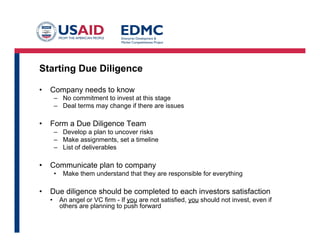

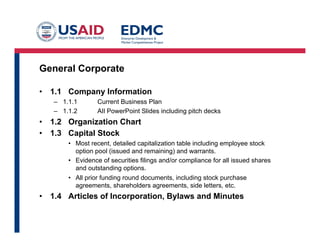

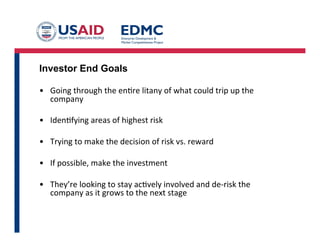

This presentation outlines the due diligence process that investors undertake when evaluating a potential investment. It discusses the intent of due diligence is to identify all reasons not to invest by examining various risk factors related to corporate structure, intellectual property, management, finances, and more. The presentation provides examples of specific areas and documentation that investors will request from companies to complete their due diligence, such as business plans, capitalization tables, financial statements, contracts, and legal documents. The overall goals of due diligence from an investor perspective are to understand the risks, evaluate the risk-reward profile, and ideally make an investment while remaining actively involved to help de-risk the company going forward.