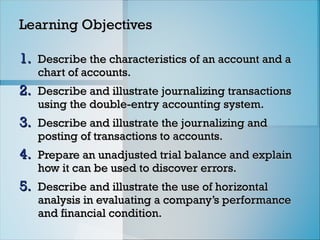

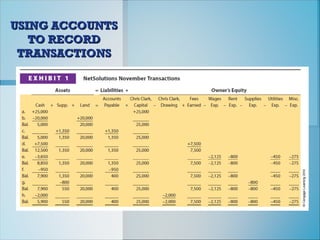

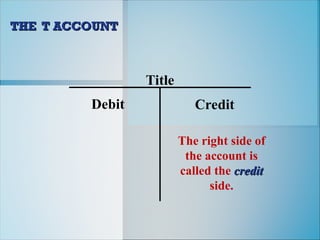

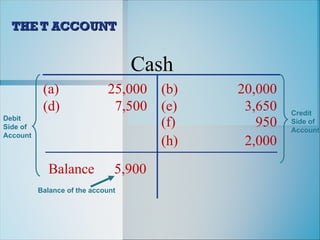

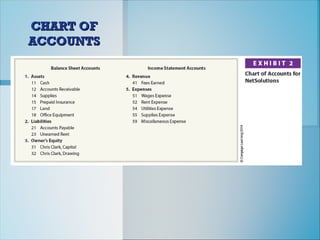

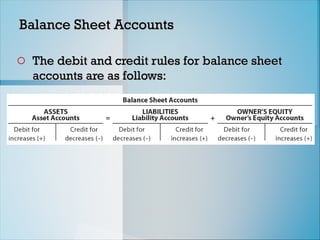

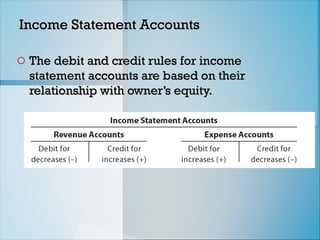

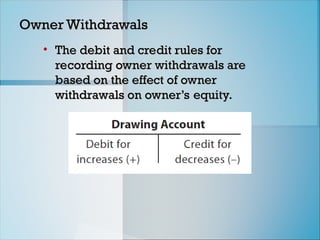

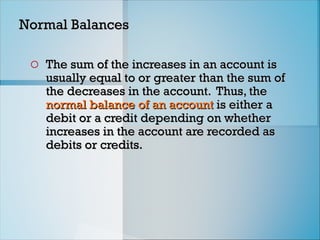

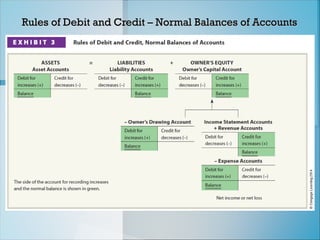

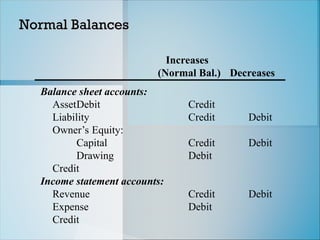

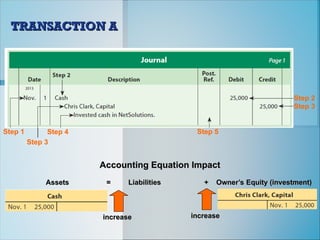

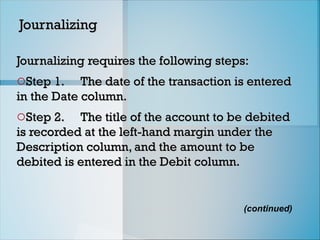

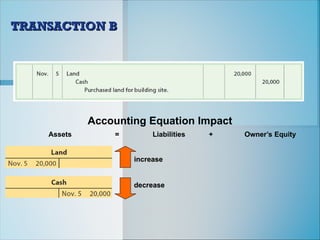

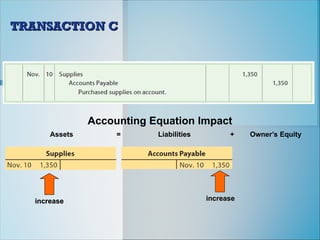

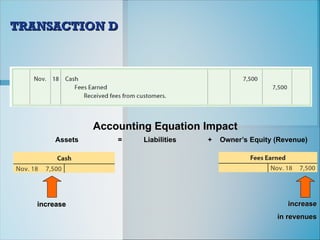

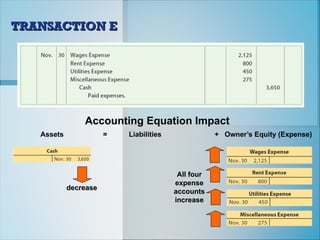

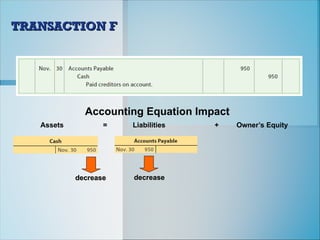

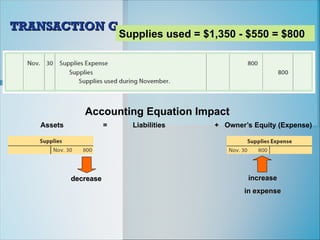

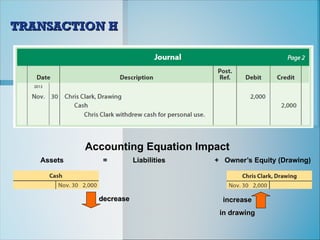

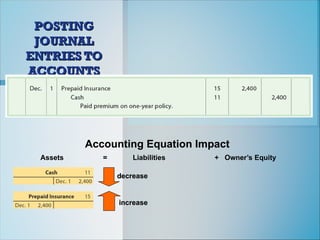

