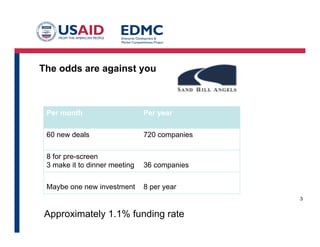

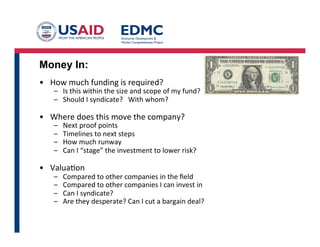

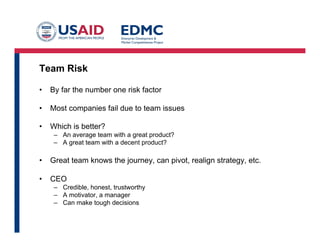

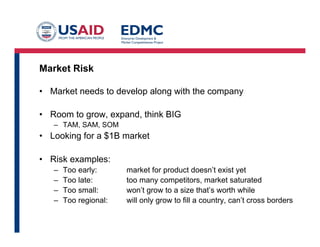

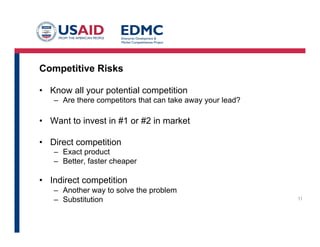

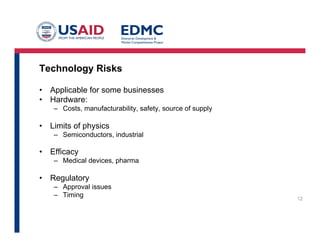

This presentation discusses the anatomy of a venture capital investment from the perspective of a venture capitalist. It notes that VCs typically only fund about 1% of the startup companies they review each month. When considering an investment, VCs evaluate factors like how much funding is required, the company's traction and milestones, potential exits, and risks. Major risk factors include issues with the team, market, competition, technology, and legal or IP concerns. The goal for VCs is achieving a high return exit through an acquisition or IPO.