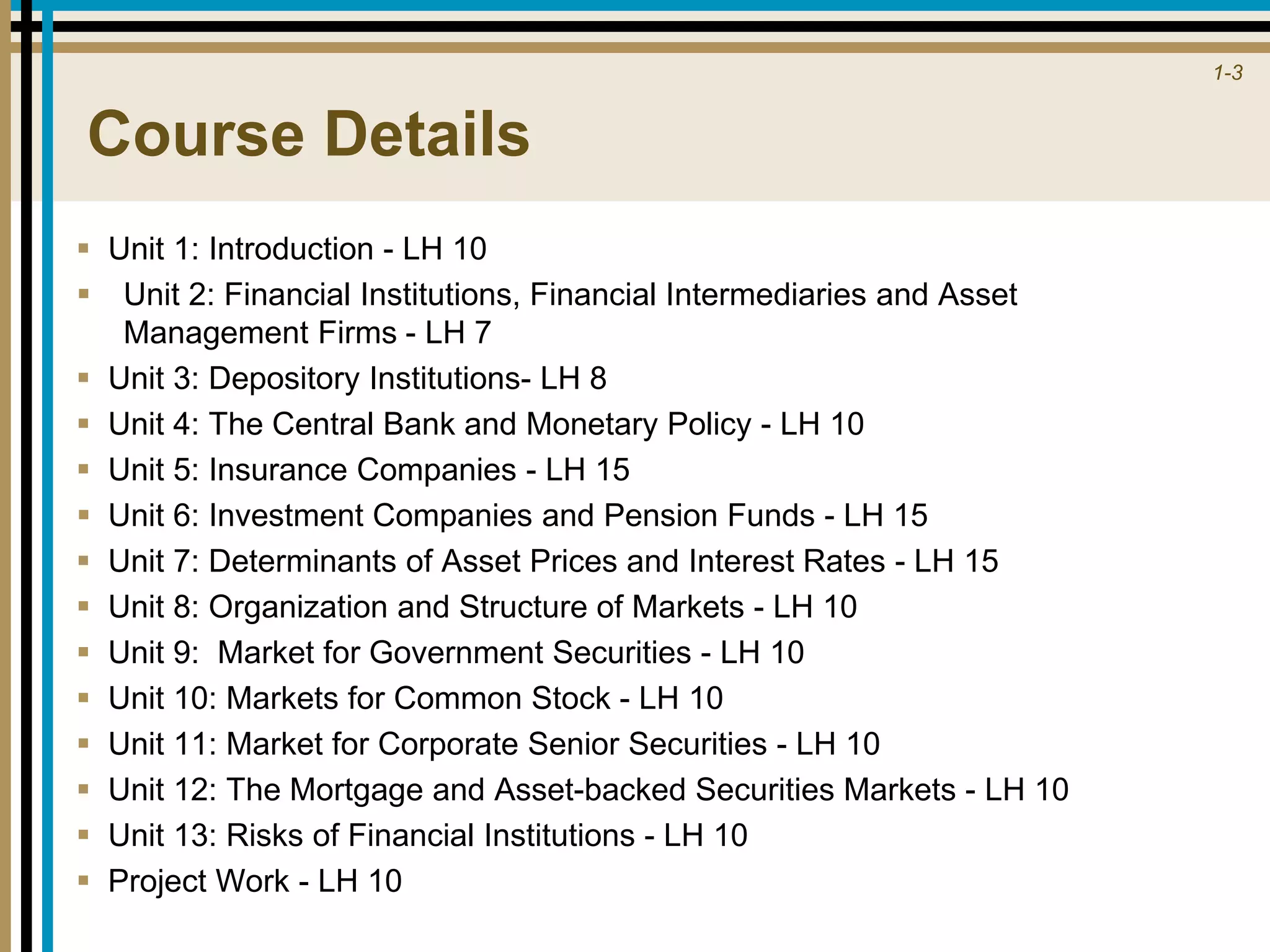

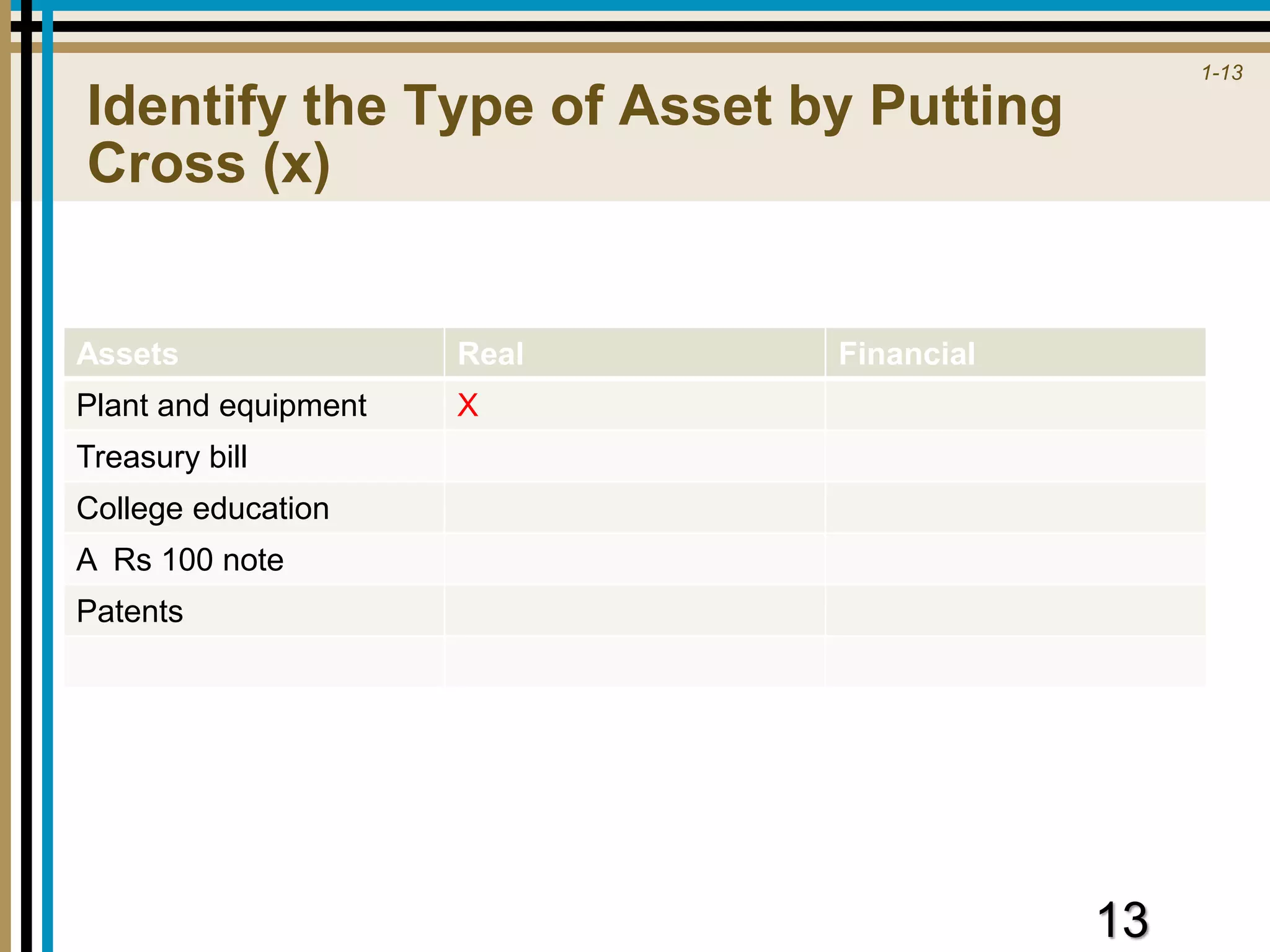

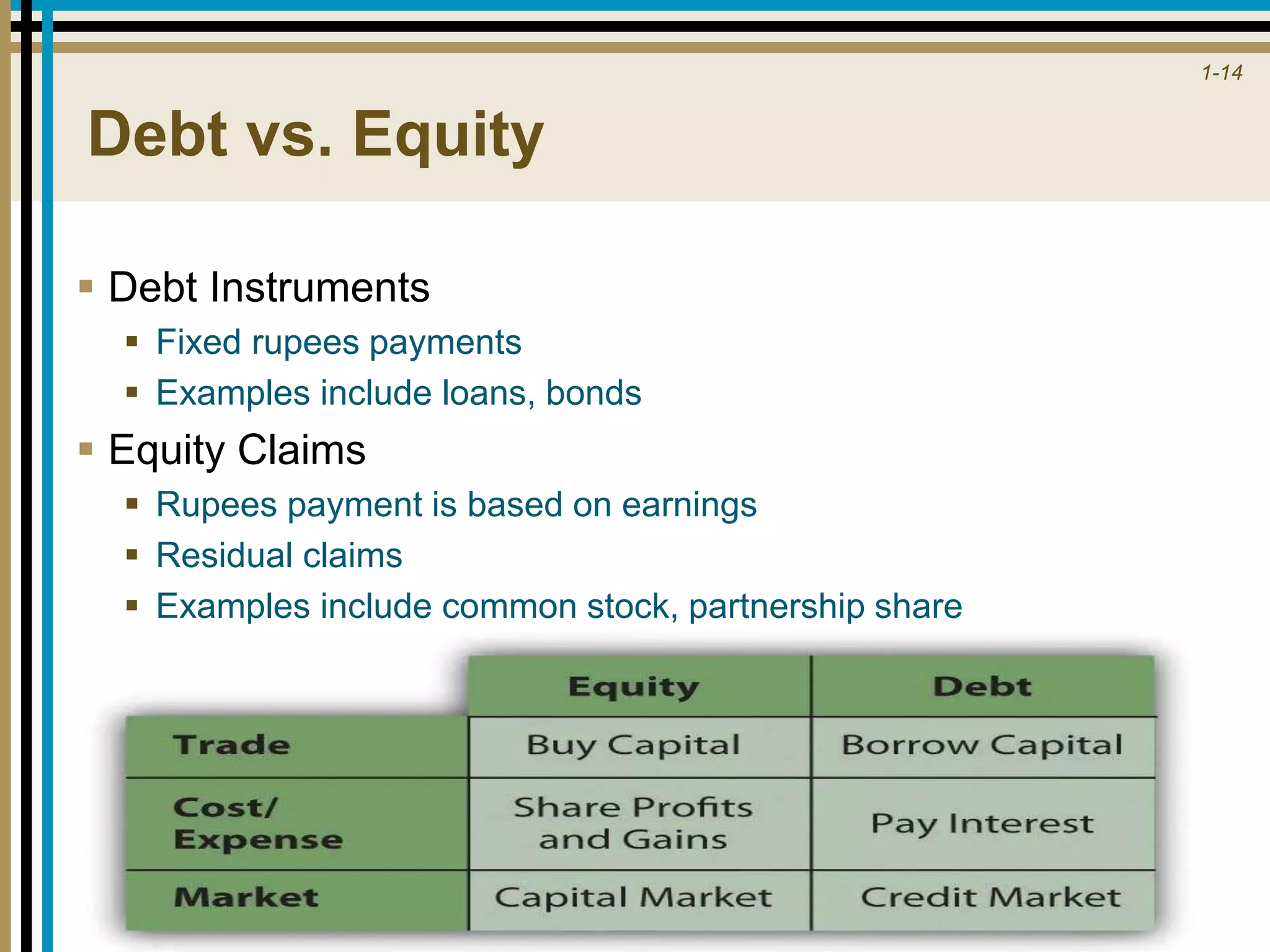

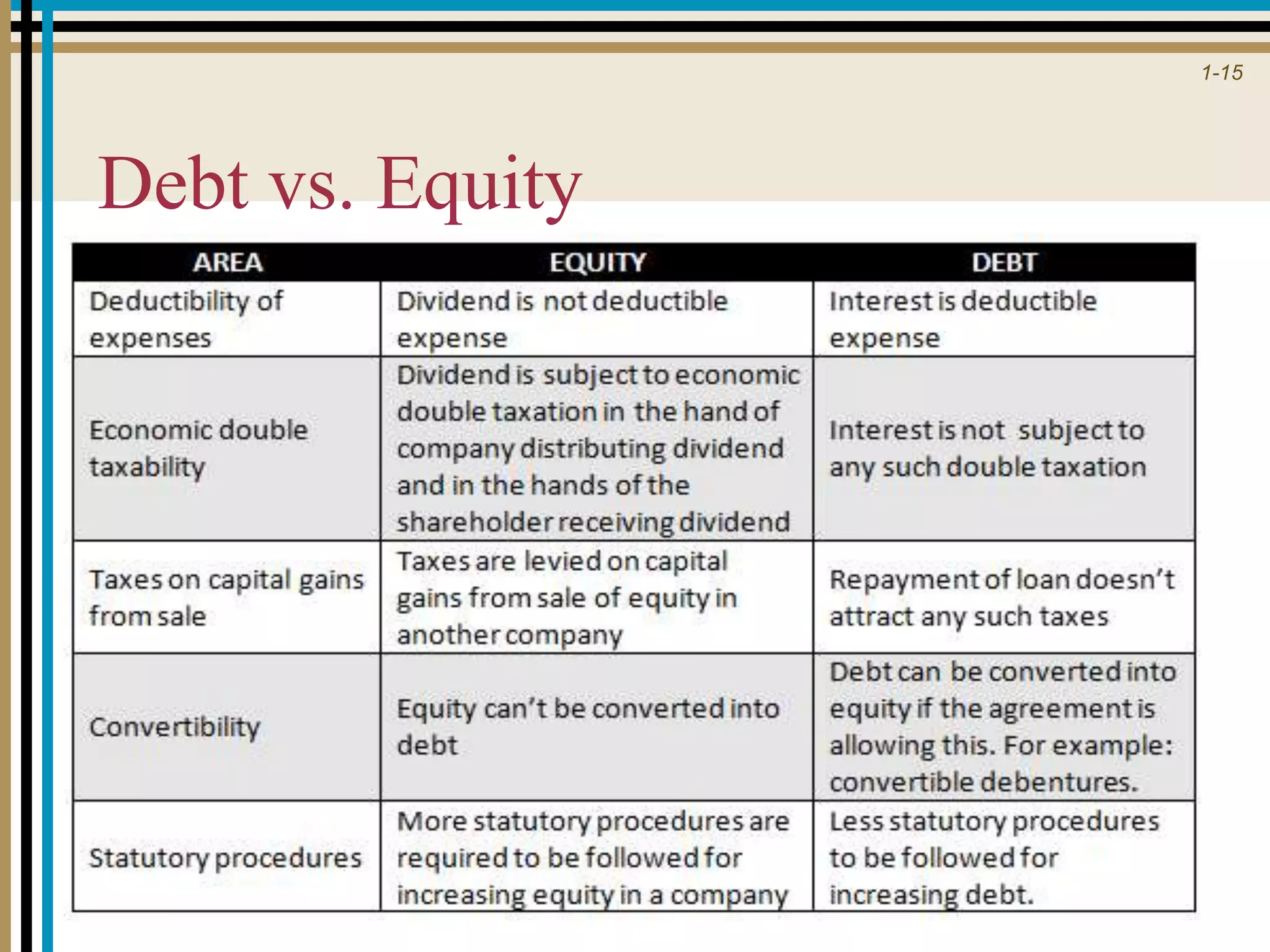

