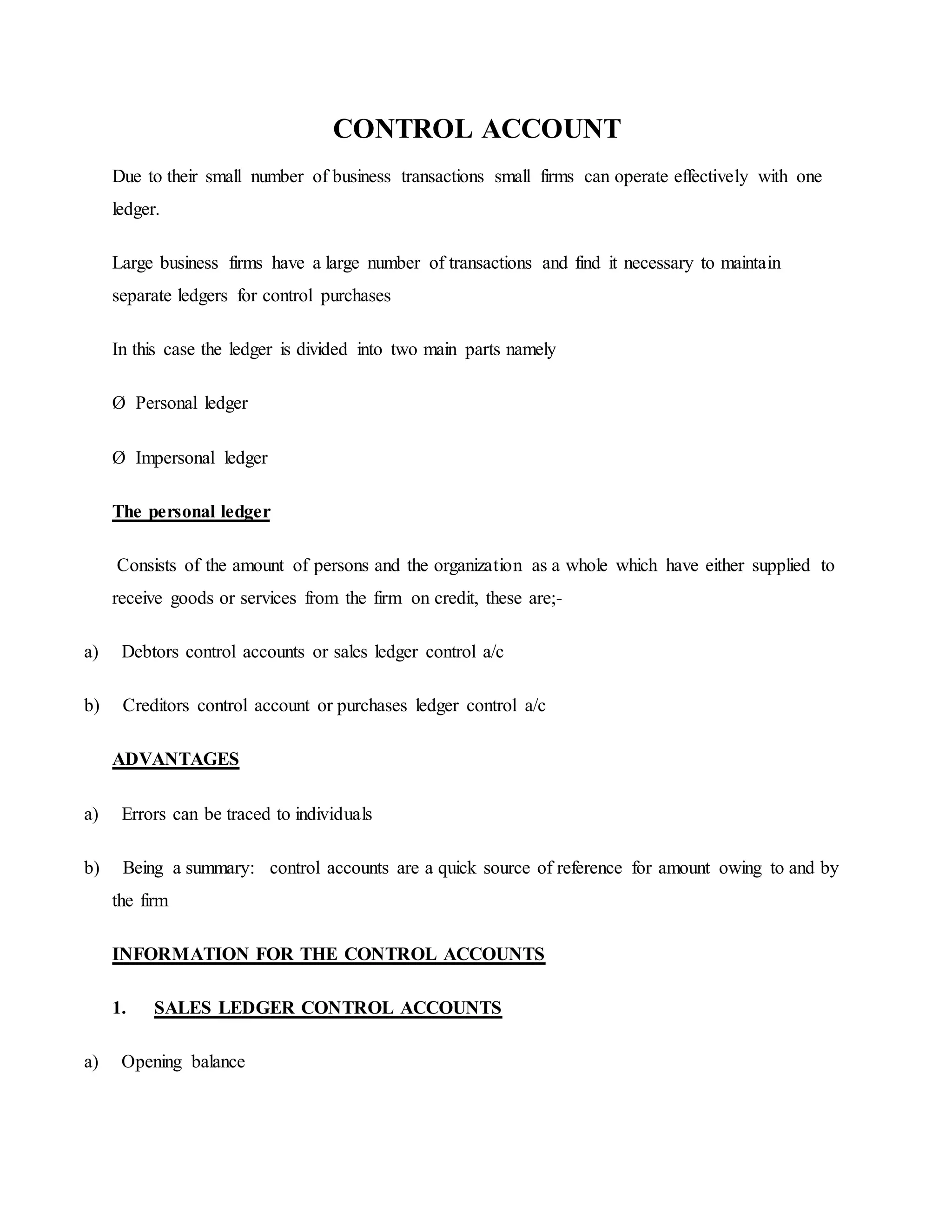

- The document discusses control accounts used by large businesses to manage transactions between the firm and its customers (sales ledger) and suppliers (purchases ledger).

- Control accounts act as a summary of amounts owed to and by the firm. They are constructed by recording transactions such as sales, purchases, cash receipts/payments, returns, and discounts in a ledger account.

