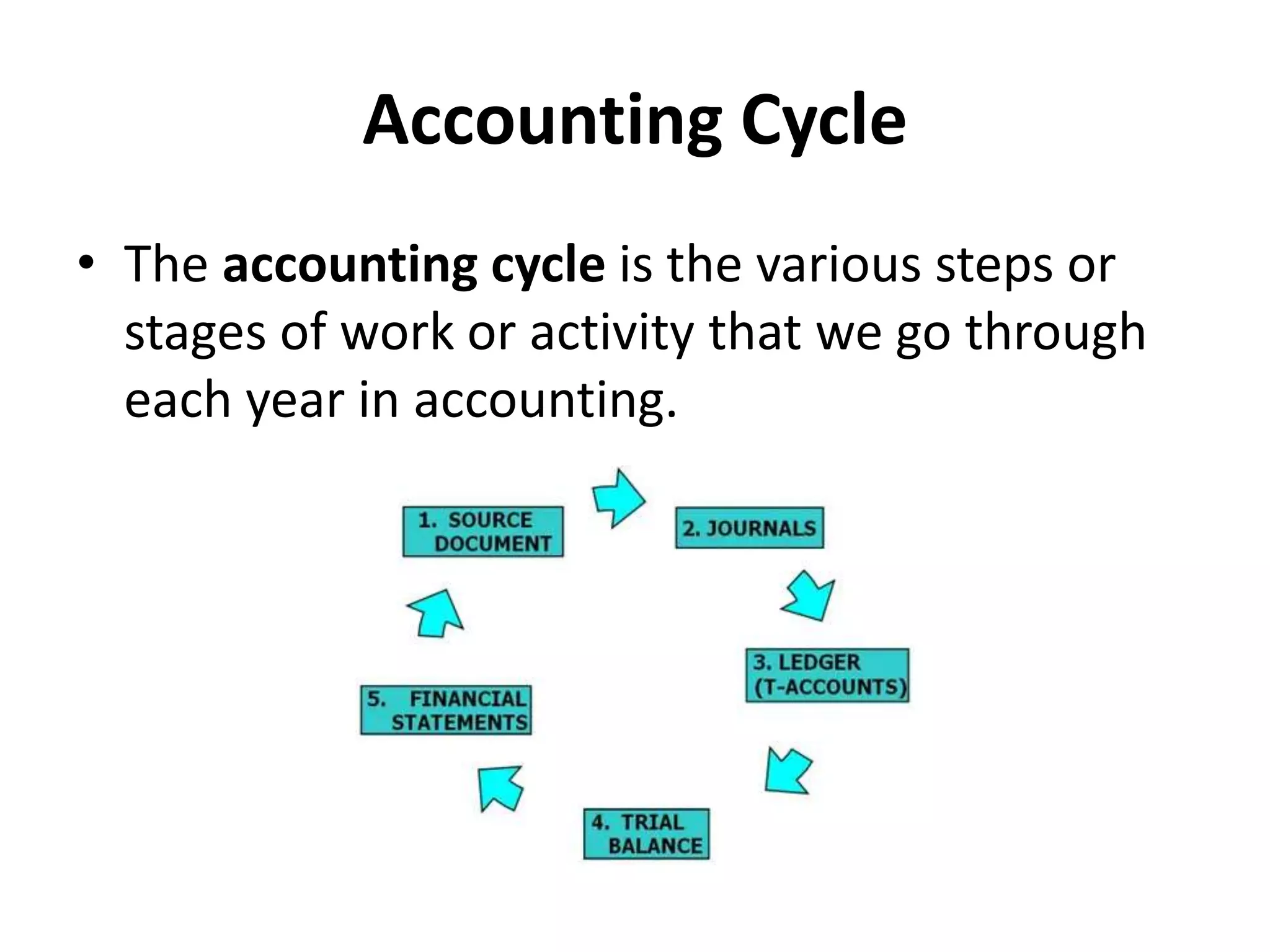

This document provides an overview of bookkeeping and accounting concepts. It discusses the accounting cycle which includes source documents, journals, ledgers, trial balances, and financial statements. It also describes different types of accounts including personal accounts, real accounts, and nominal accounts. The key principles of double-entry bookkeeping are explained such as debiting expenses and losses and crediting incomes and gains. Journal entries are the first recording of transactions according to these principles before being posted to ledgers.