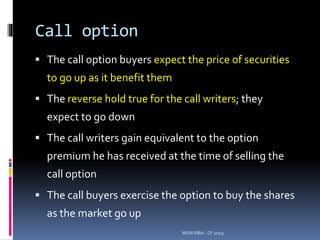

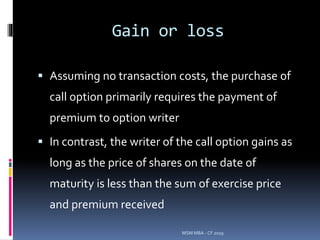

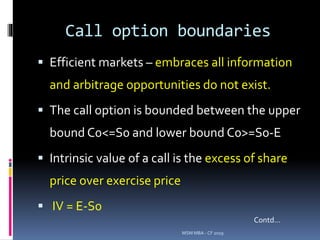

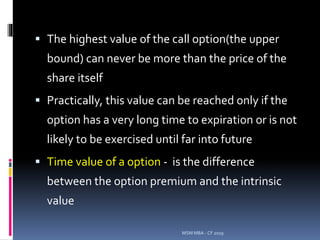

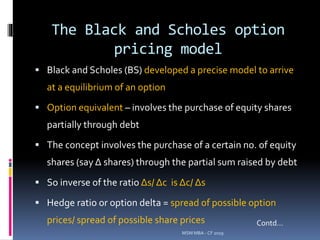

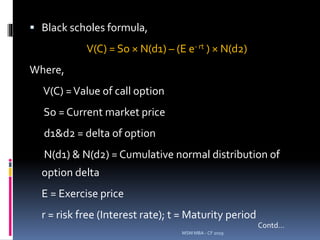

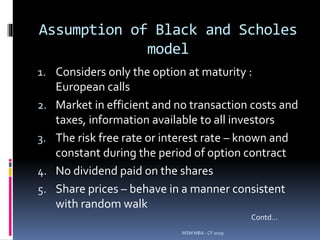

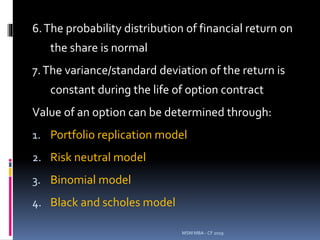

This document discusses corporate financing decisions and cash flow issues for firms. It covers topics like cash insolvency, cash inadequacy, determining debt capacity, and using simulation and option pricing models to evaluate financing choices. Key factors that influence the valuation of call options are discussed, including the current stock price, exercise price, risk-free rate, time to expiration, and price volatility. The Black-Scholes option pricing model is also introduced as a way to calculate the theoretical value of an option.

![d1 = Ln [S0/E] + [ r+0.5(σ2 )] × t

σ √t

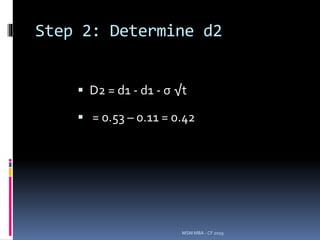

d2 = d1 - σ √t

Here “σ ” – Measure ofVolatility (standard

deviation)

V(p) =V(c) + [E e- rt] ] – So

MSM MBA - CF 2019](https://image.slidesharecdn.com/cfunit4financingdecision-190822140856/85/Corporate-Finance-unit-4-Financing-decision-32-320.jpg)

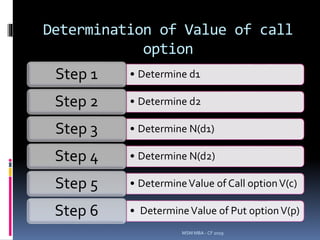

![Step 1: Determine d1

d1 = Ln [S0/E] + [ r+0.5(σ2 )] × t

σ √t

d2 = d1 - σ √t

= Ln [415/400] + [0.05+(0.5 * (0.22)2 )] 0.25

0.22 * √0.25

= 0.03922* 1.04 + 0.01855 /0.11

= 0.5252

= 0.53

MSM MBA - CF 2019](https://image.slidesharecdn.com/cfunit4financingdecision-190822140856/85/Corporate-Finance-unit-4-Financing-decision-37-320.jpg)

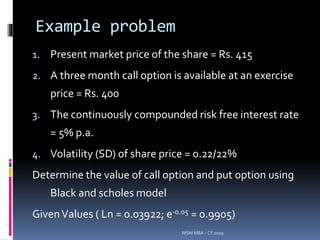

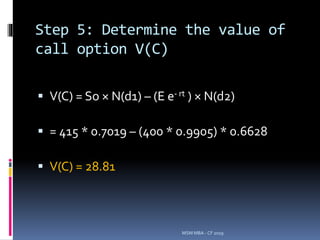

![Step 6: Determination of Value

of call option

Using call – put parity theory, value of put

option is,

V(p) =V(c) + [E e- rt] ] – So

= 28.81 + (400 * 0.9905) – 415

V(p) = 9.83

MSM MBA - CF 2019](https://image.slidesharecdn.com/cfunit4financingdecision-190822140856/85/Corporate-Finance-unit-4-Financing-decision-42-320.jpg)

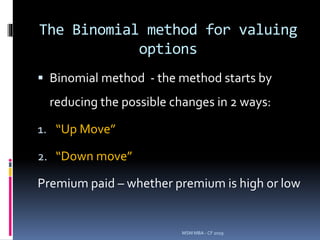

![ PV of option value = 7/1.05 = Rs.6.67

Value of option = Cu P + Cd (1-P)

R

Where,

Cu = Call option Up

Cd = Call option down

P = Probability

R = Rate of return

Calculation of Probability

P = [R-d]/[U-d] = p(U)

MSM MBA - CF 2019](https://image.slidesharecdn.com/cfunit4financingdecision-190822140856/85/Corporate-Finance-unit-4-Financing-decision-47-320.jpg)

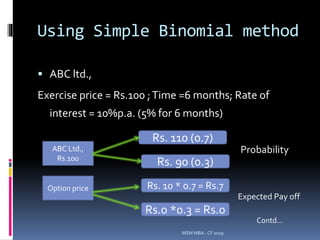

![Example problem

Exercise price = Rs.100 ;Time = 6 months; So Current

price = Rs.100 ; U=10% ; d= 10%; R=10% p.a. (6

months =0.5)

Step 1: (Probability of up and down)

P(u) = [1.05-0.90]-[1.10-0.90] = 0.75

P(d) = 1 – P(u) = 1 – 0.75 = 0.25

Value of option = Cu P + Cd (1-P)

R

= (10 * 0.75)+(0*0.25)/1.05 = 7.5/1.05 = Rs.7.14

MSM MBA - CF 2019](https://image.slidesharecdn.com/cfunit4financingdecision-190822140856/85/Corporate-Finance-unit-4-Financing-decision-48-320.jpg)