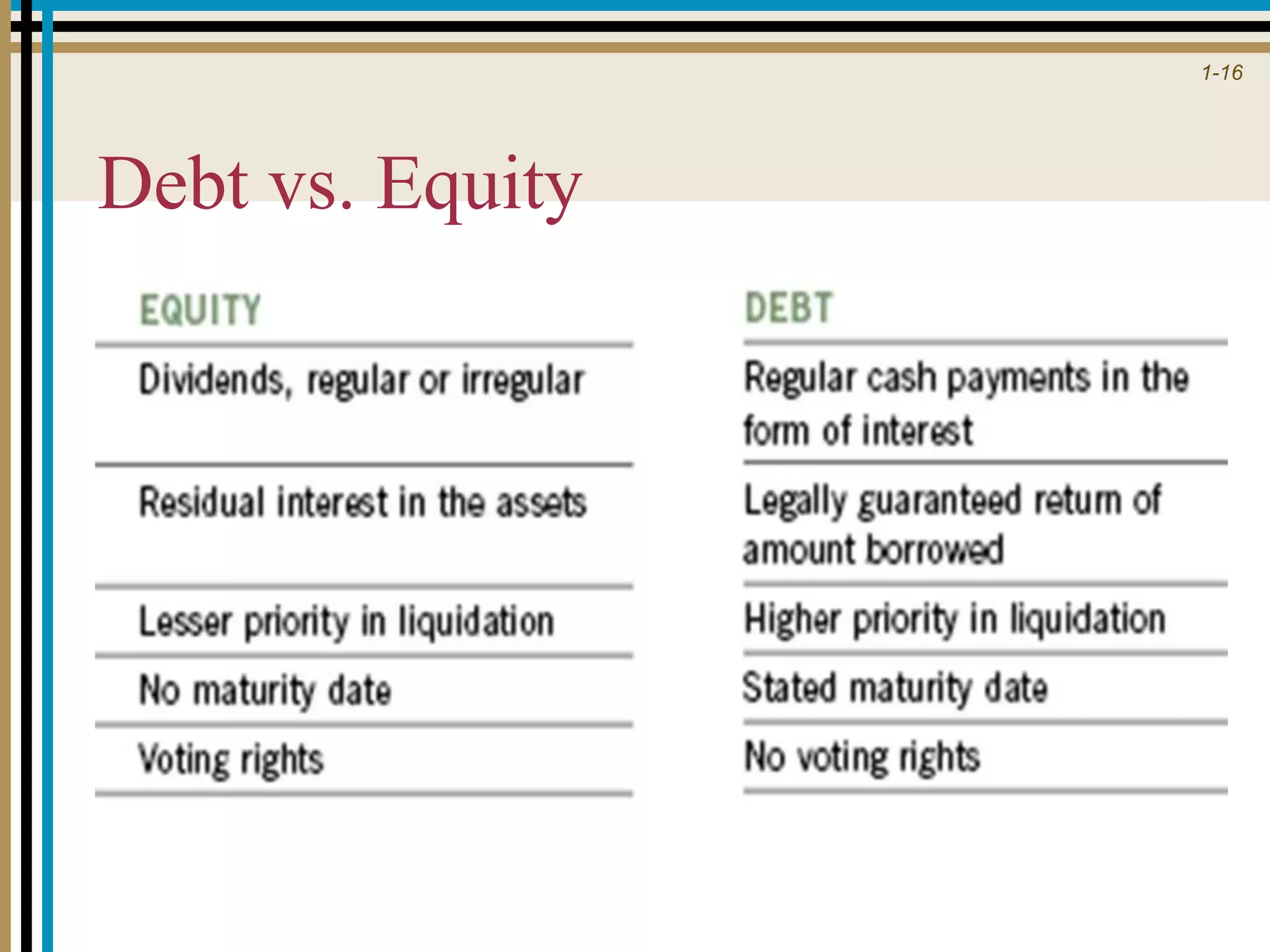

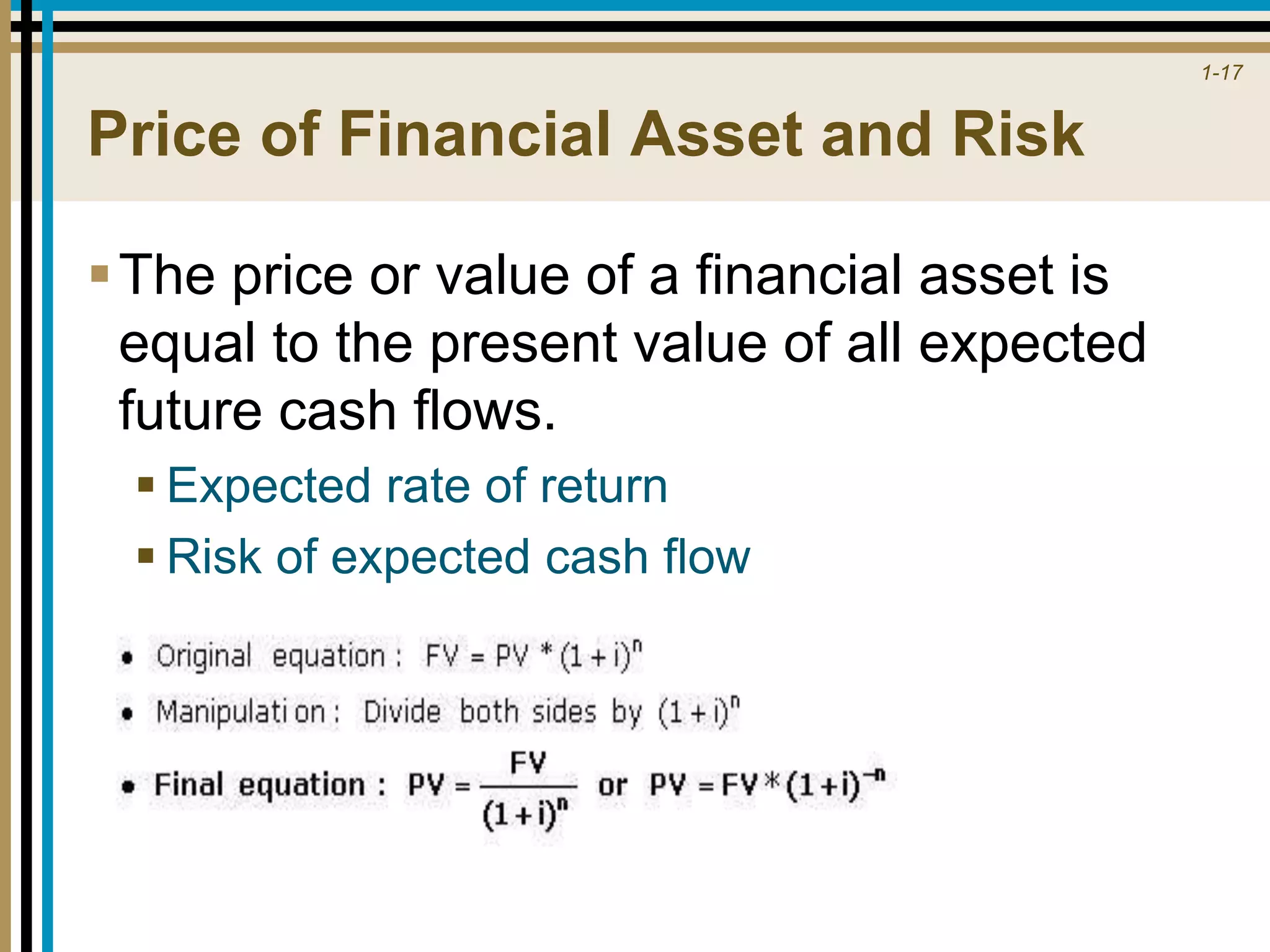

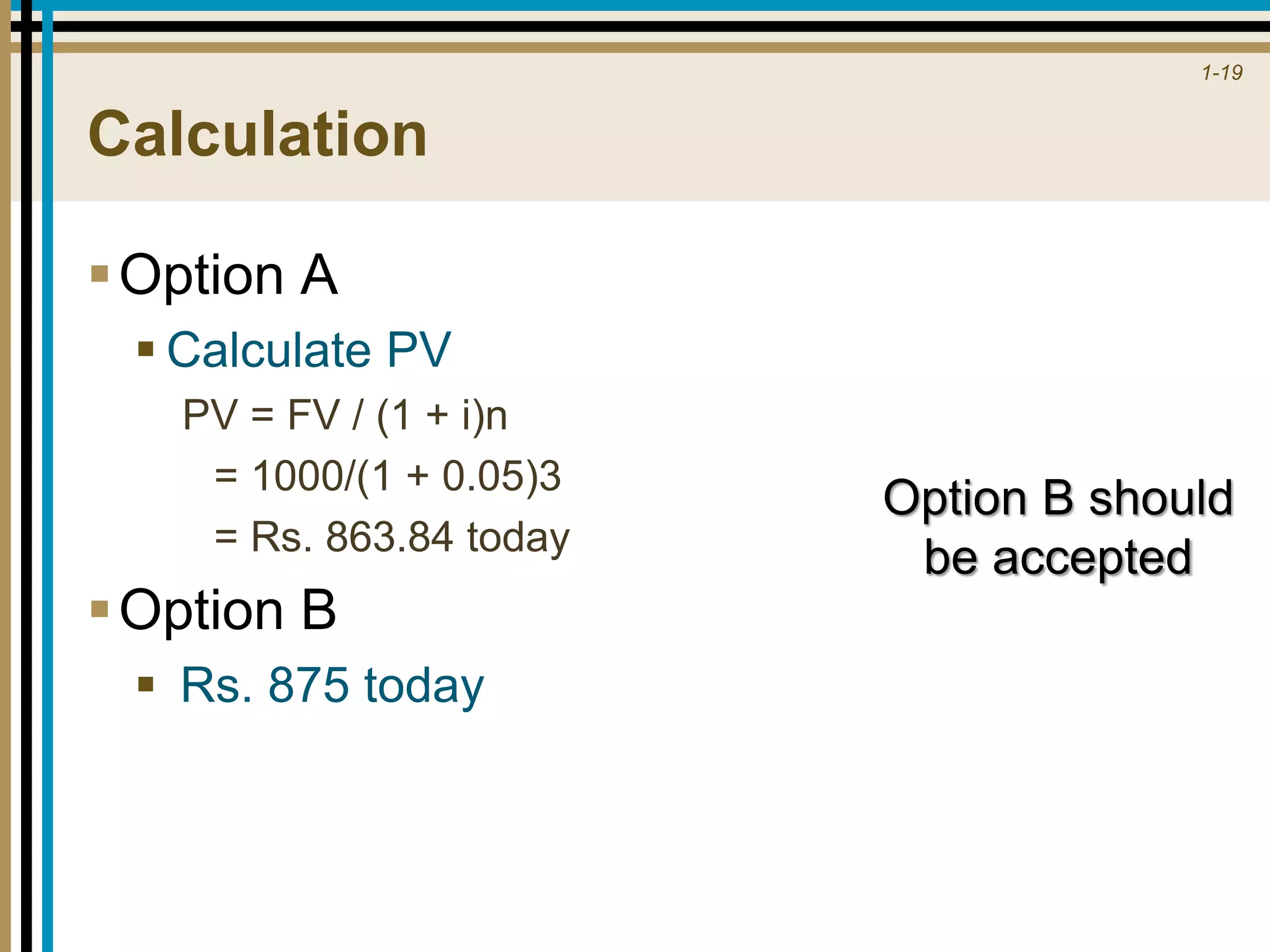

