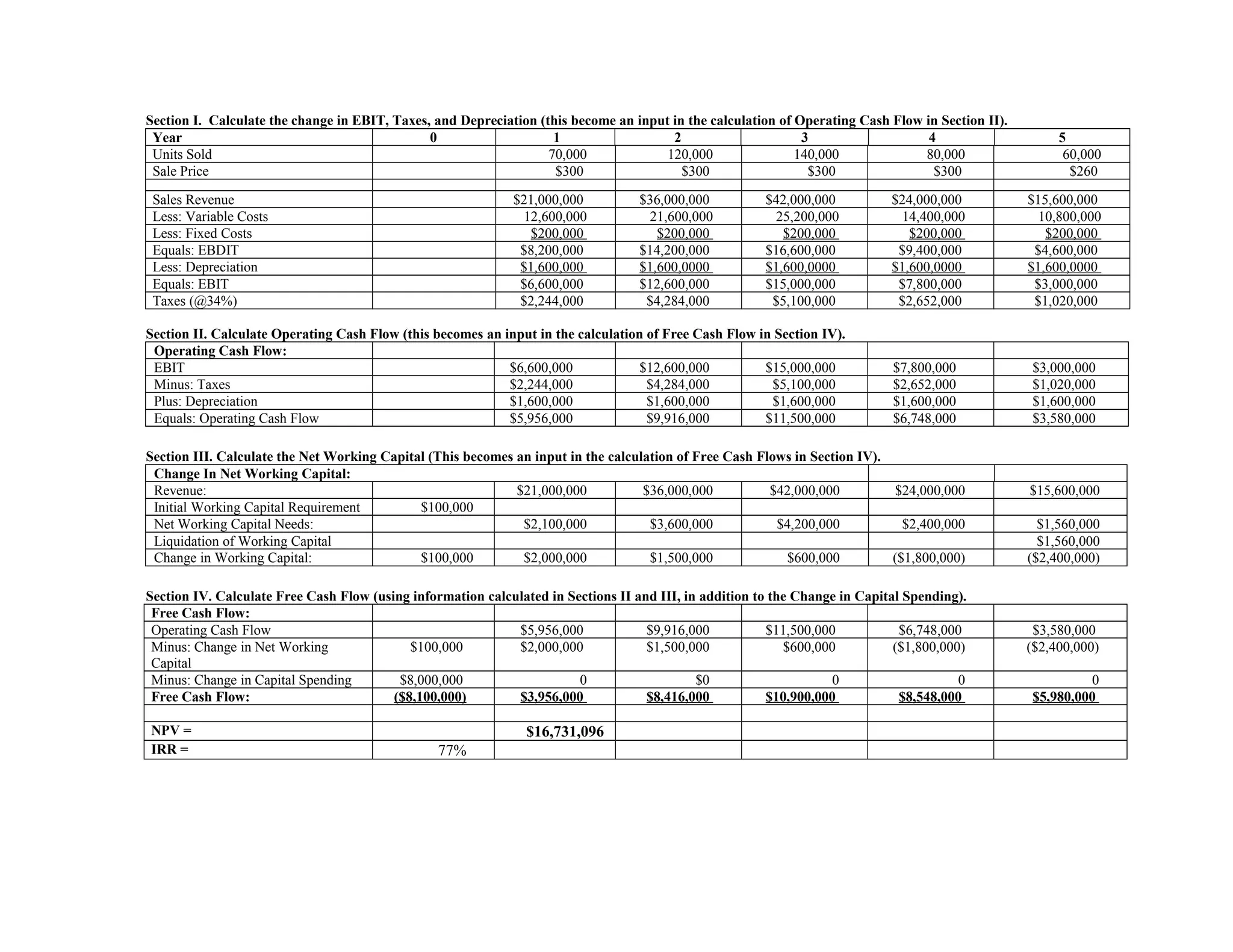

The document outlines the assignment of an assistant financial analyst at Caledonia Products, involving cash flow analysis and capital budgeting for a new product's investment. It provides specific financial details, including costs, expected sales, and the methodology for calculating net present value and internal rate of return. The document also examines key financial concepts such as cash flows versus accounting profits, the relevance of depreciation, and risk measurement in capital budgeting.