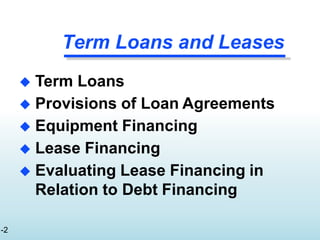

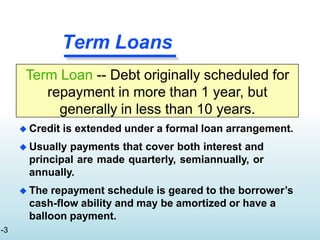

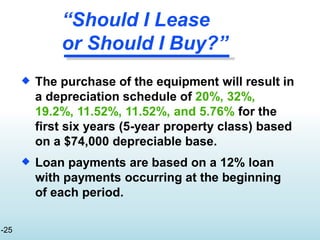

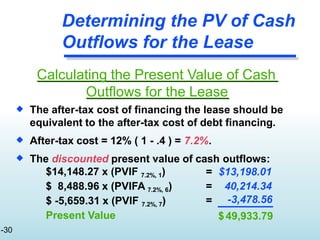

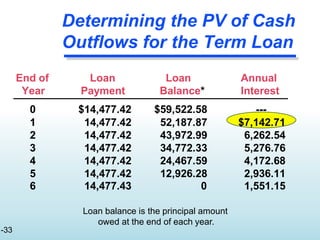

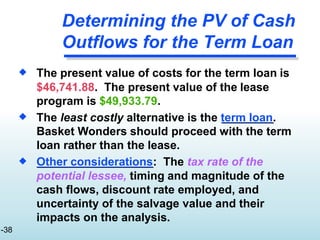

The document discusses various types of term loans and lease financing. It defines term loans as debt that is scheduled to be repaid in more than one year but generally less than ten years. Term loans typically involve regular payments of both interest and principal. The document also discusses the costs and benefits of term loans versus lease financing. It provides examples of different types of leases and factors to consider when deciding whether to lease or purchase equipment.