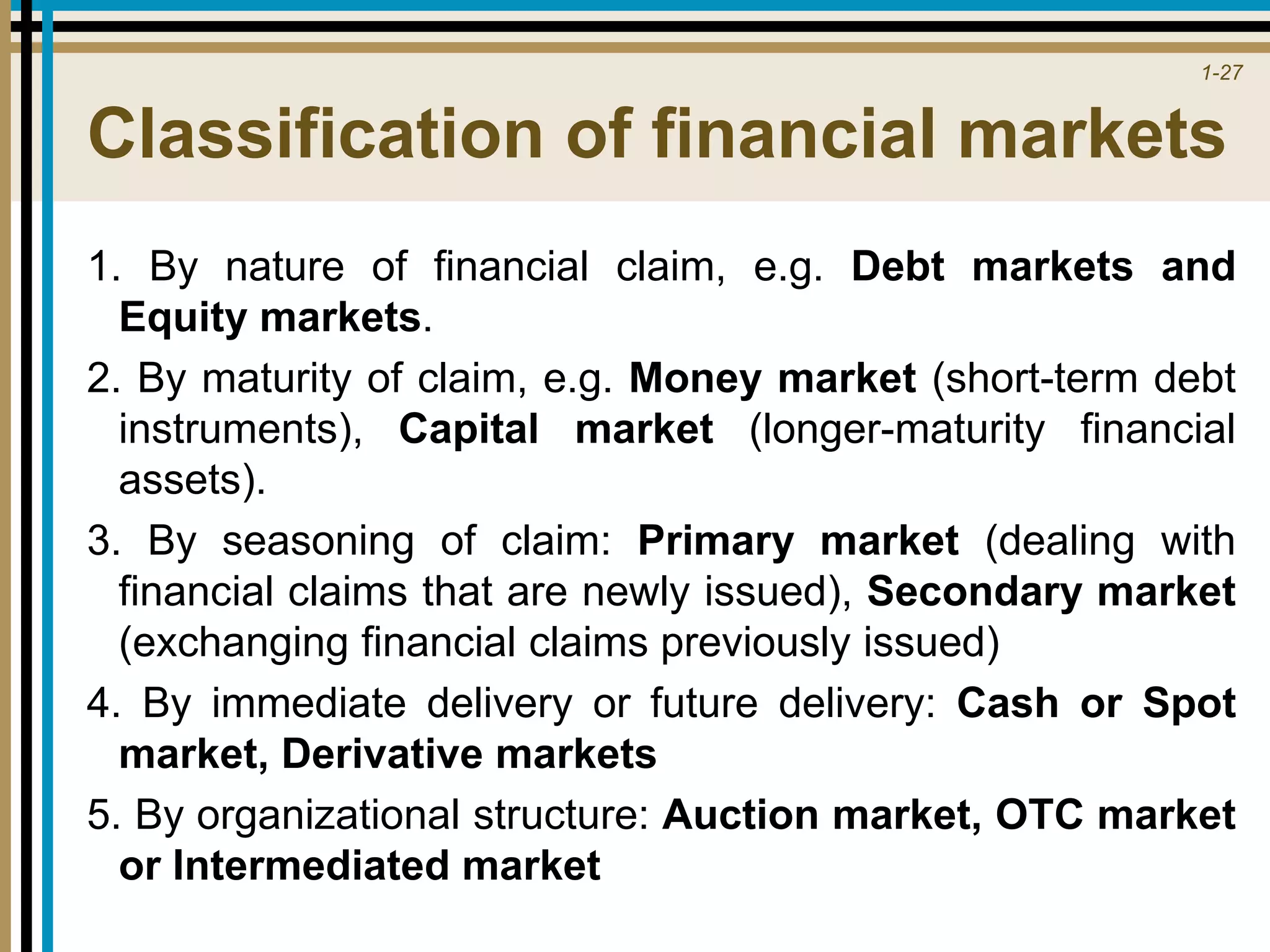

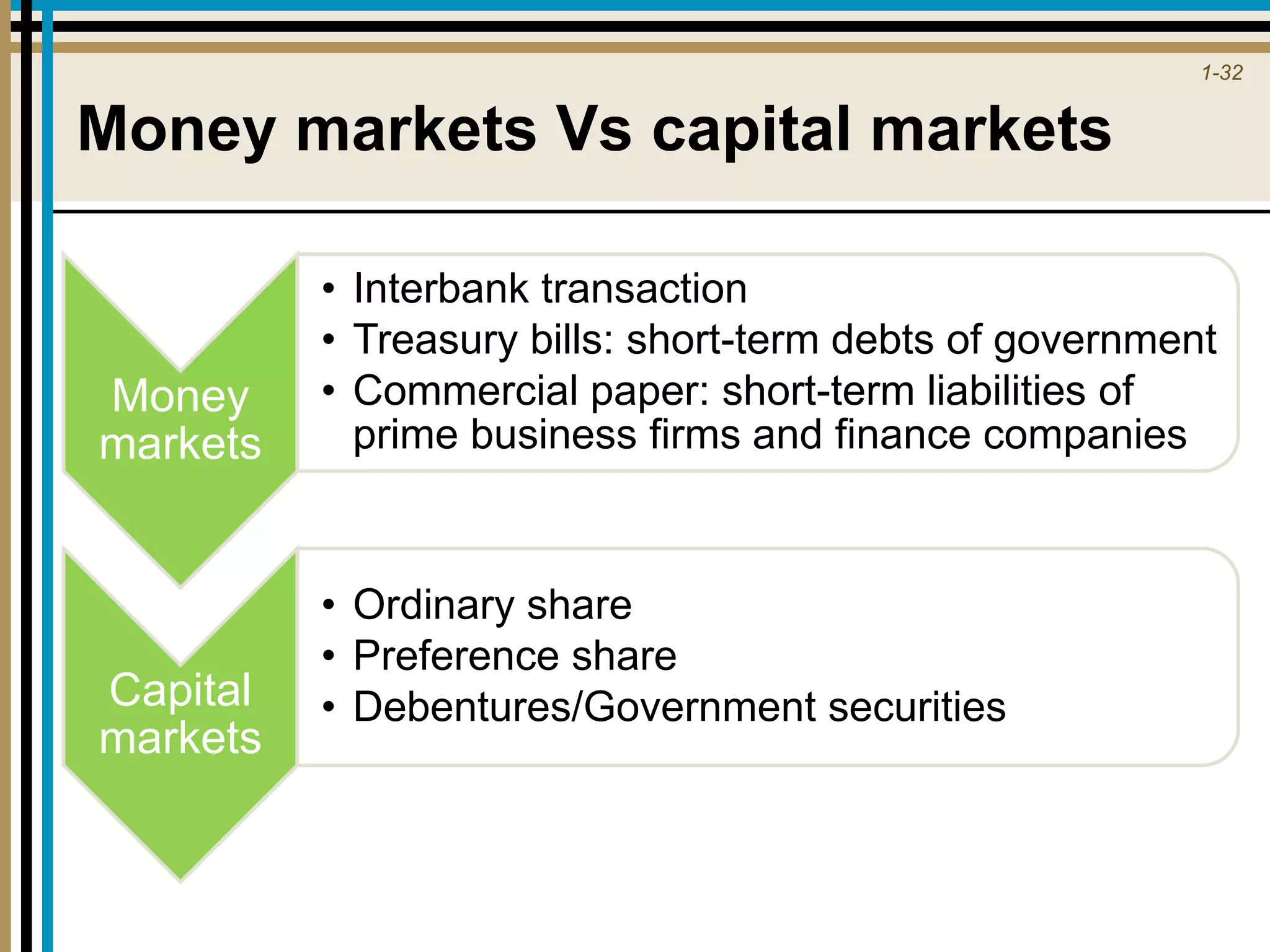

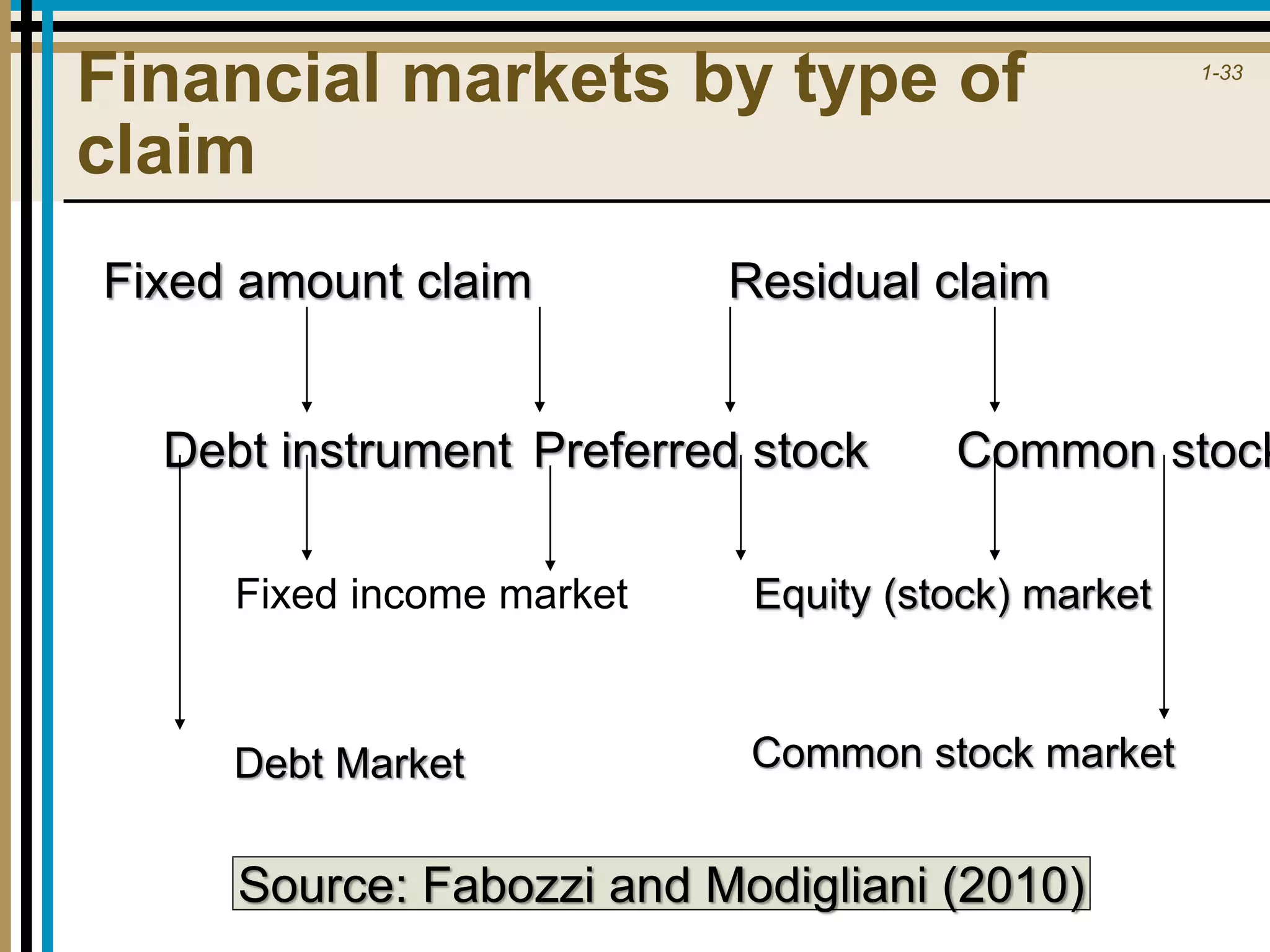

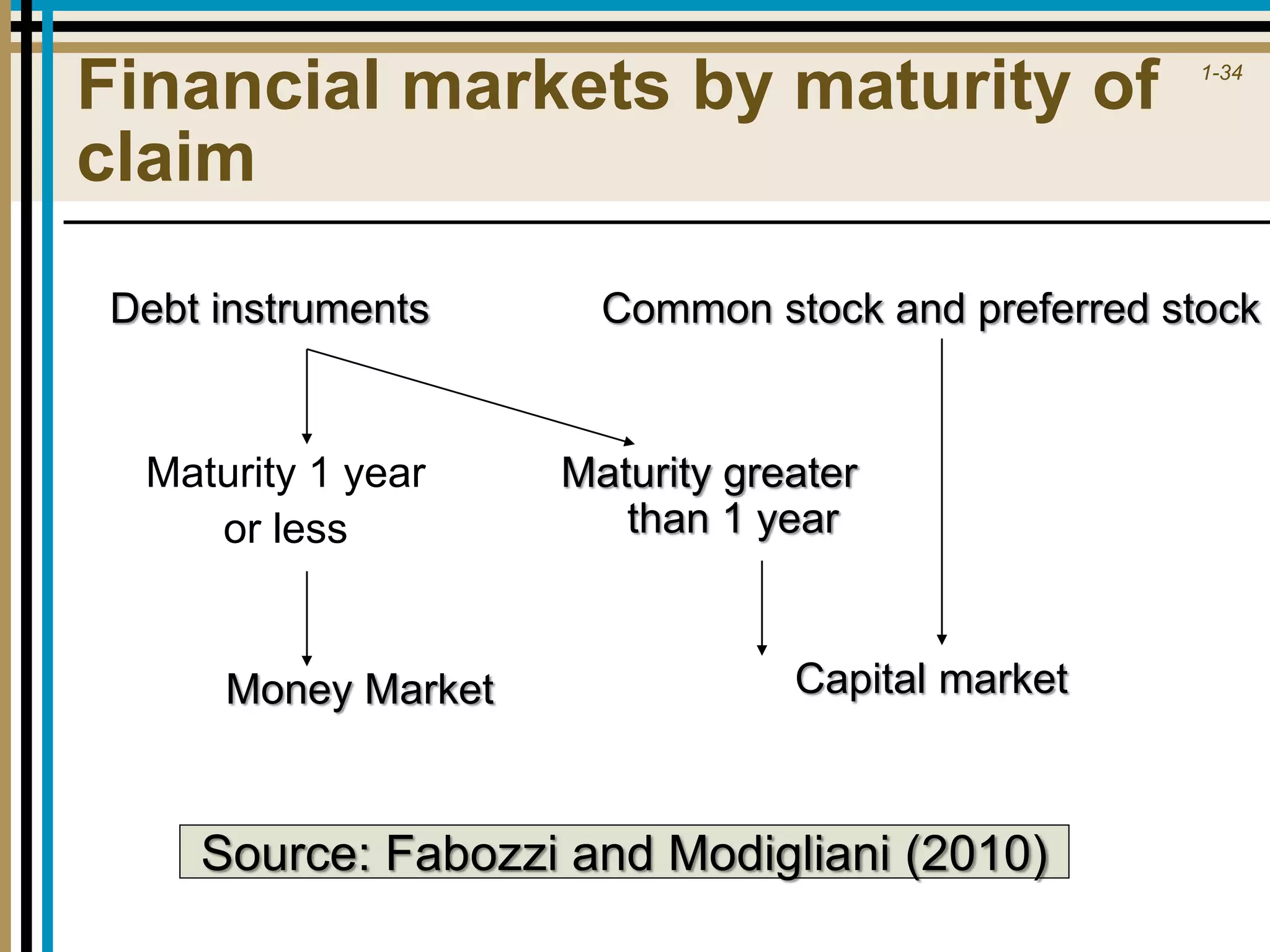

