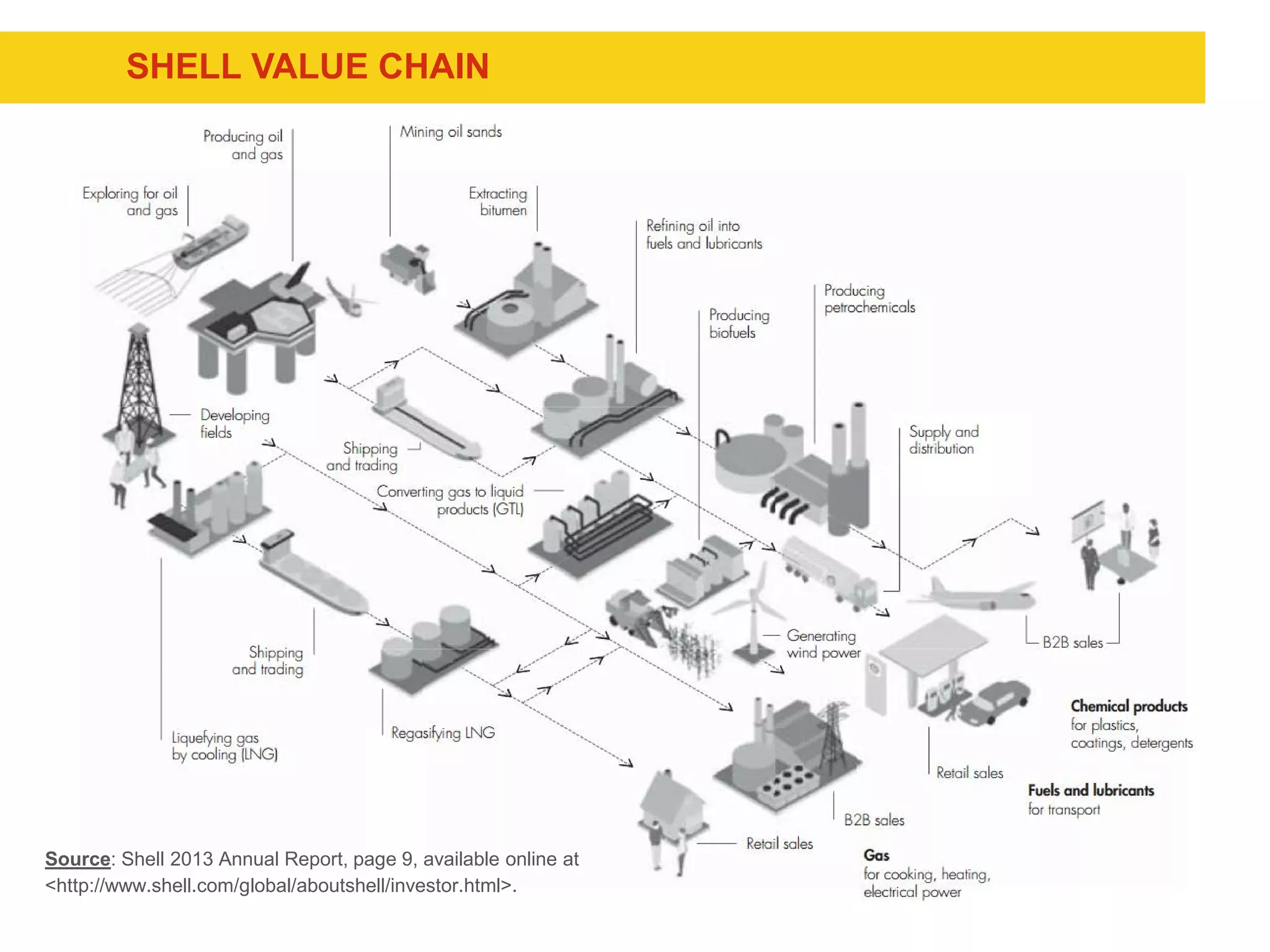

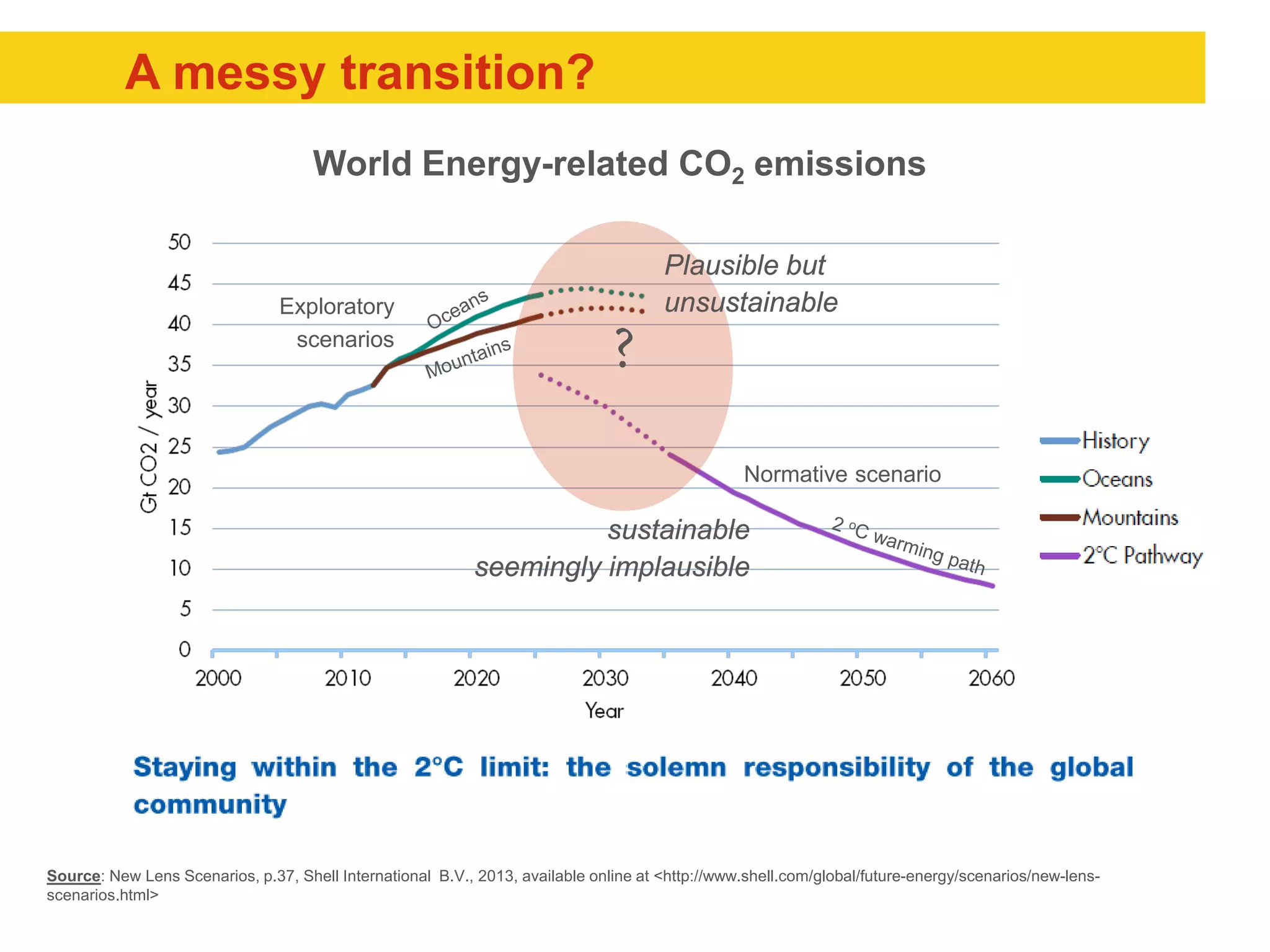

