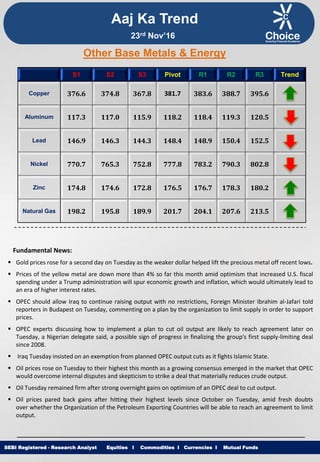

The document provides a technical analysis of commodity markets. It summarizes recent trends in gold, silver, copper and crude oil prices based on technical indicators. It expects gold prices to fall further to 28700 levels but sees upside for silver, copper and crude oil, predicting prices could rise to 41550, 390 and 3360 respectively. The analysis also provides pivot levels and recent closing prices for various commodities on domestic and international exchanges.