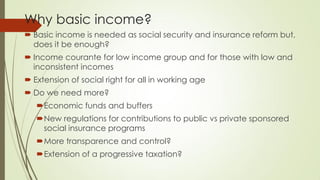

The document discusses the challenges and complexities surrounding income distribution in the 21st century, questioning the roles of economists, social scientists, and policymakers in addressing issues of increasing inequality and sustainability of welfare states. It emphasizes the need for a new agenda that includes progressive taxation, effective policies for income distribution, and the consideration of basic income as a reform for social security. Historical analysis and current trends suggest a shift is necessary to properly address the distribution of wealth and risks in a rapidly changing economy.