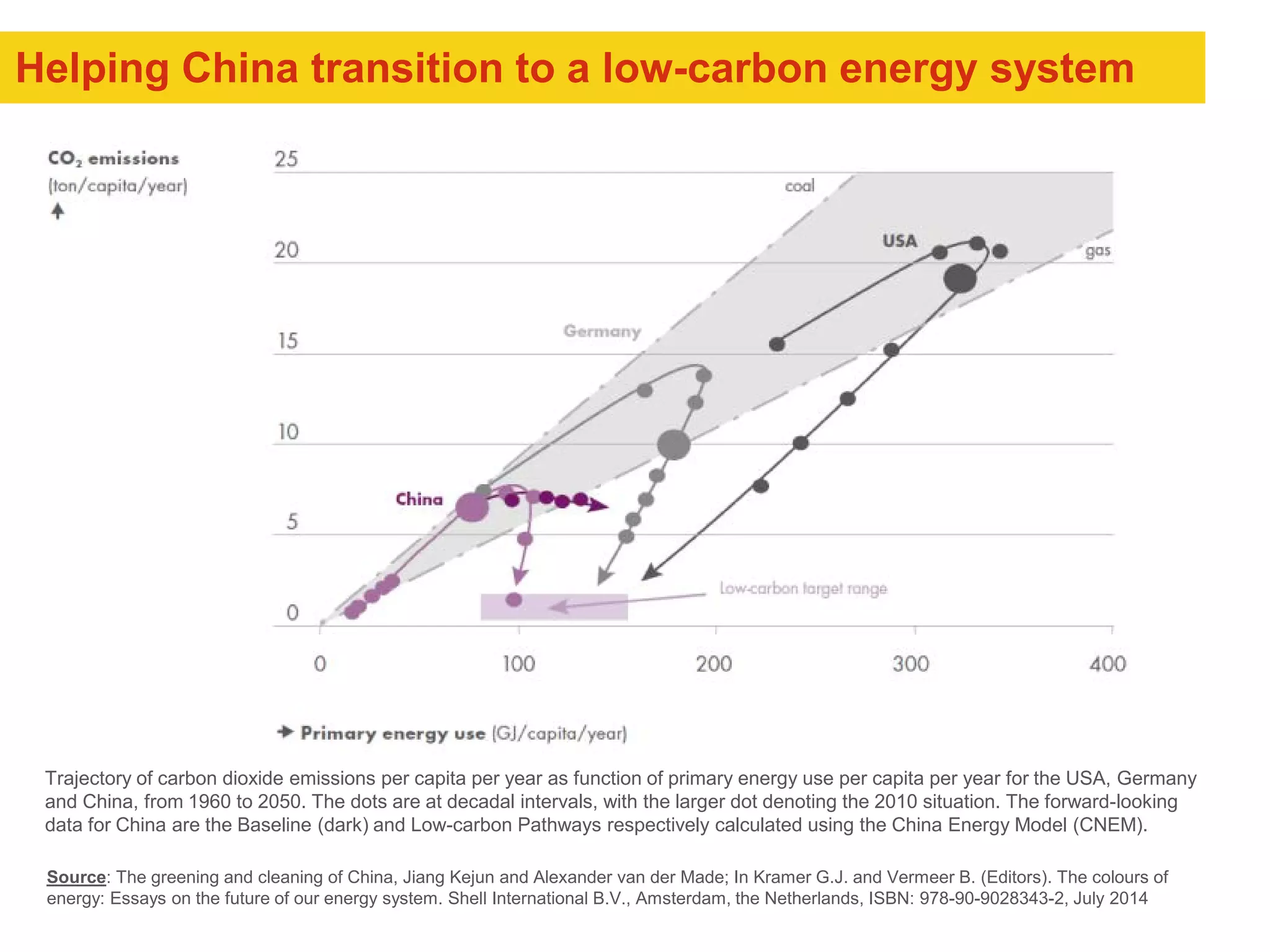