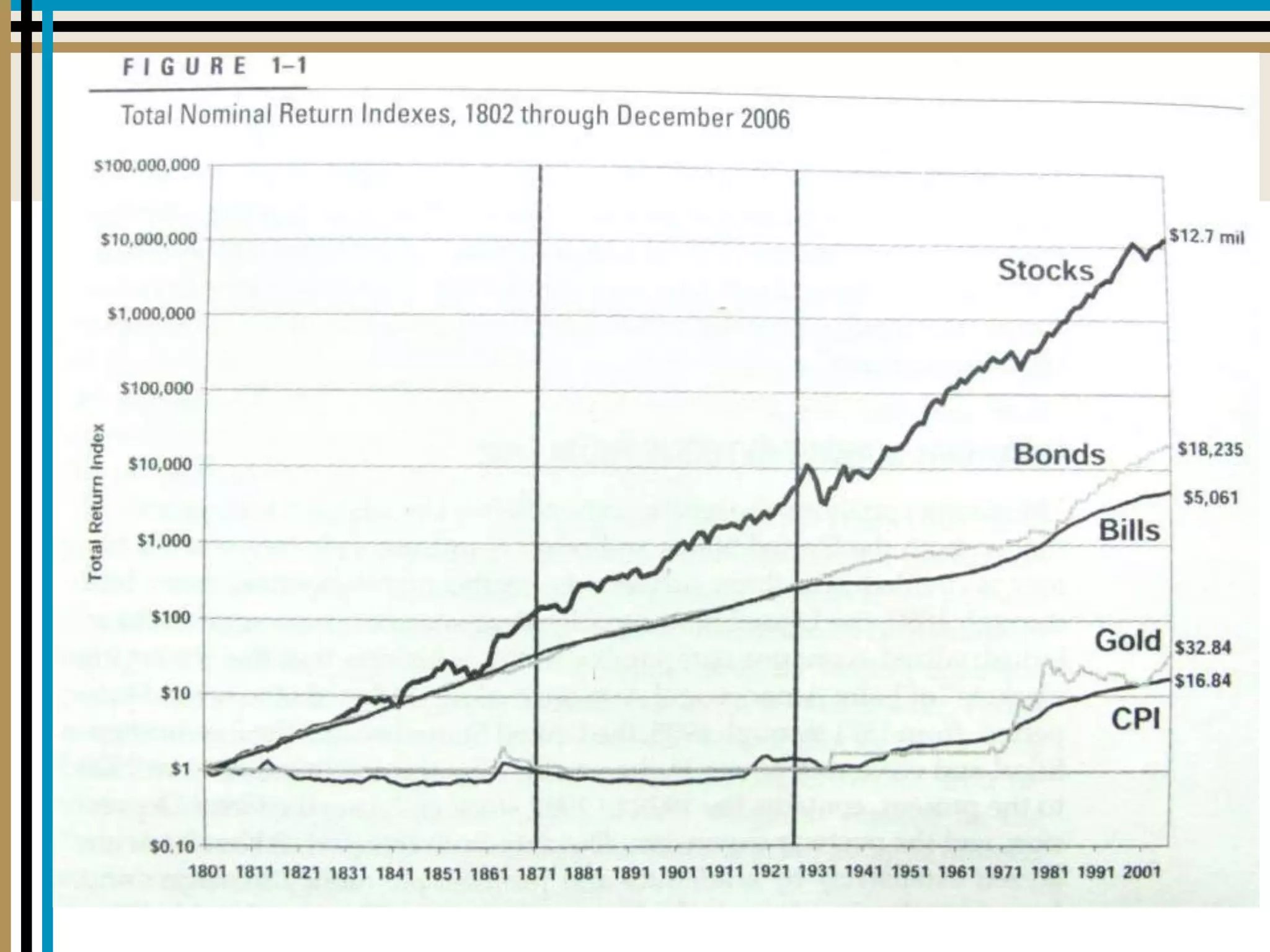

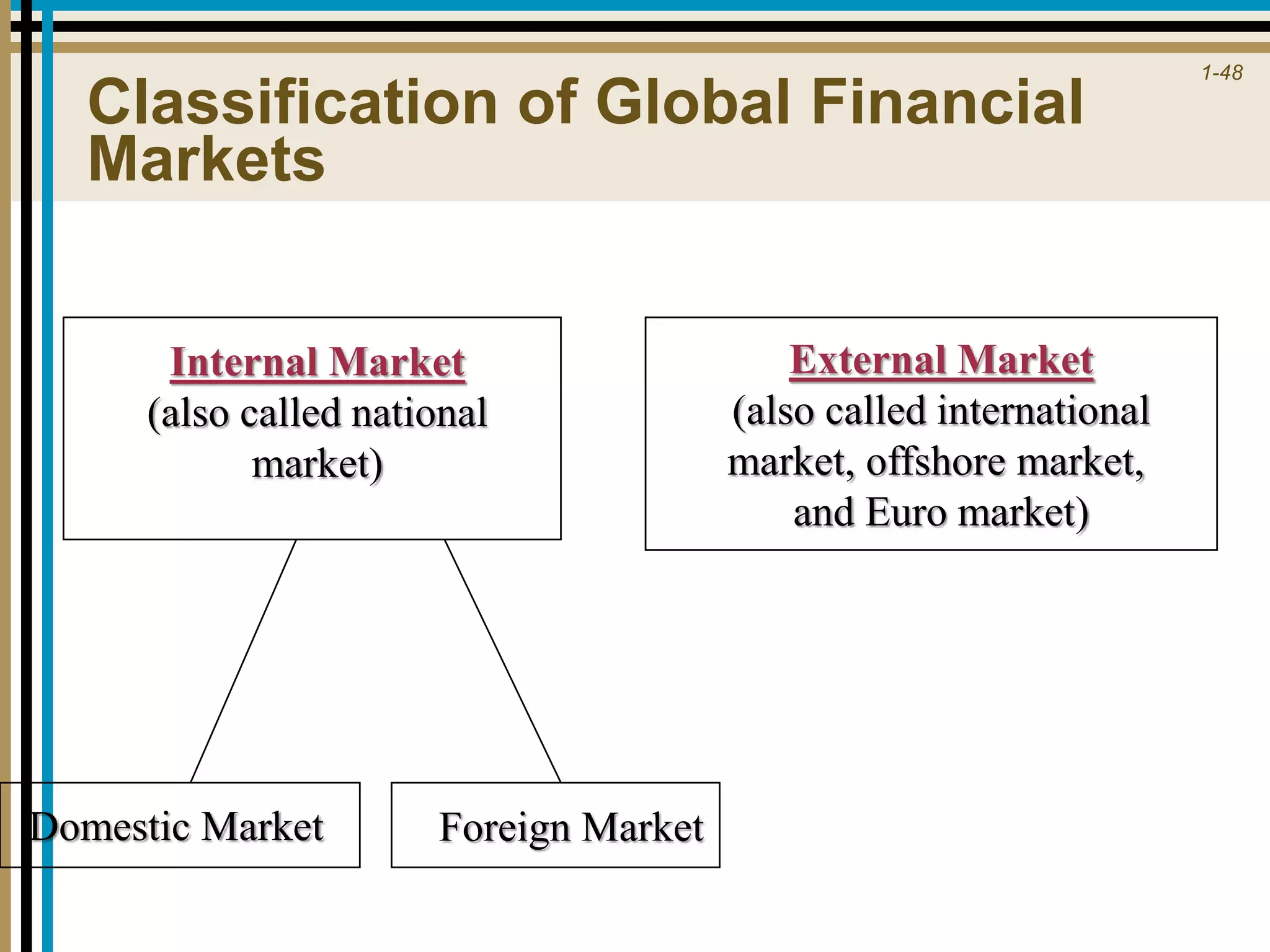

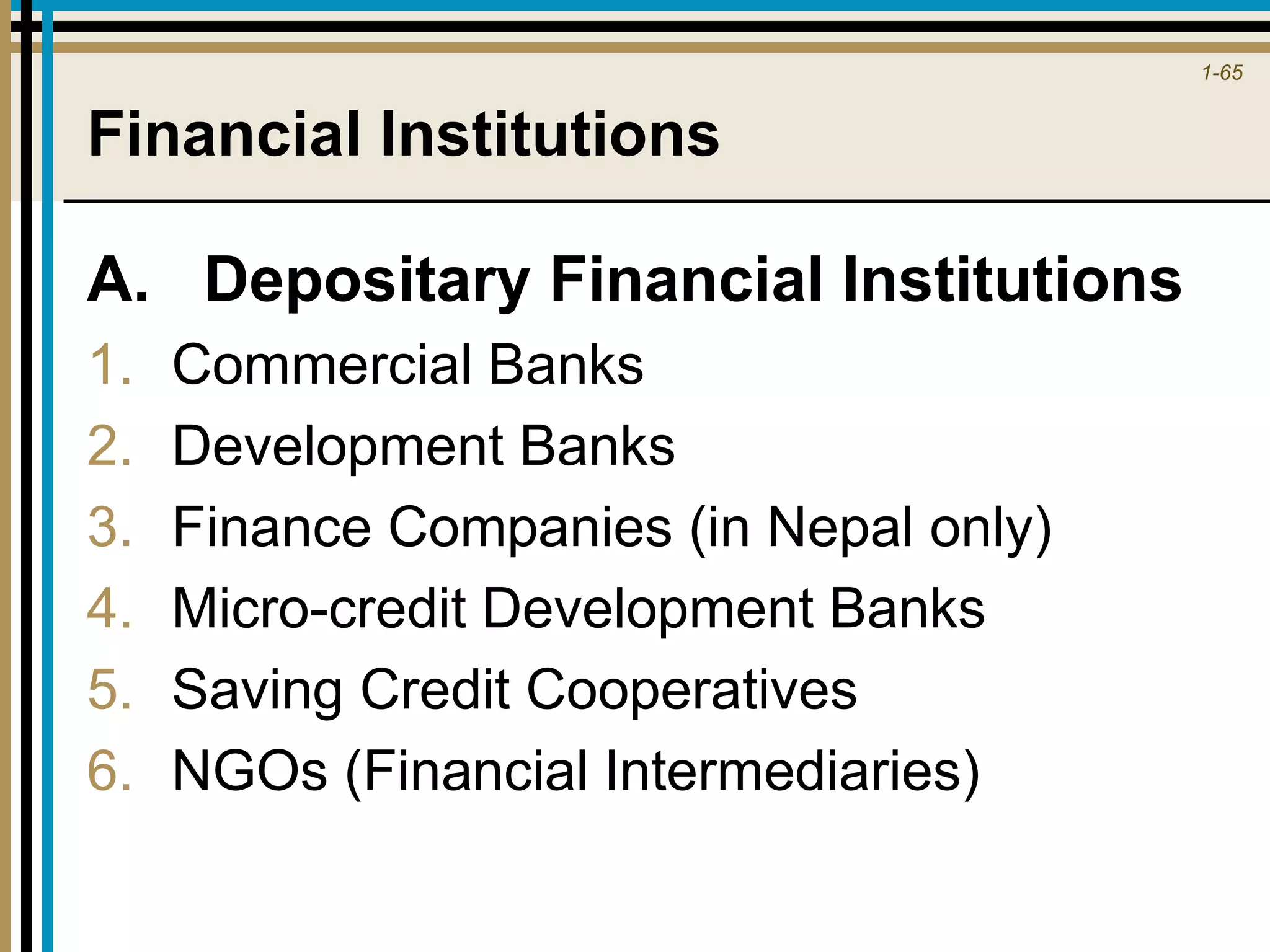

