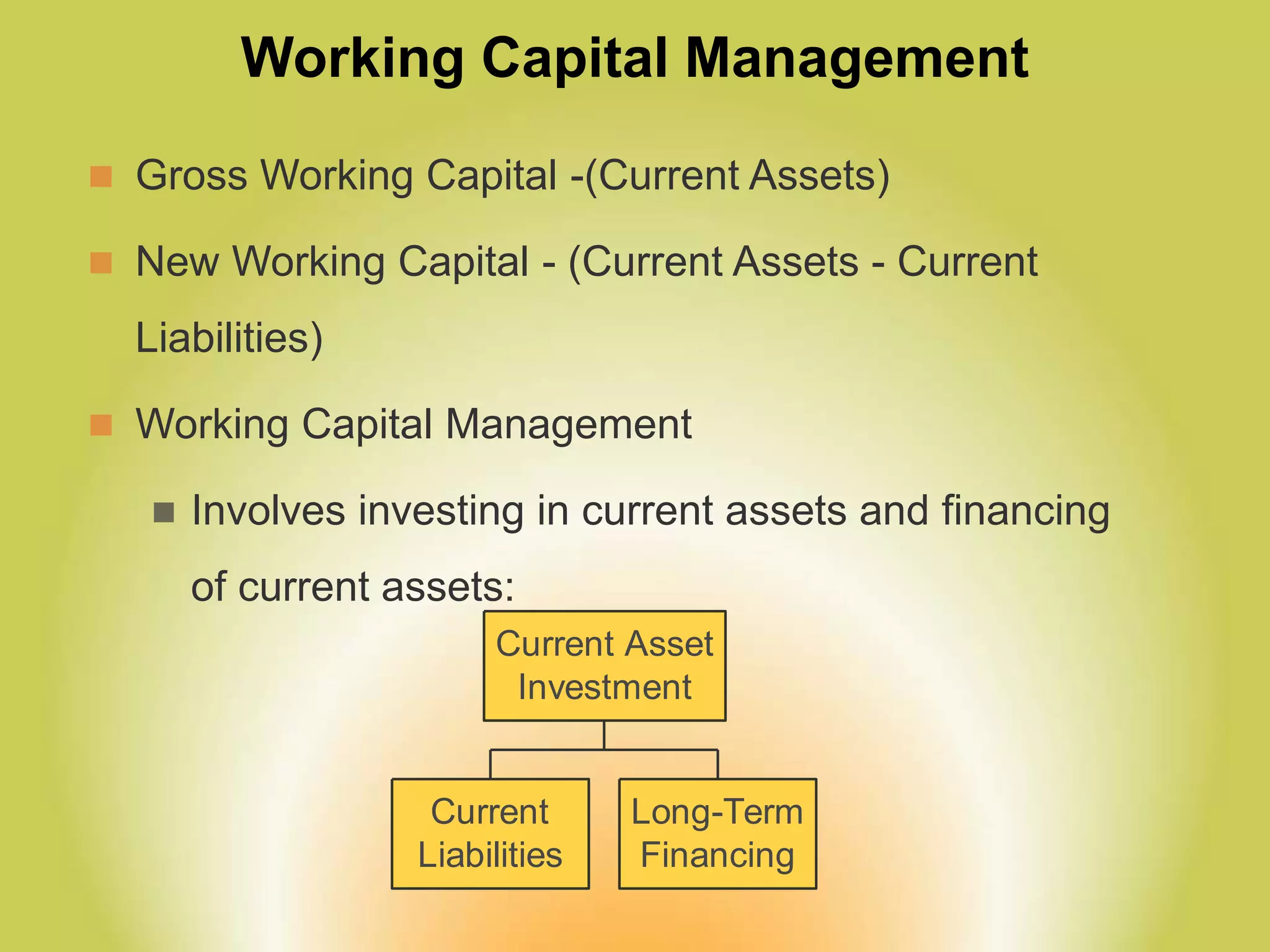

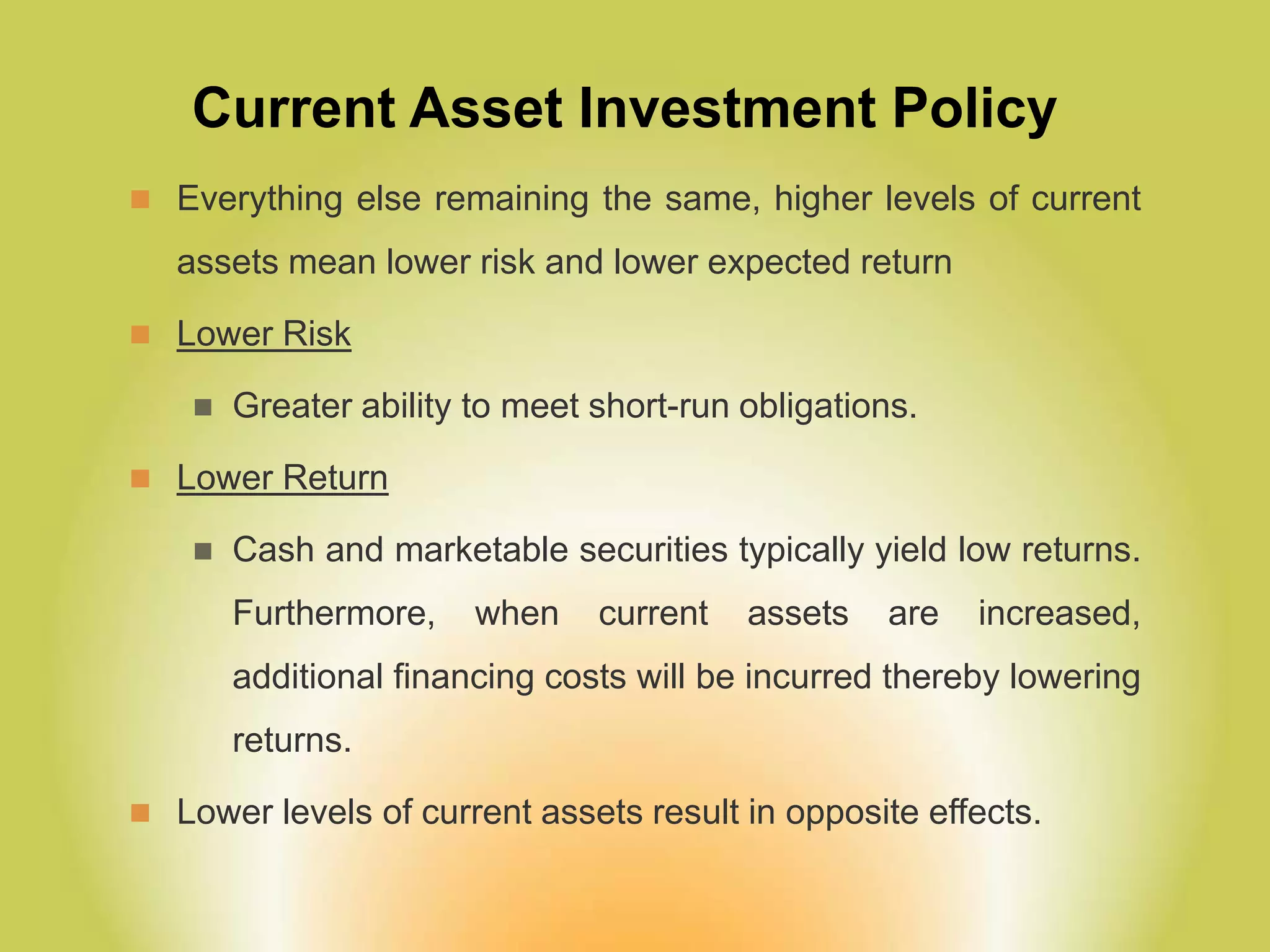

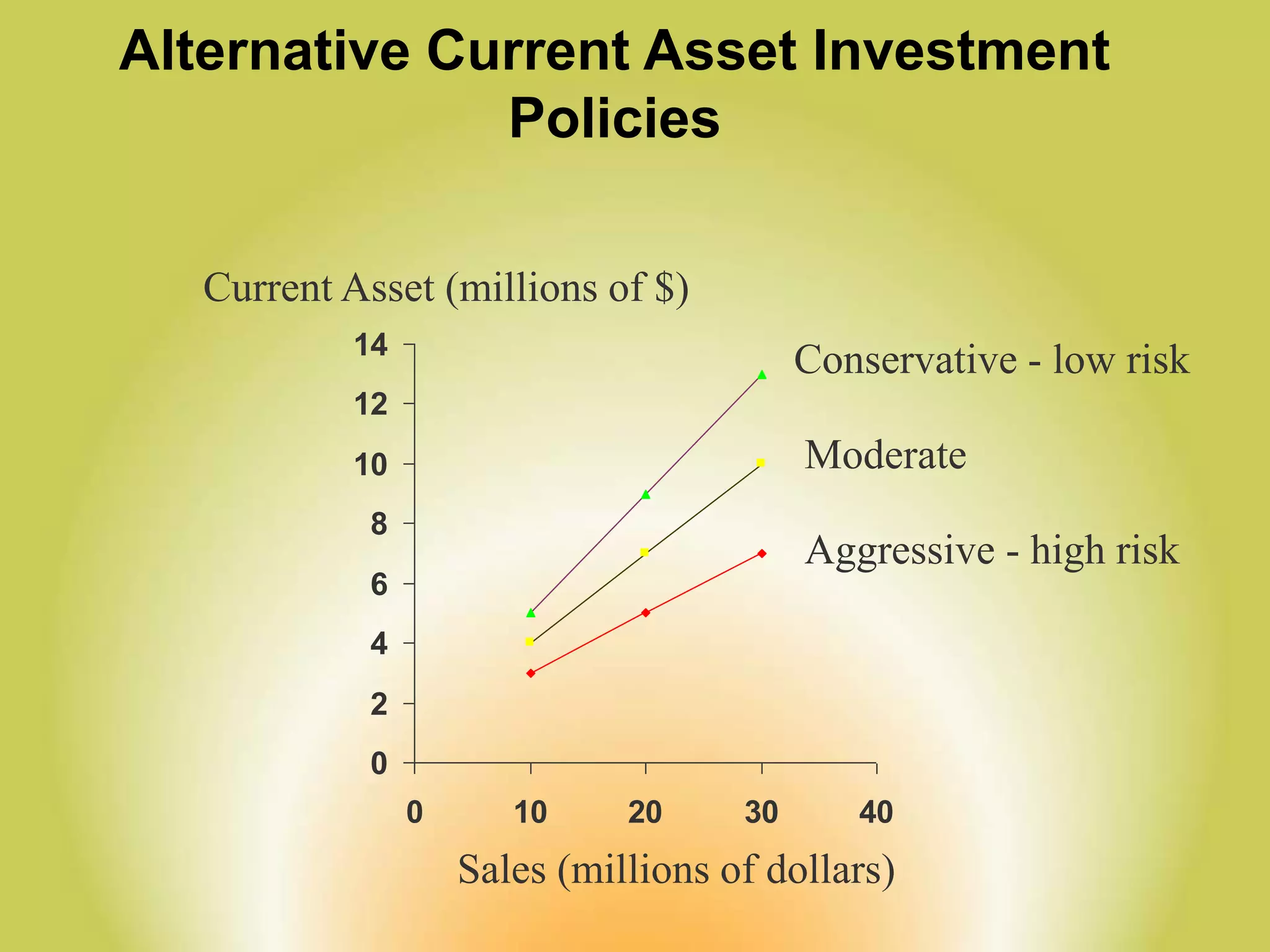

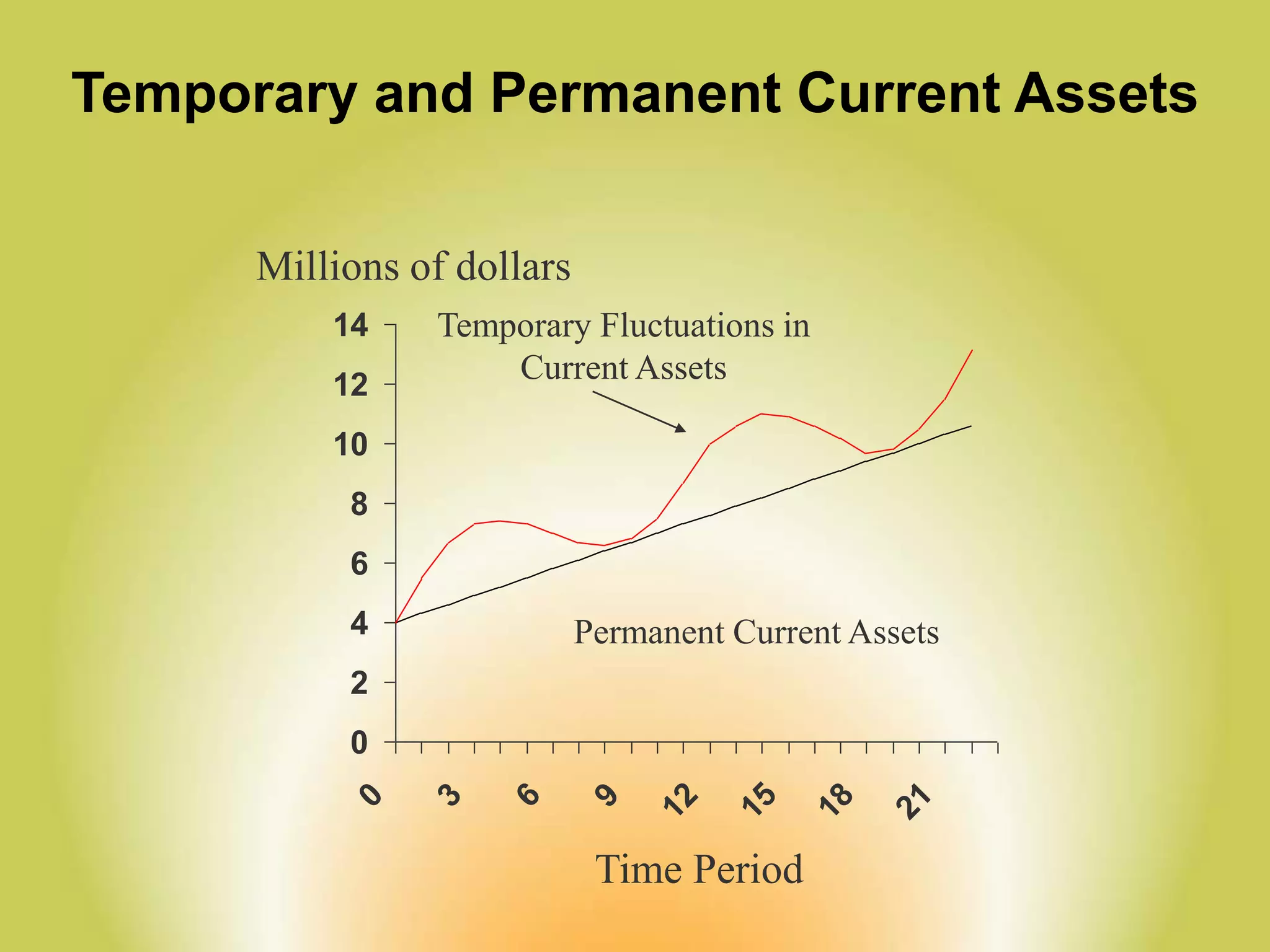

This document provides an overview of current asset management. It discusses key aspects like working capital management, current asset investment policies, cash management, marketable securities, accounts receivable management, and inventory management. The goal of current asset management is to optimize investment in current assets to balance risk and return while maintaining sufficient liquidity to meet short-term obligations.