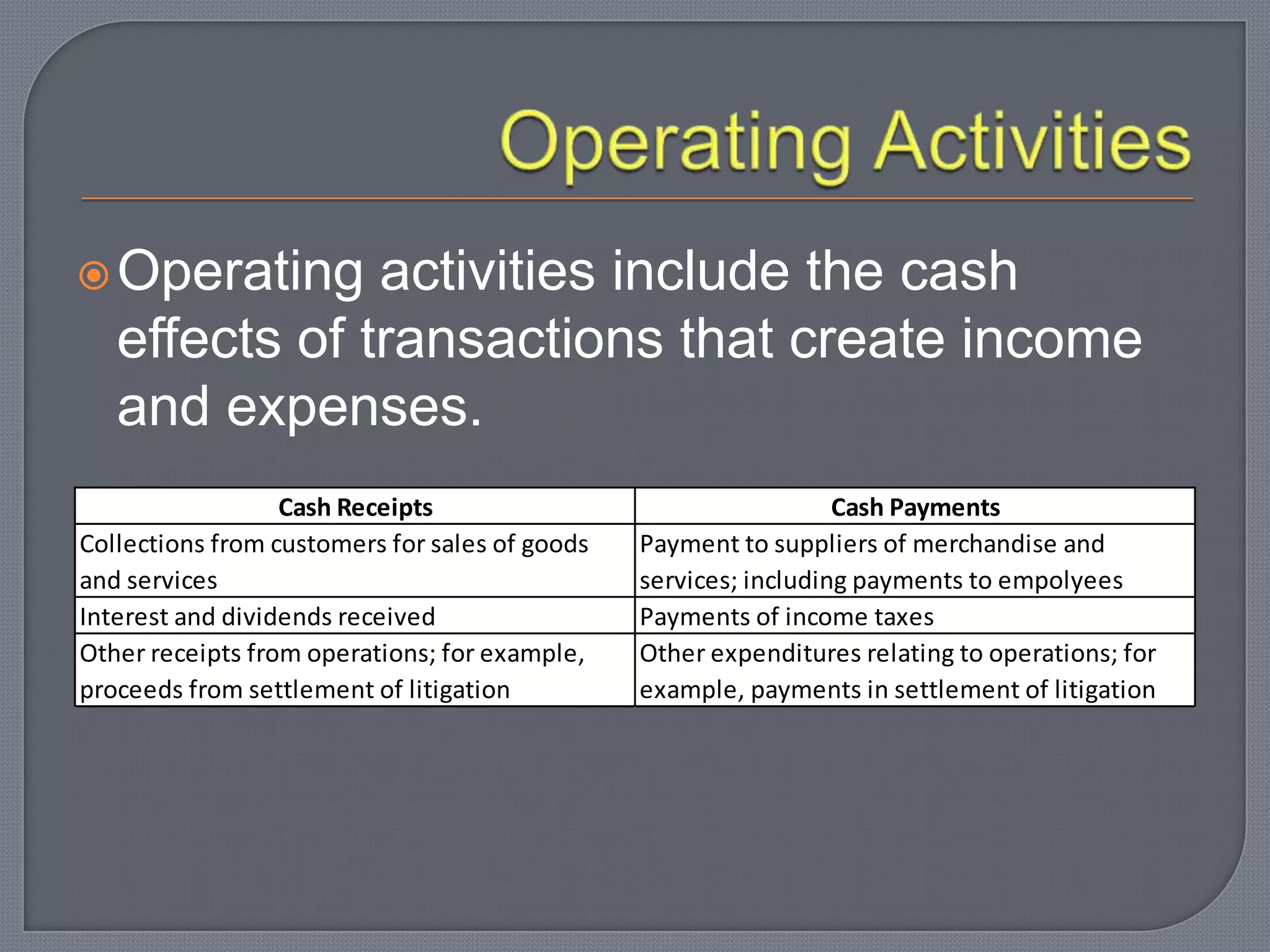

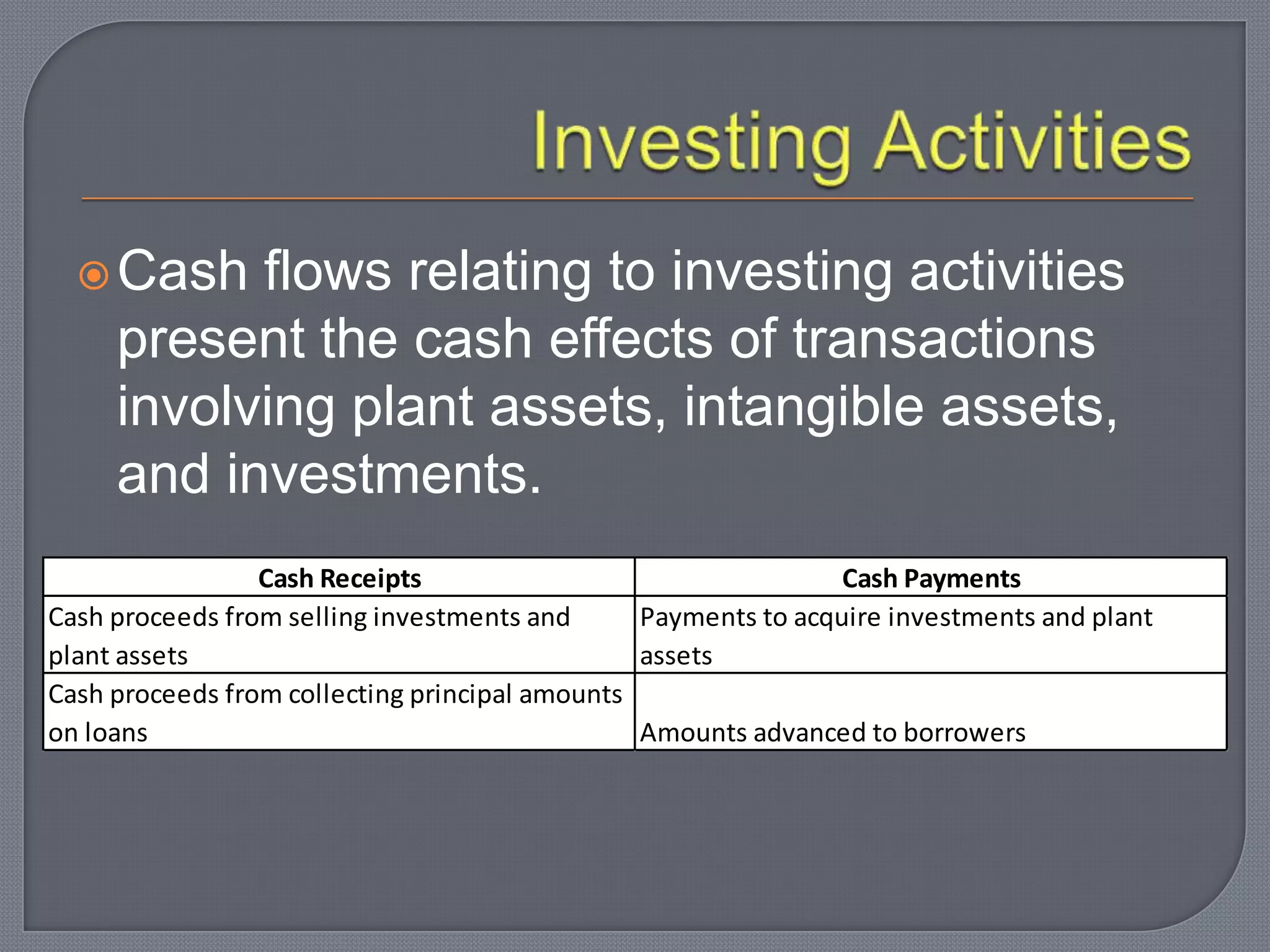

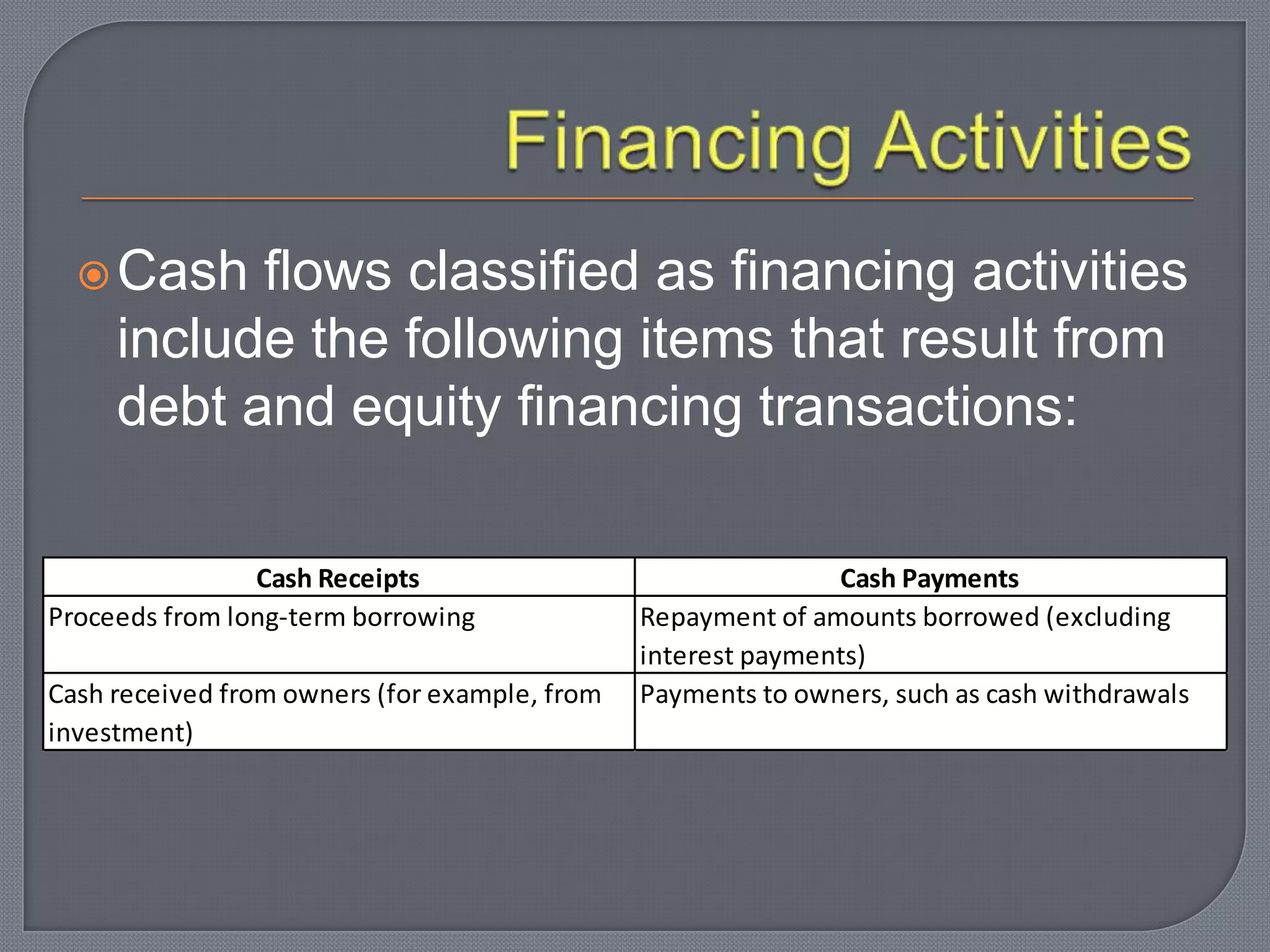

The document discusses the statement of cash flows, which reports cash receipts, payments, and changes in cash from operating, investing, and financing activities. It helps assess a company's ability to generate cash flows, pay dividends, and meet obligations. Operating activities include cash effects from transactions that create income and expenses. Investing activities present cash flows from transactions involving assets and investments. Financing activities include cash flows from debt and equity transactions like borrowing and payments to owners. The direct method identifies specific cash activities by category, while the indirect method starts with net income and reconciles to operating cash flows.