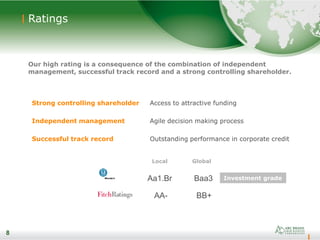

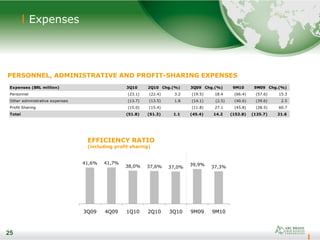

This investor presentation provides an overview of Banco ABC Brasil. It discusses the bank's history, business segments, competition, financial highlights, and ownership structure. ABC Brasil focuses on providing loans and structured products to mid-sized and large corporate clients. It has a strong controlling shareholder in Arab Banking Corporation and maintains a high credit quality with low historical losses. The presentation provides details on the bank's credit portfolio quality, funding sources, capitalization, and financial results.