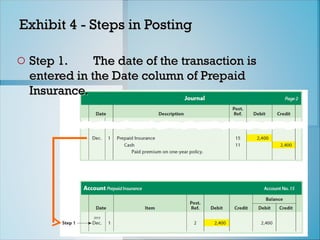

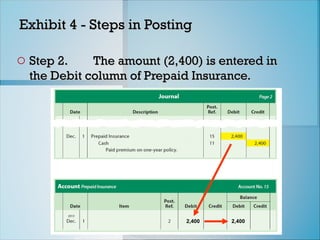

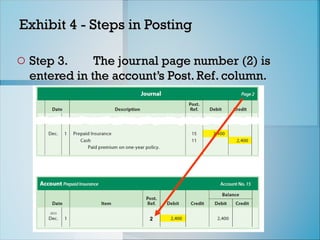

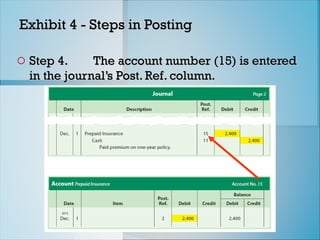

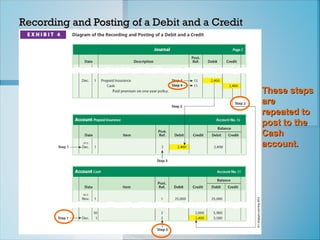

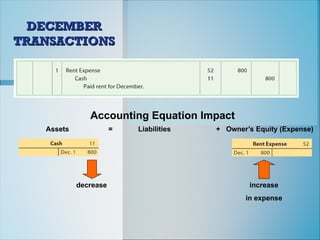

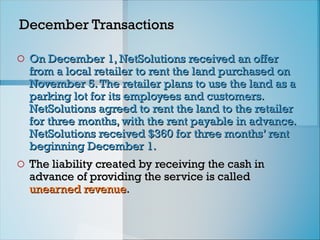

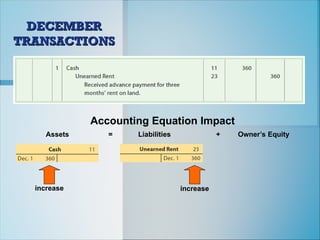

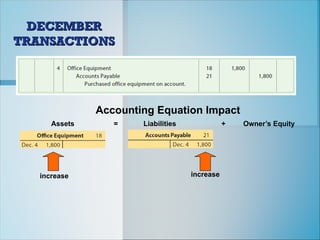

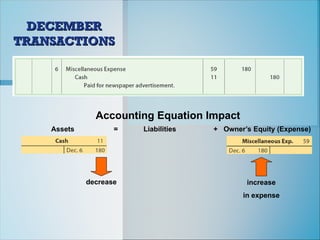

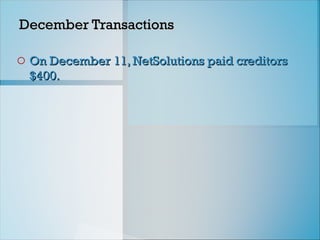

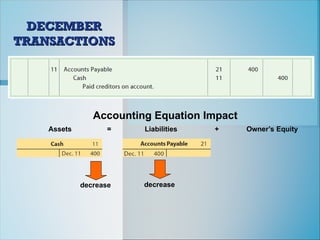

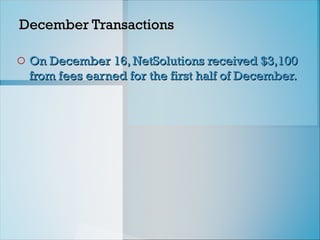

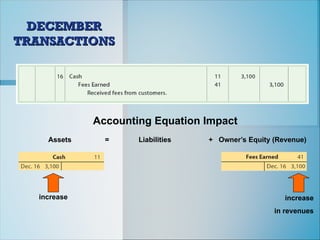

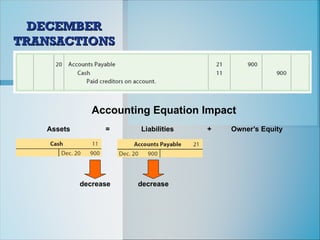

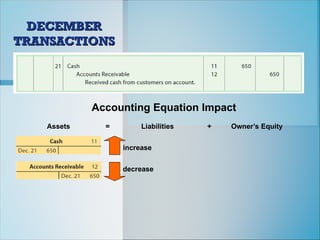

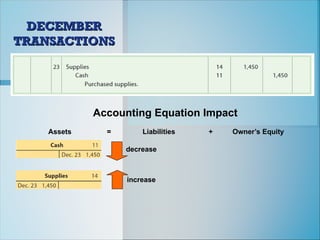

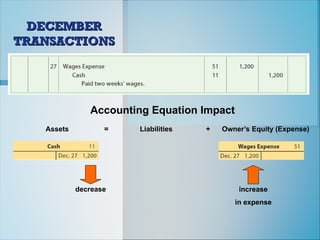

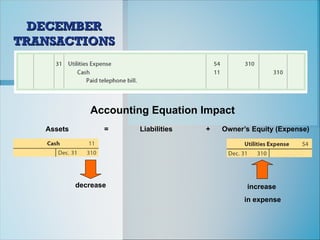

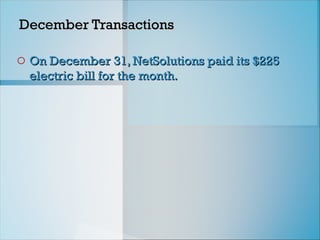

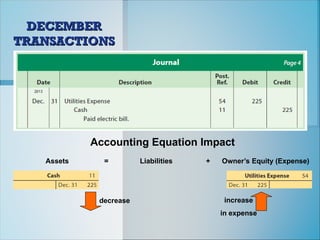

