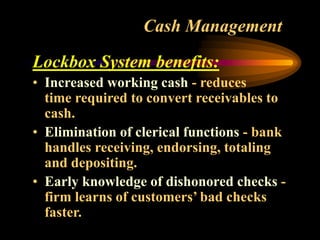

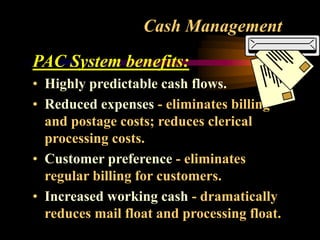

The document discusses cash and marketable securities management. It describes the motives for holding cash as transactions, precautionary, and speculative reasons. The objectives of cash management are to have enough cash on hand to meet needs while minimizing idle cash balances. Methods to manage cash inflows and outflows like lockboxes, preauthorized checks, and zero balance accounts are presented. The document also covers considerations and types of marketable securities that can be held, such as Treasury bills, federal agency securities, commercial paper, and money market mutual funds.