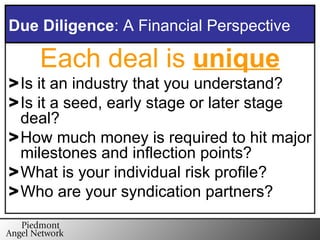

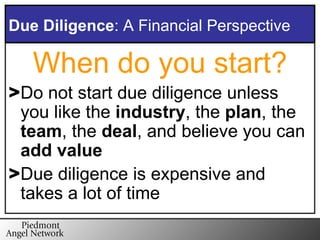

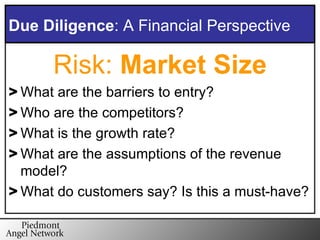

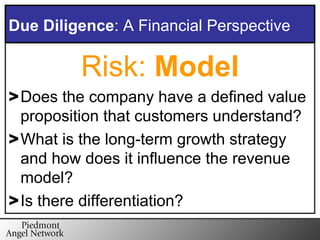

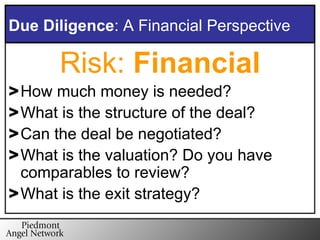

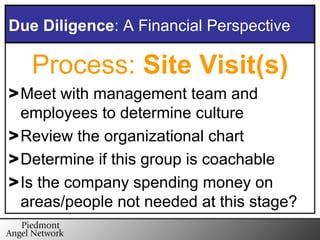

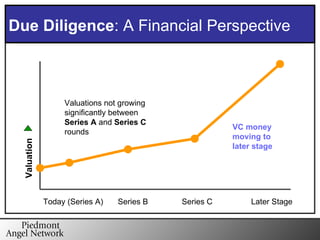

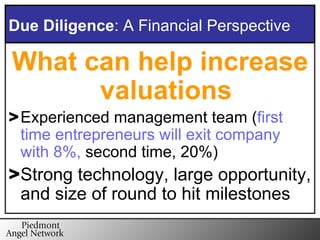

The document discusses the due diligence process for angel investors from a financial perspective. It outlines key risks to evaluate such as management team, market size, financial model, and numbers. The due diligence process includes reviewing business plans, site visits, references, competitive analysis, and determining valuation. The goal is to identify reasons not to invest and negotiate terms to increase the likelihood of high returns.

![The Due Diligence Process: A Financial Perspective Troy Knauss , Fund Executive Piedmont Angel Network Adjunct Professor, Wake Forest Univeristy [email_address] Presentation](https://image.slidesharecdn.com/knauss-financial-dd-1230456401609558-1/85/Knauss-Financial-Dd-1-320.jpg)

![Contact Information : Troy Knauss Piedmont Angel Network [email_address] (336) 235-0941](https://image.slidesharecdn.com/knauss-financial-dd-1230456401609558-1/85/Knauss-Financial-Dd-32-320.jpg)