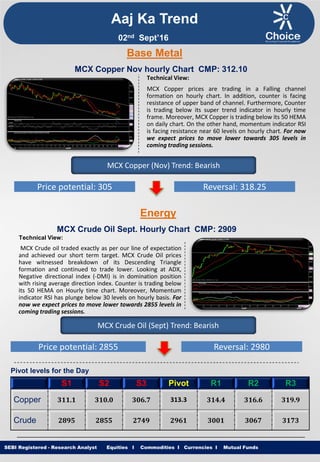

The document provides a technical analysis of commodity markets. It summarizes that MCX gold and silver prices are expected to rise in the near term based on technical indicators. MCX copper and crude oil prices are expected to fall based on indicators showing bearish trends. Pivot levels are provided for different commodities to indicate support and resistance levels.