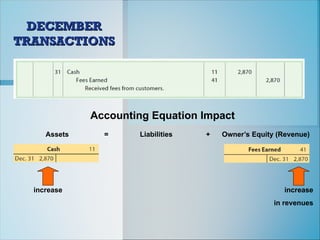

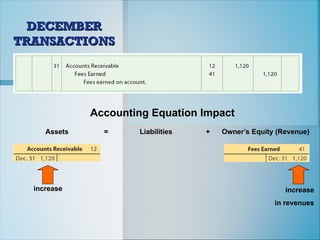

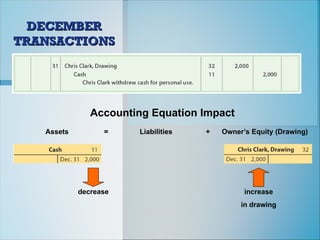

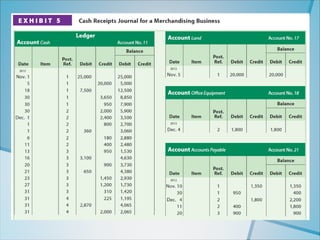

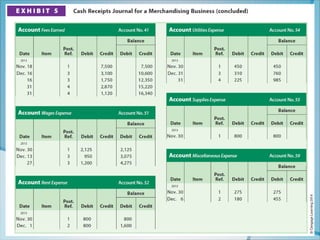

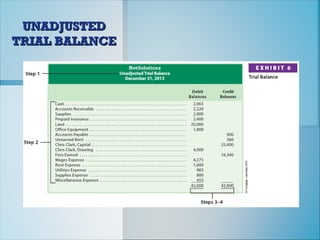

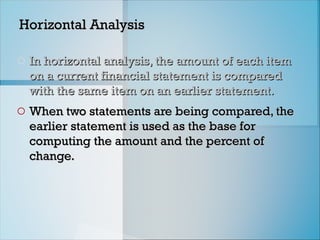

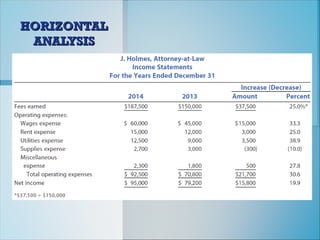

The document outlines accounting principles focused on analyzing transactions, detailing characteristics of accounts, chart of accounts, and illustrating journalization and posting of transactions using the double-entry accounting system. It explains the definitions of assets, liabilities, owner’s equity, revenues, and expenses, and includes examples of various transactions and their impact on the accounting equation. Additionally, it covers the process of preparing an unadjusted trial balance and the significance of horizontal analysis in evaluating company performance.