal references in the appropriate ledgers. It concludes with a discussion of proving the accounts payable and accounts receivable ledgers using schedules of accounts.