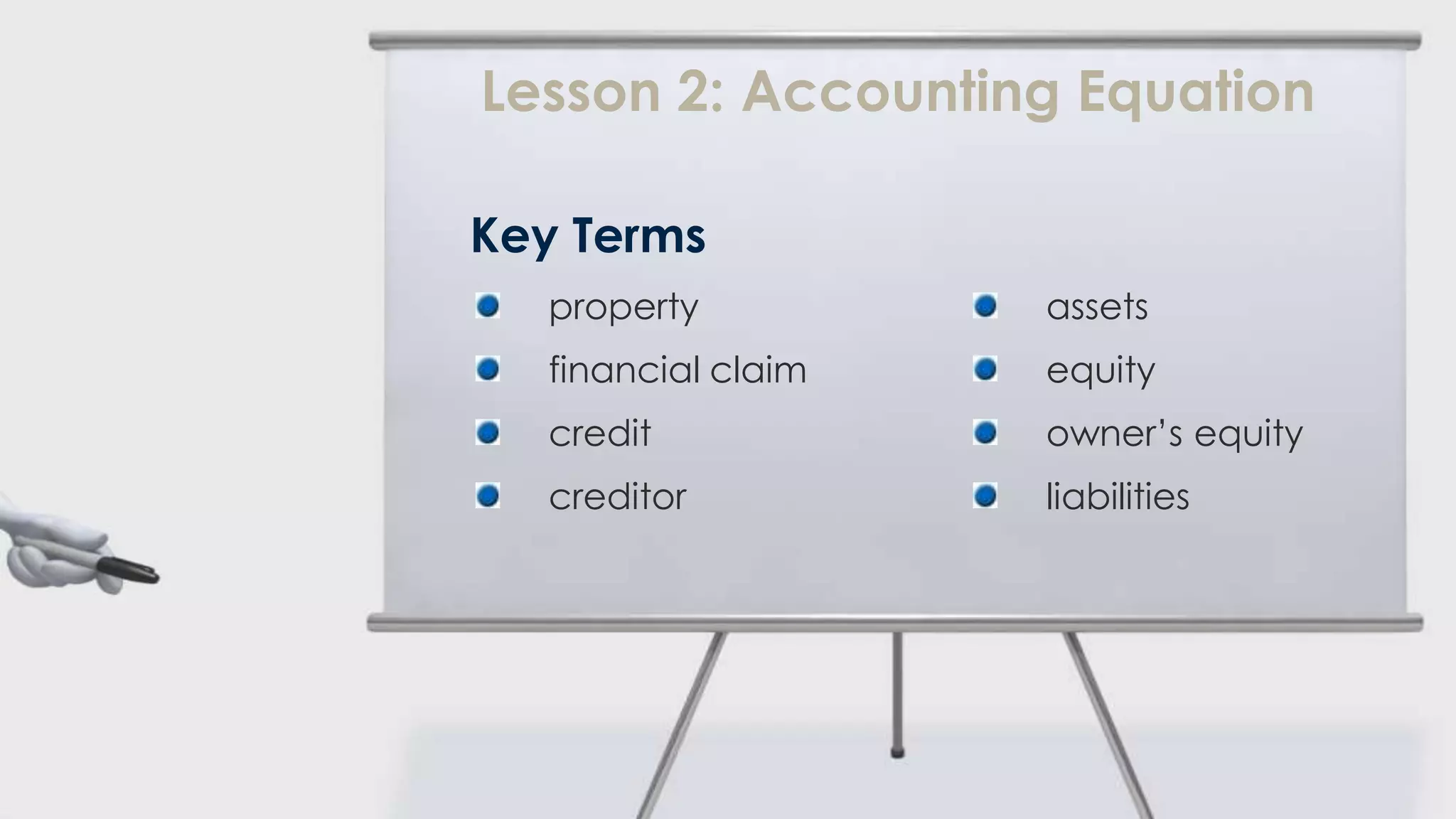

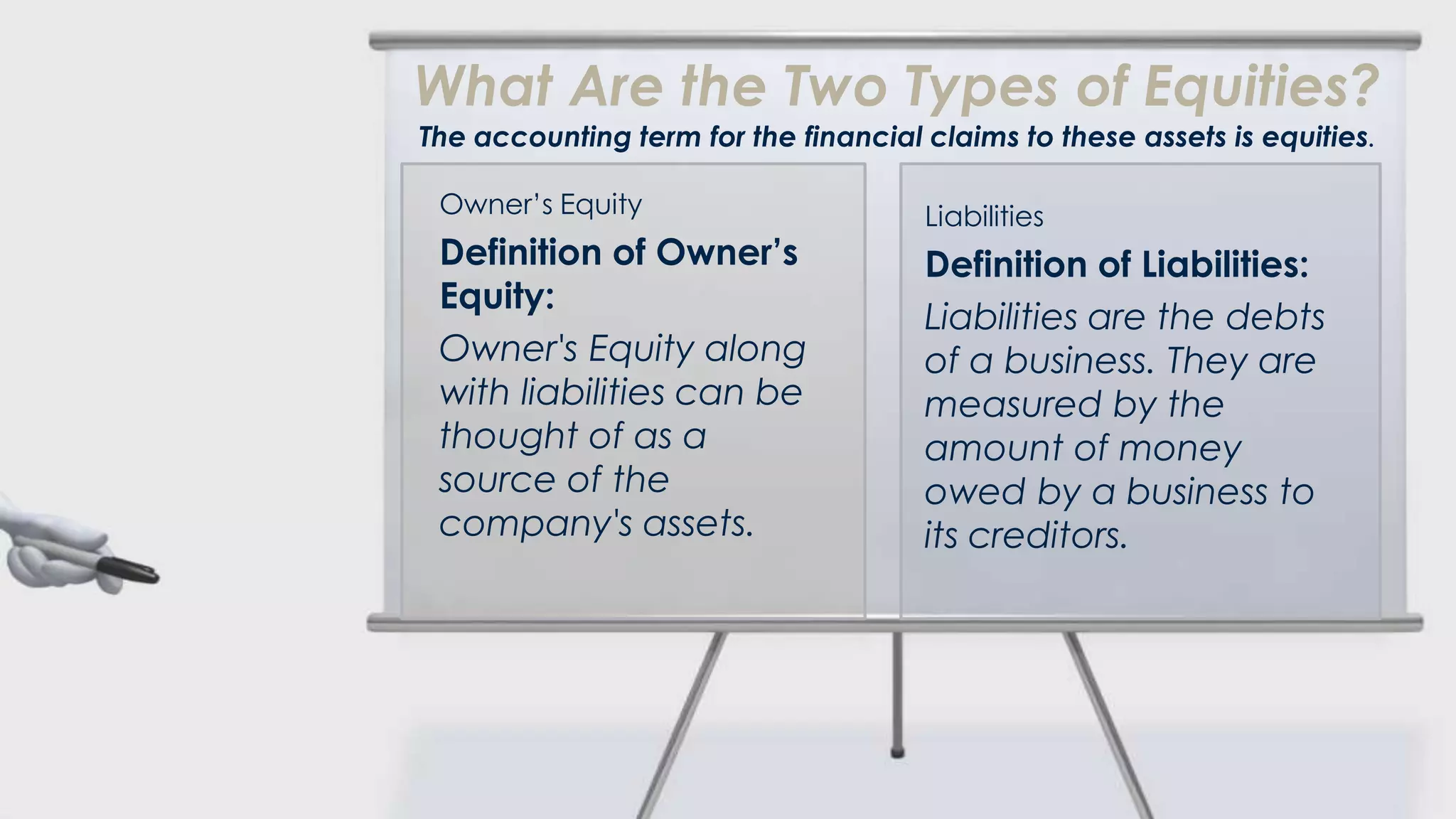

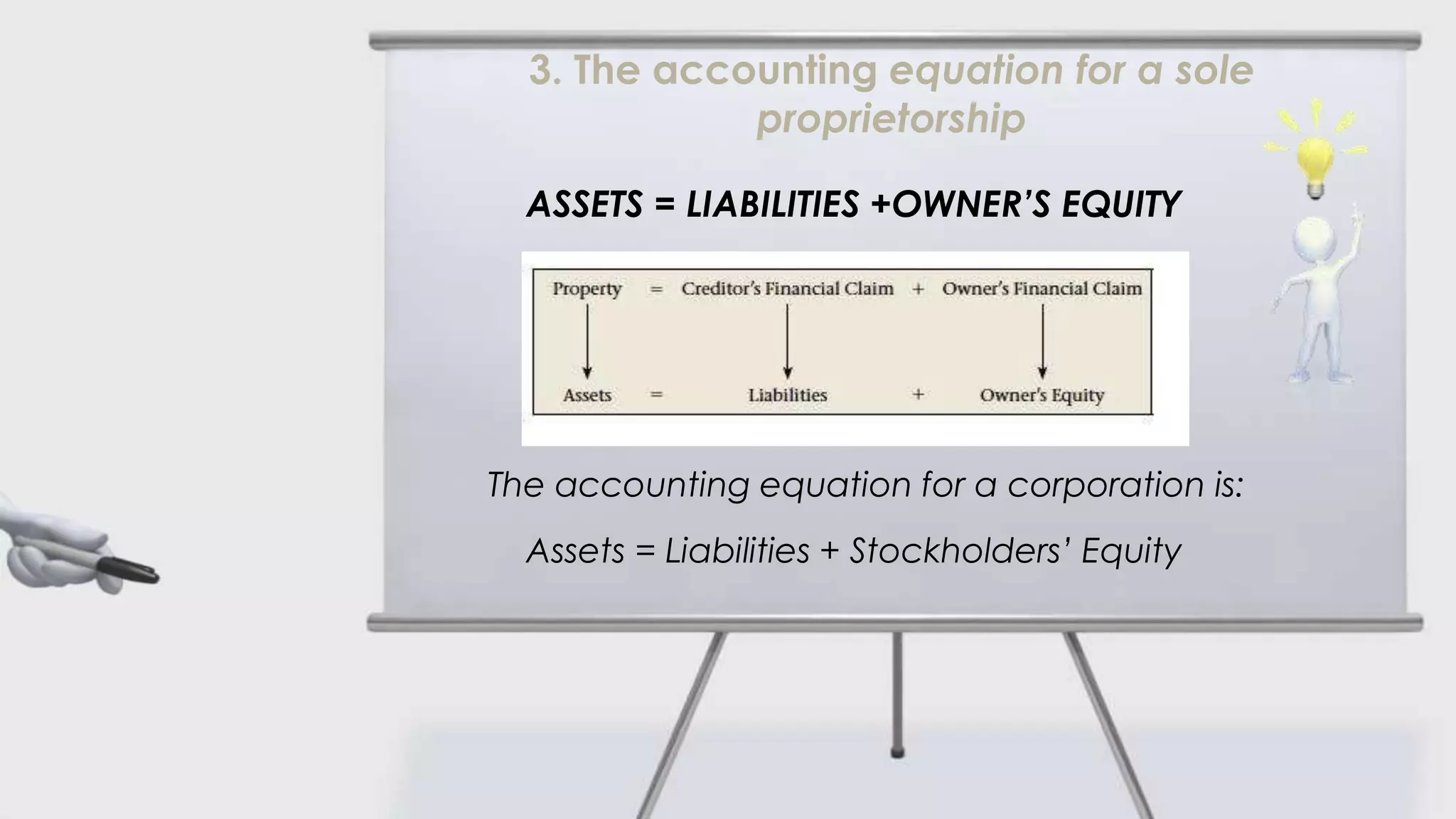