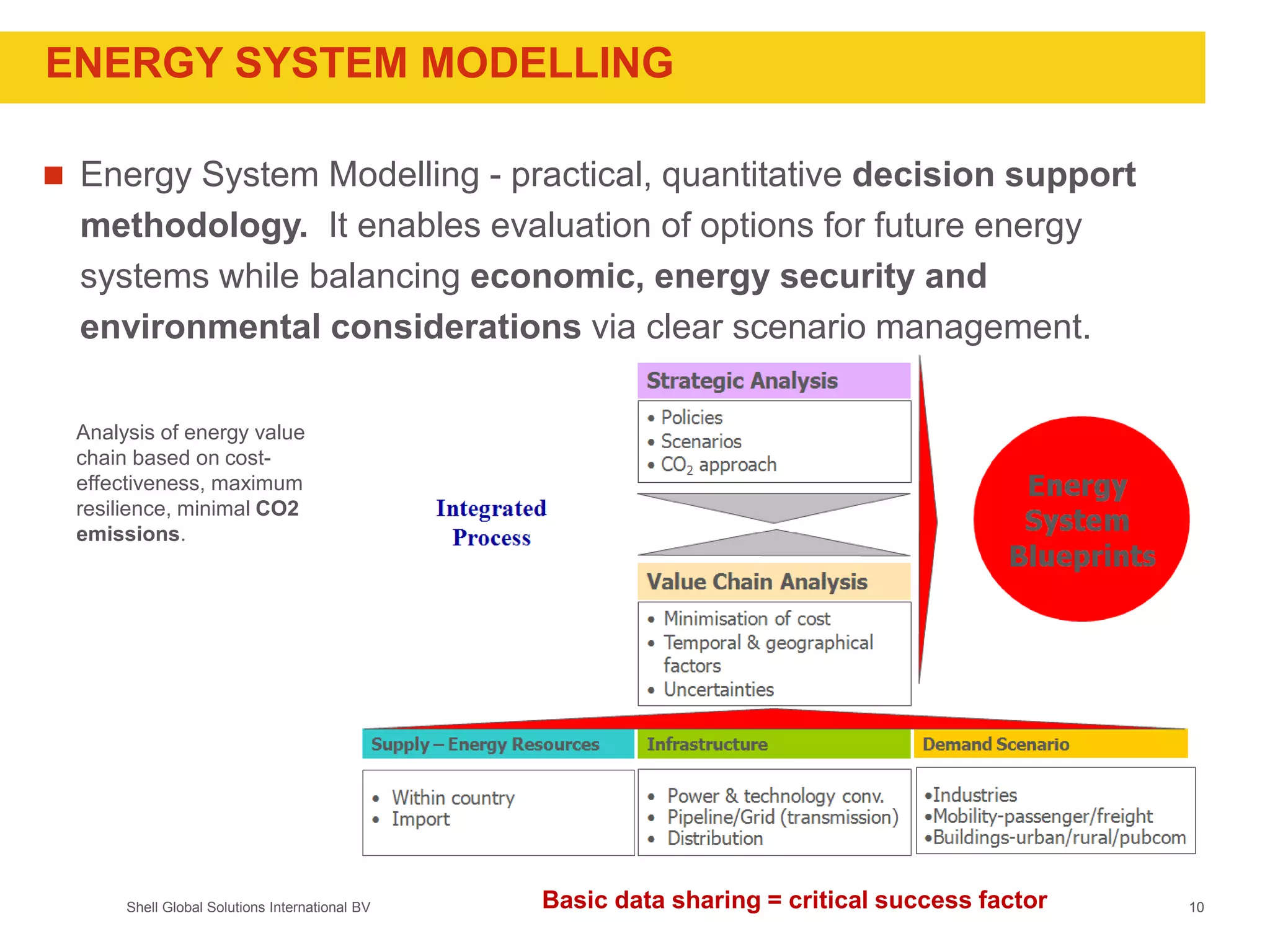

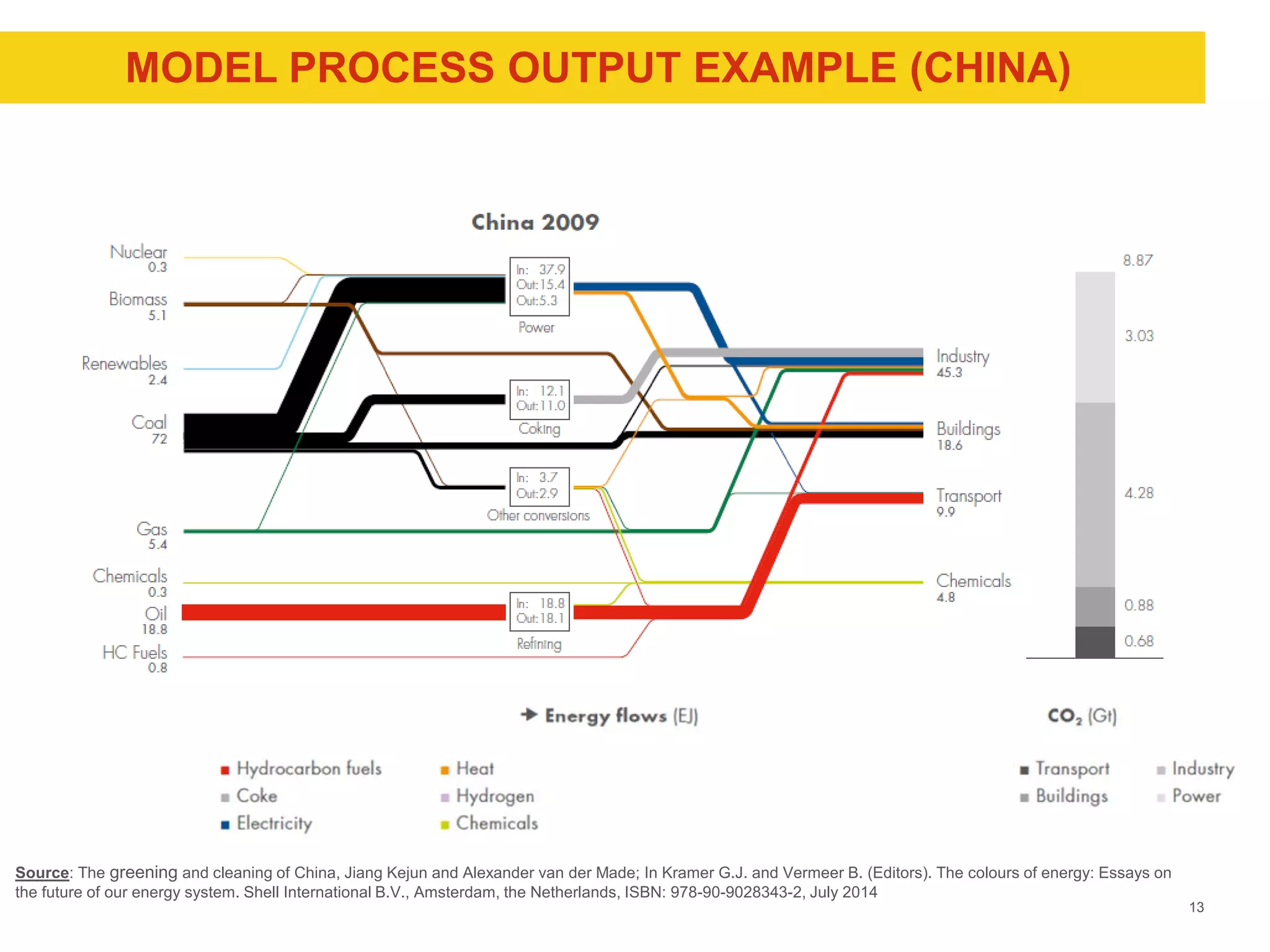

