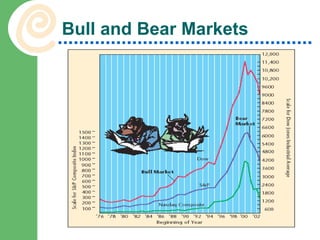

The document discusses various types of securities and investments including stocks, bonds, and other investment vehicles. It provides details on stock exchanges in Pakistan like the Karachi Stock Exchange, as well as the different types of stocks and bonds available in Pakistan. It also briefly discusses investment banks, securities markets, and regulatory bodies like the Securities and Exchange Commission of Pakistan.