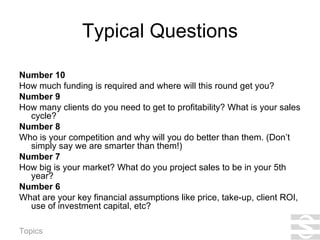

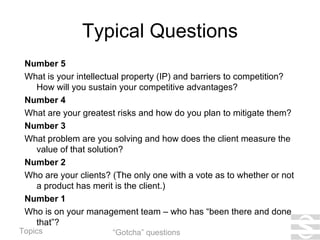

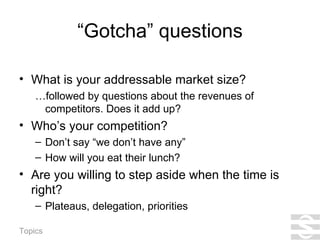

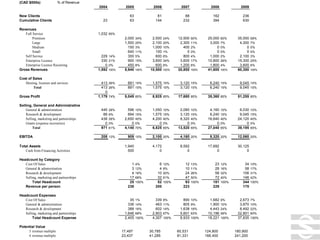

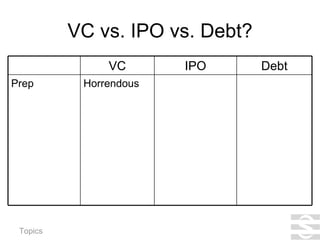

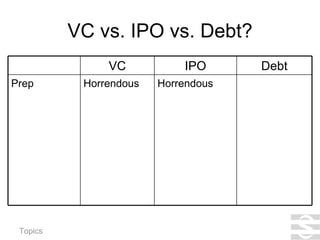

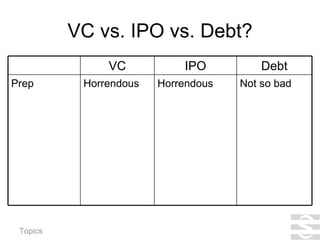

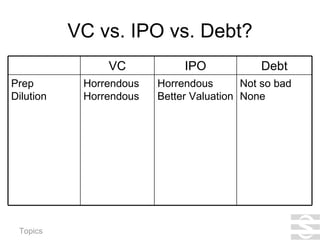

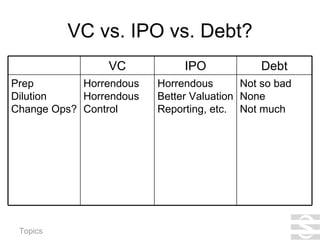

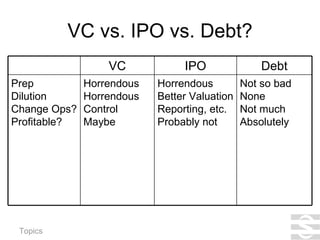

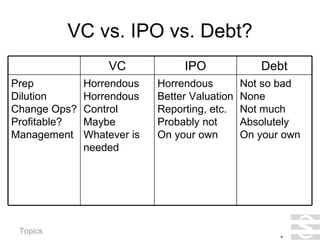

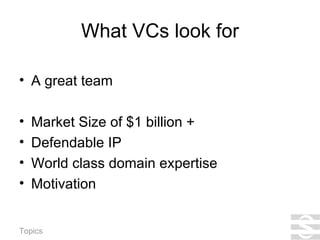

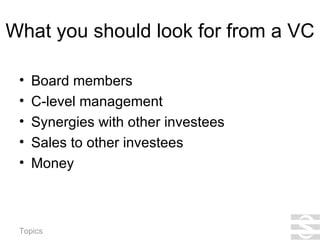

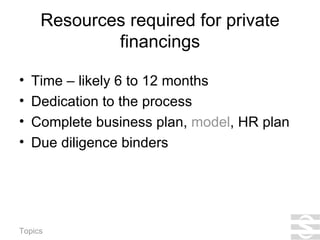

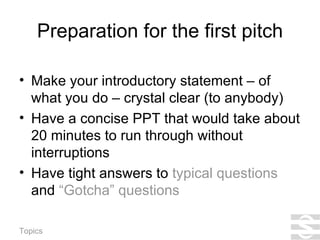

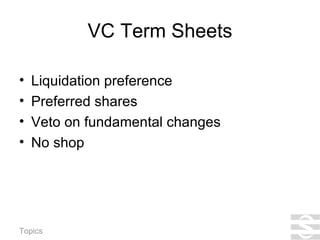

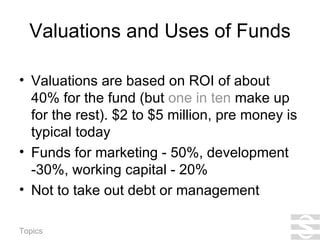

The document discusses various topics related to financing a growing company, including the differences between venture capital (VC), initial public offerings (IPO), and debt financing. It notes that VC involves less preparation than an IPO but results in dilution and loss of control. The ideal company for VC has a large market size, defensible intellectual property, and an experienced management team. It also provides tips for fundraising pitches, common questions from investors, and financial projections.

![Elevator Pitch Tips Everyone in the company has to be able to give it to their grandmother Start with a pain statement, like “The [target market] is suffering from an inability to do [something], because of [this and that].” Follow that with a value proposition, like “Our team, with x0 years of experience in this have developed a solution that will be much better/faster/cheaper than existing solutions”. Finish with a result like “We are confident we can build a company with $x million in sales in five years. Focus on why the customer will need to buy](https://image.slidesharecdn.com/venturecapitalconsiderations-091116173501-phpapp01/85/Venture-Capital-Considerations-18-320.jpg)