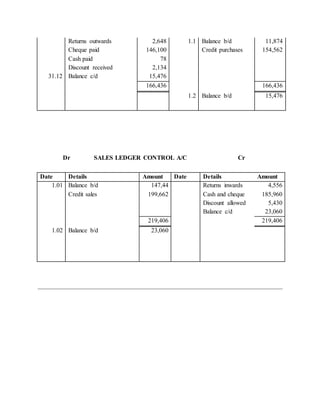

- Examples are provided of constructing sales and purchases ledger control accounts from sample transaction data. Exercises are also given for learners to practice preparing control accounts.

![Refund on

over due

xxx Set off

[purchase

ledger]

xxx

Balance

c/d

xxx

xxxx xxxx

Balance

c/d

xxx

Example

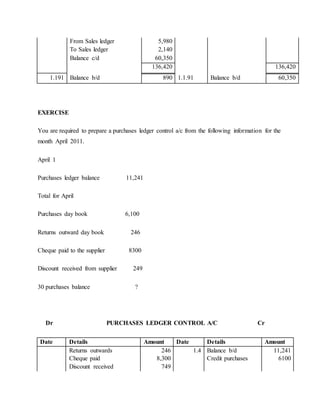

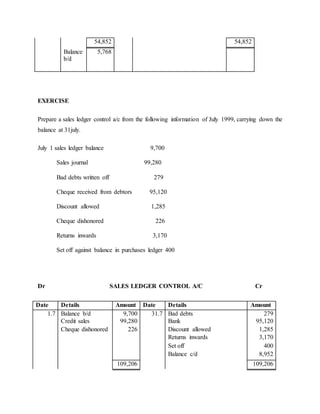

You are required to prepare a sales ledger control a/c from the following details May 1st sales

ledger balance 4,936

31 returns inwards journal..............................1,139

Sales journal ................................................49,916

Cash and cheque received from customers .....46,490

Discount allowed ......................................1455

May 31 sales ledger balance C/D ................... 5,768

Dr SALES LEDGER CONTROL

A/C Cr

D Date Details Amount Date Details Amount

1.5 Balance

b/d

4,936 31.5 Returns inwards 1139

Credit

sales

49,916 Discount allowed 1,455

Cash /bank received 46,490

Balance c/d 5,768](https://image.slidesharecdn.com/controlaccount-220201132633/85/Control-account-3-320.jpg)

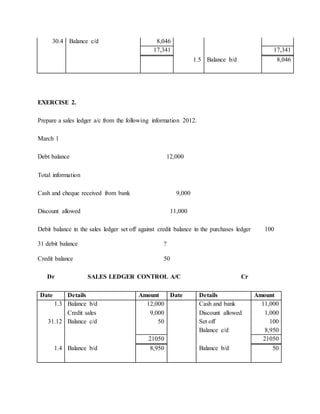

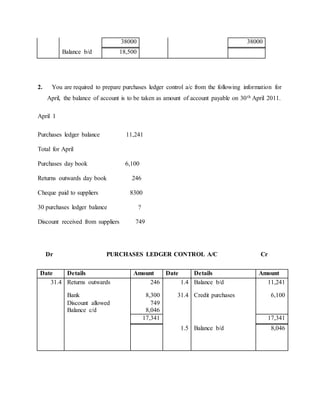

![EXAMPLE

The following figures were taken from the books of gold company limited 1st January 1990

Balance on sales ledger Dr 112,320

Balance on sales ledger Cr 1,470

Balance on purchases ledger Dr 1,180

Balances on purchases ledger CR 72,280

Transaction up 31st December 1990

Sales to customers on credit 108,450

Cash sales during the year 20,000

Purchases on credit for supplier 63,250

Cash purchase 30,000

Allowances made to customers 1,870

Goods returned to suppliers 1,230

Cash received from customer 96,450

Bad debts [written off] 850

Discount allowed to customer 4,960

Discounted allowed by supplier 4,120

Cash paid to the supplier 61,420

Cash paid to customer 250](https://image.slidesharecdn.com/controlaccount-220201132633/85/Control-account-9-320.jpg)