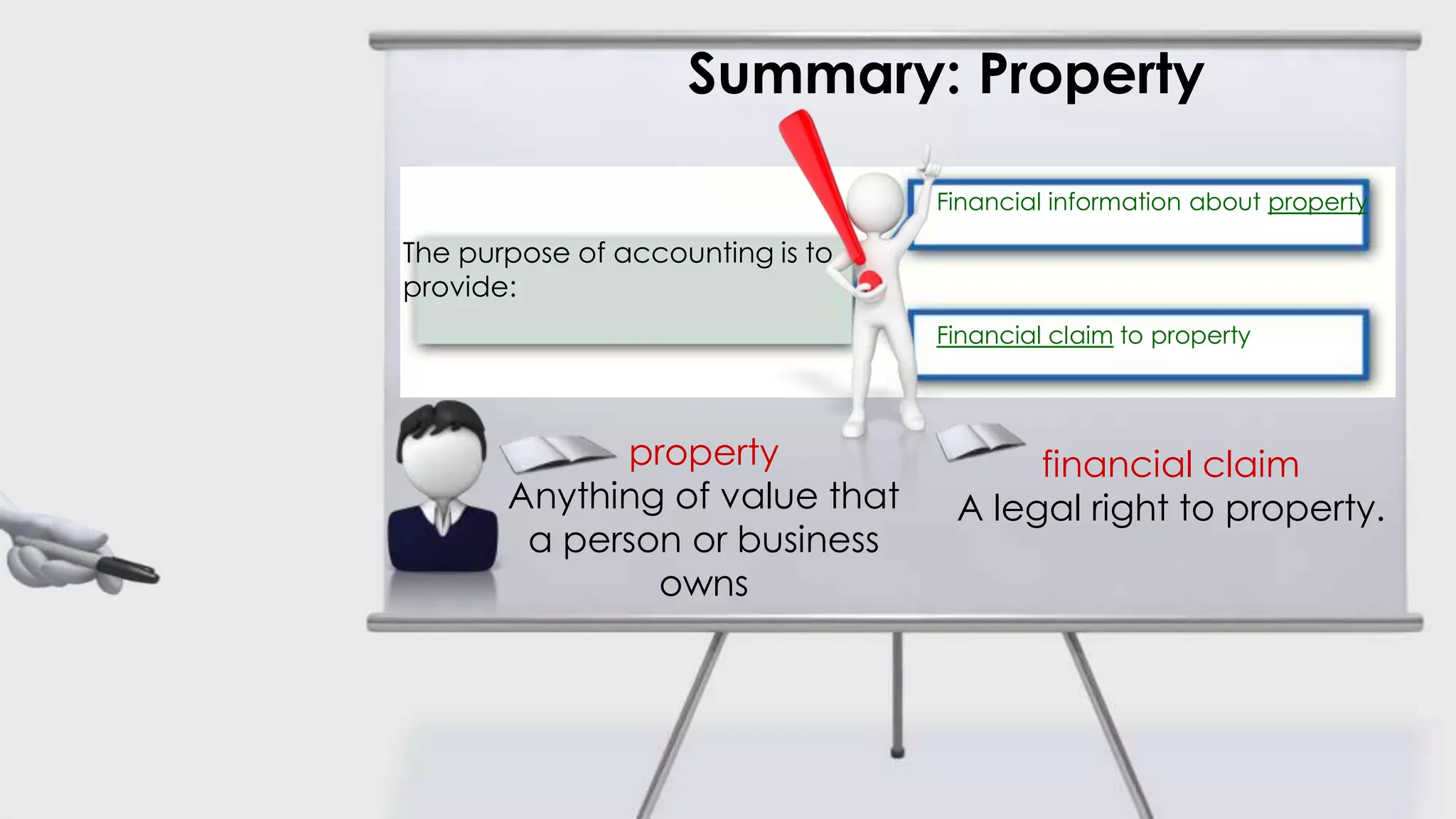

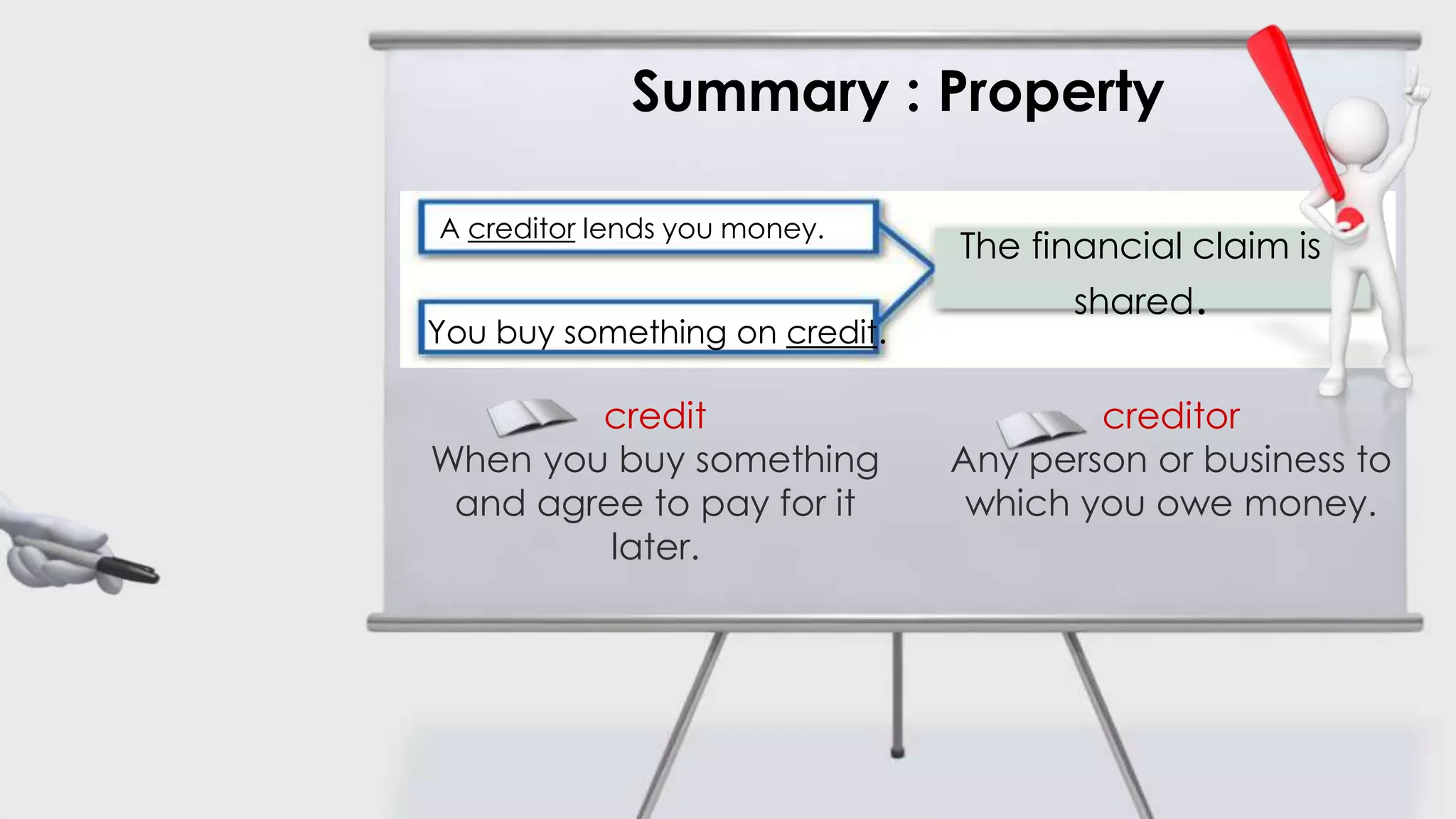

Lesson 2 covers the accounting equation, defining key terms like property, assets, liabilities, and owner's equity. It explains the significance of these concepts in accounting, particularly how they relate to financial claims and the sources of a company's assets. The lesson concludes with the accounting equation for both sole proprietorships and corporations: assets = liabilities + owner's equity or stockholders' equity.