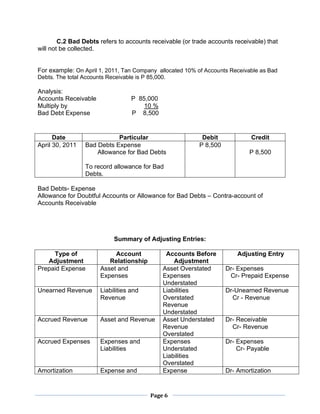

1. Adjusting entries are journal entries recorded at the end of an accounting period to match incomes and expenses to the appropriate periods. They involve at least one income statement account and one balance sheet account.

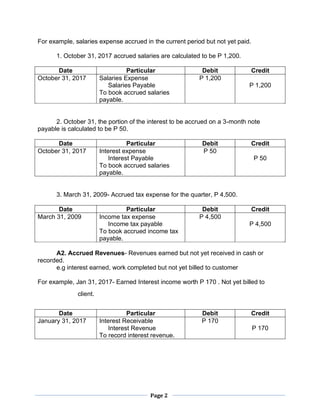

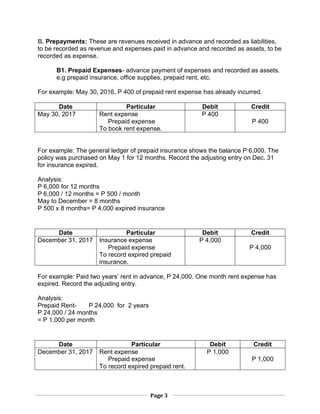

2. There are several types of adjusting entries including accruals, which record revenues/expenses earned/incurred but not yet received/paid, and prepayments, which record expenses/revenues paid/received in advance.

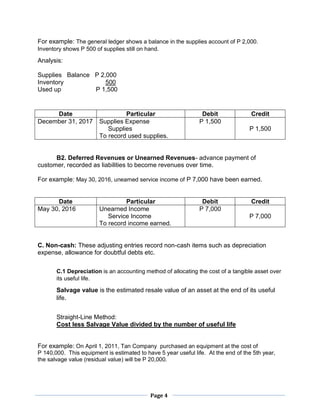

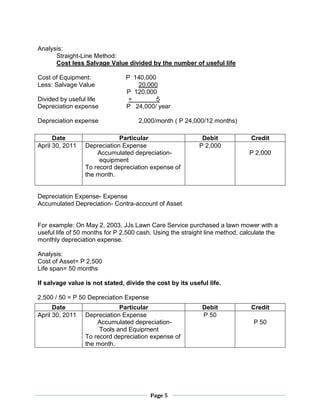

3. Other adjustments include deferrals that shift revenues between periods, and non-cash items like depreciation that allocate the cost of assets over their useful lives.