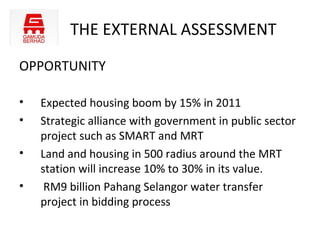

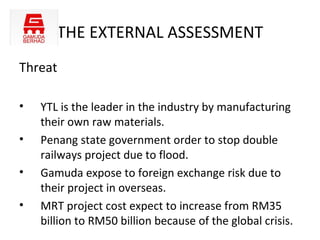

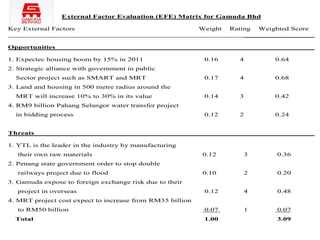

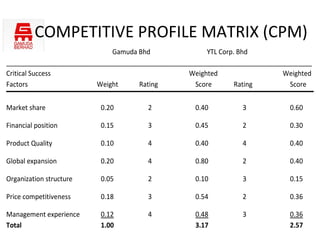

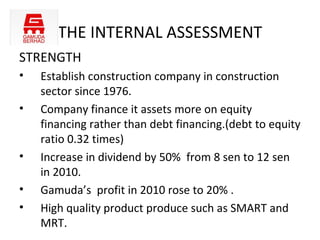

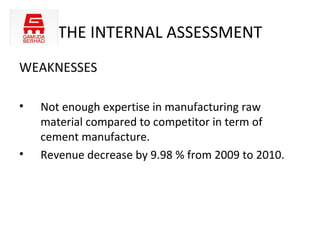

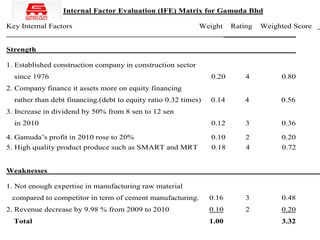

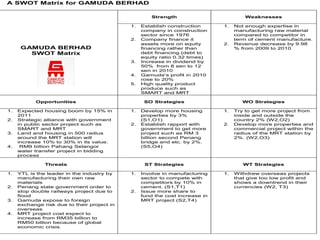

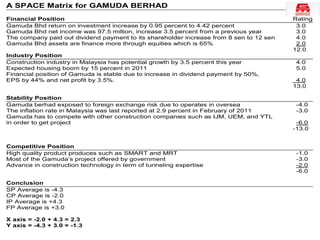

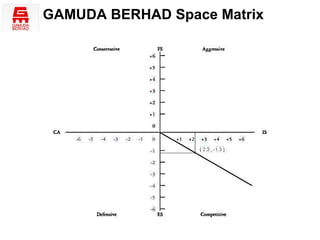

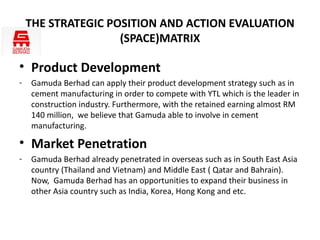

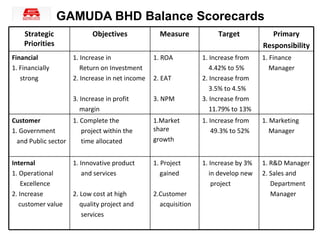

The document provides information on Gamuda Berhad, a Malaysia-based construction company. It discusses the construction sector in Malaysia and background of Gamuda. The company operates in engineering and construction, property development, water and expressway concessions. A key competitor is YTL Corporation. The document also includes Gamuda's vision and mission statements, an external assessment identifying opportunities and threats, an internal assessment of strengths and weaknesses, and a SWOT analysis matrix.