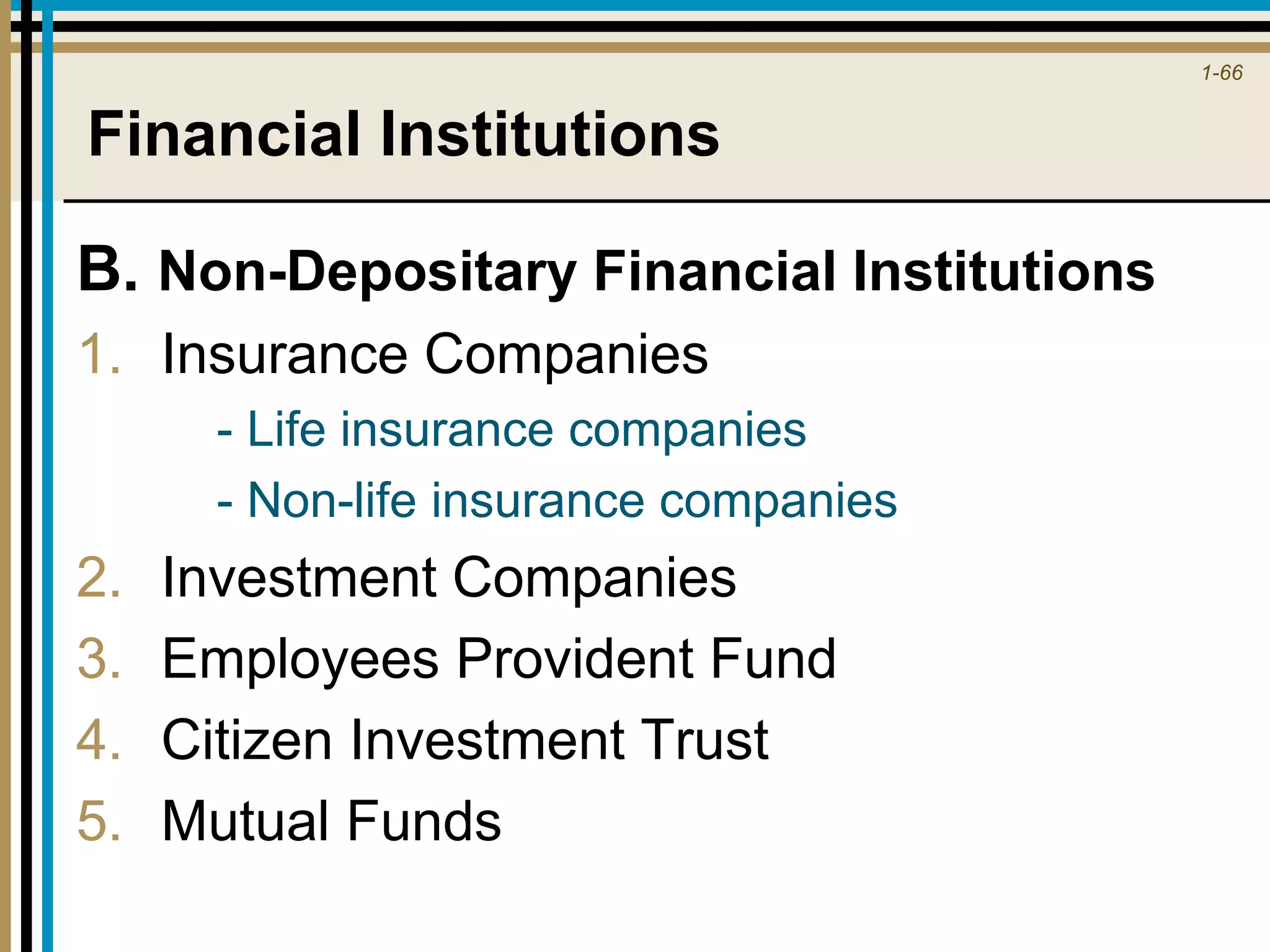

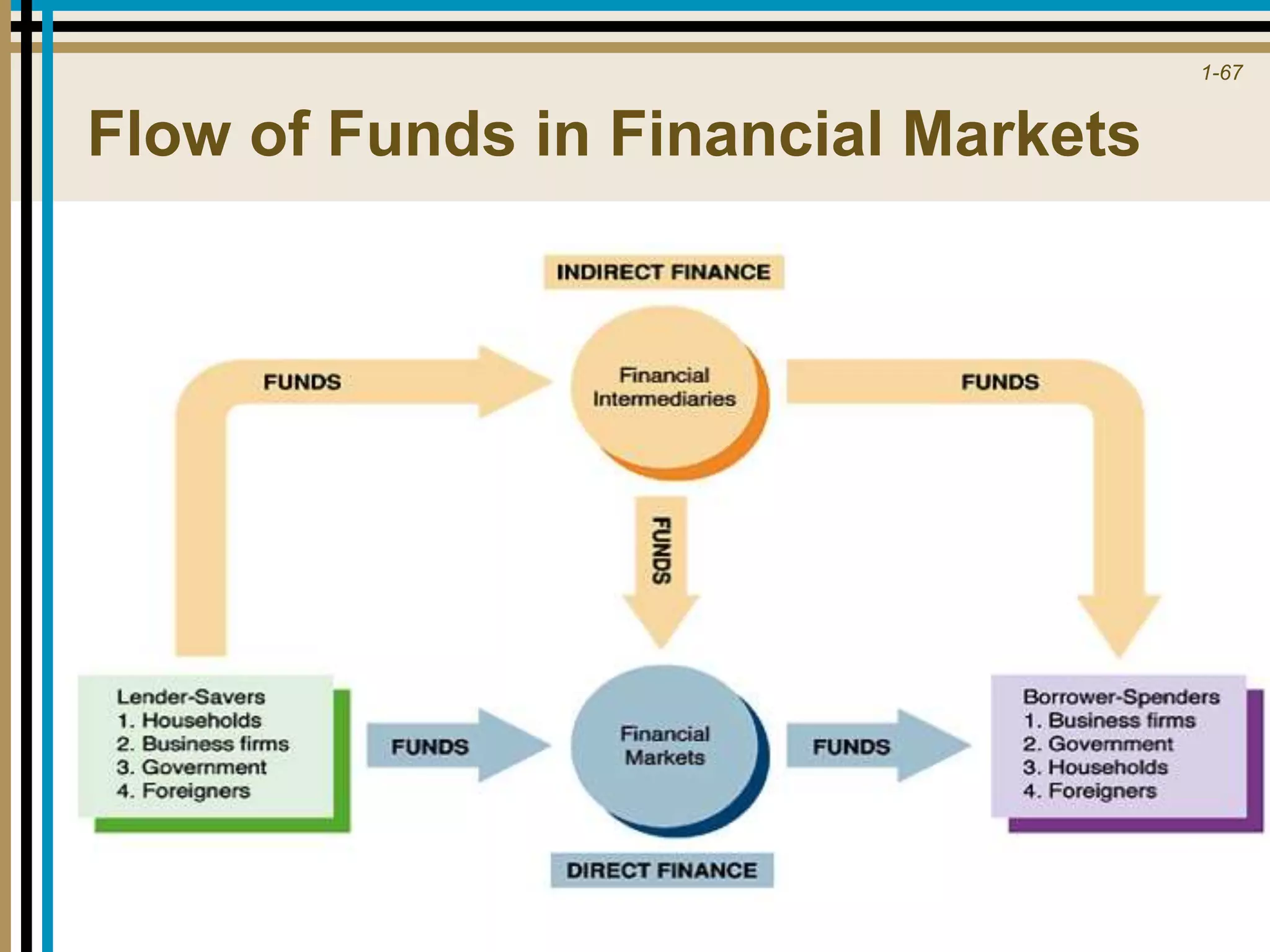

The document outlines a course on the foundations of financial markets and institutions, covering various topics such as financial assets, types of markets, and their economic functions. It includes detailed units on financial institutions, the role of government, market structures, risks associated with financial assets, and different asset classifications. Additionally, the document discusses globalization impacts, derivatives markets, and the importance of regulation in maintaining market integrity.