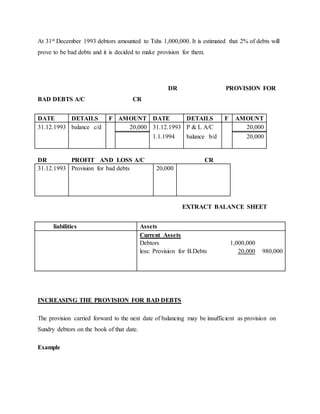

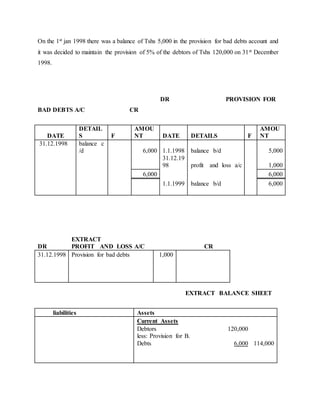

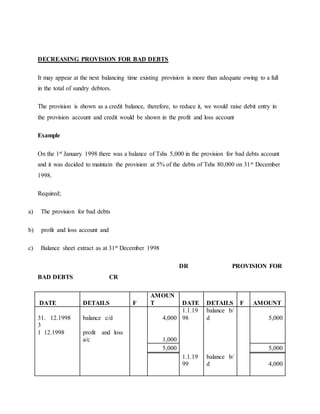

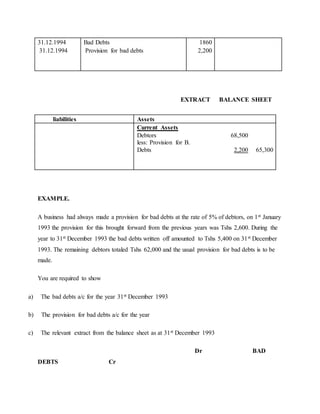

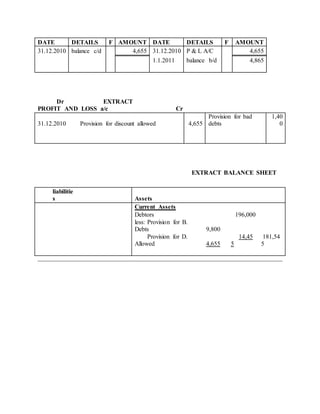

The document discusses provisions for bad debts and doubtful debts. It provides examples of accounting entries for bad debts, provisions for bad debts, increasing or decreasing provisions based on changes in debtors balances. It also discusses provisions for discounts on debtors to account for potential discounts customers may receive upon payment. Key points covered include debiting bad debts and provisions to the profit and loss account, and extracting relevant balances for debtors, provisions for bad debts and discounts in the balance sheet.

![PROVISIONS

BAD DEBTS AND PROVISION FOR BAD DEBTS / PROVISION FOR DOUBTFUL

DEBTS

If a firm finds it is impossible to collect a debt that should be written as bad debt.

BAD DEBTS

Are risks which are under taken when some of the customers [debtors] fail to pay their debts.

The debts failed to be paid are the expenses for the firm and transferred to the profit and loss

account.

Example

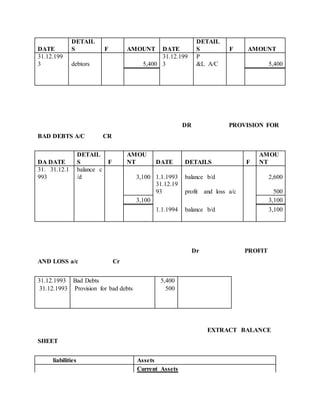

Goods sold to C. Chacha on 5th Jan 1995 Tshs 900, he had become bankrupt. On 16th Feb 1995

also the goods sold to R magembe for Tshs 2400, he managed to pay 2,000 on 17th may 1995 but

he would never be able to pay the final Sh. 400.

DR C.

CHACHA A/C CR

DATE DETAILS F AMOUNT DATE DETAILS F AMOUNT

5.1.1995 sales 900 31.12.1995 bad debts 900

DR MAGEMBE

A/C CR

DATE DETAILS F AMOUNT DATE DETAILS F AMOUNT

5.1.1995 sales 2,400 31.12.1995 cash 2,000

bad Debts 400

2,400 2,400](https://image.slidesharecdn.com/provisions-220201133311/85/Provisions-1-320.jpg)