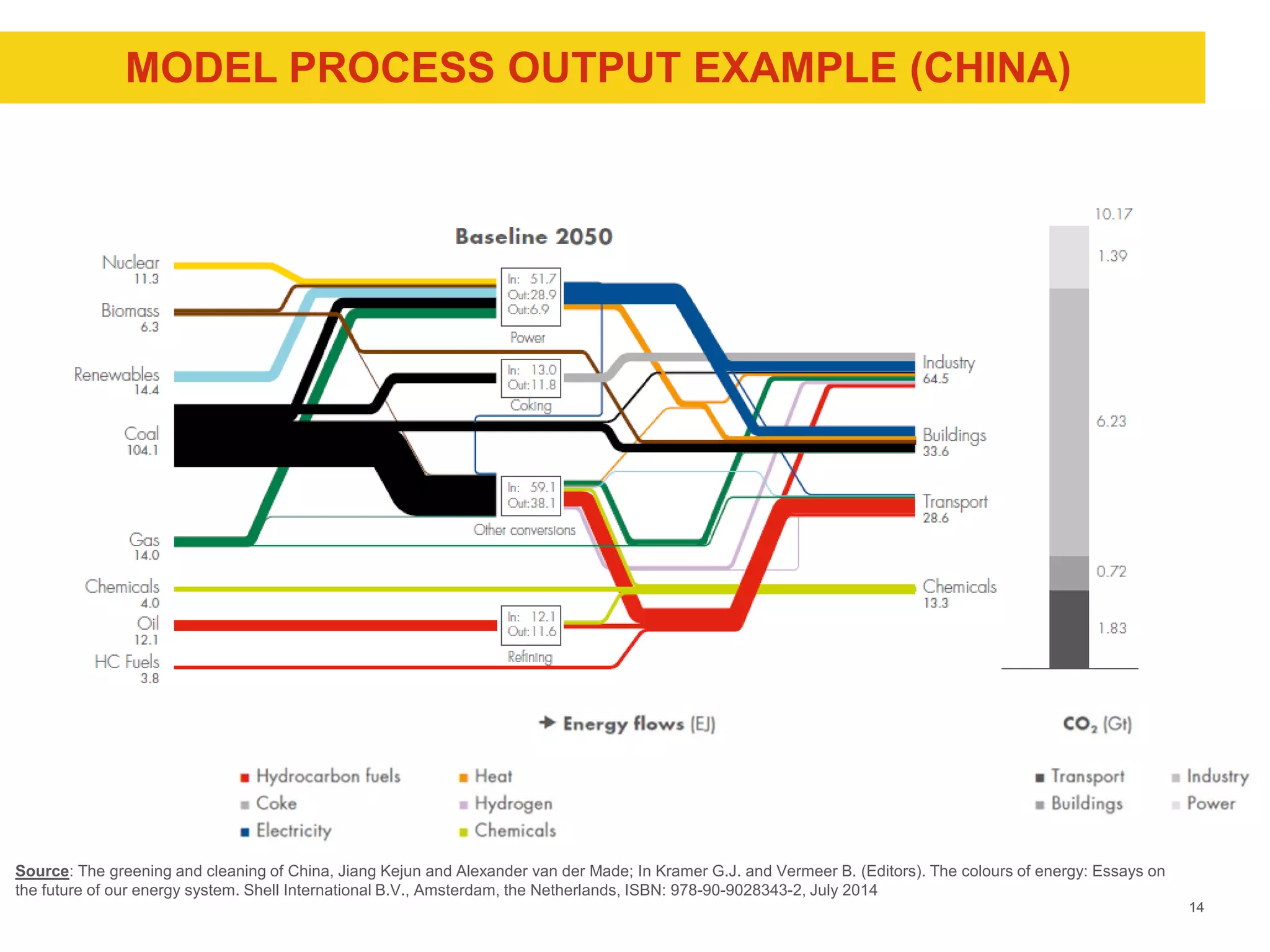

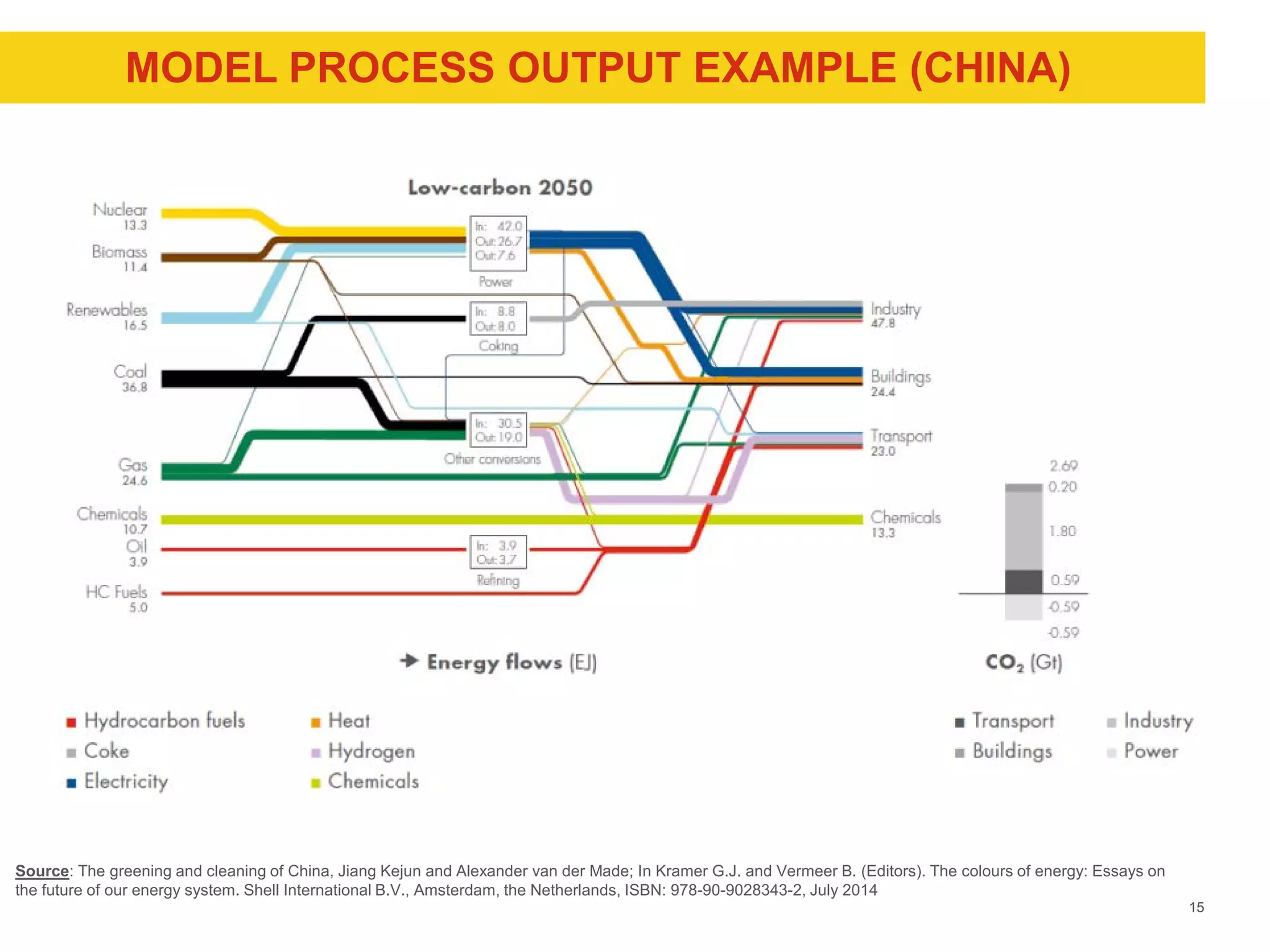

1) Shell uses energy systems modeling with tools like GMOS/NetSim to help optimize large scale energy systems and evaluate transition pathways for countries like China to lower carbon systems.

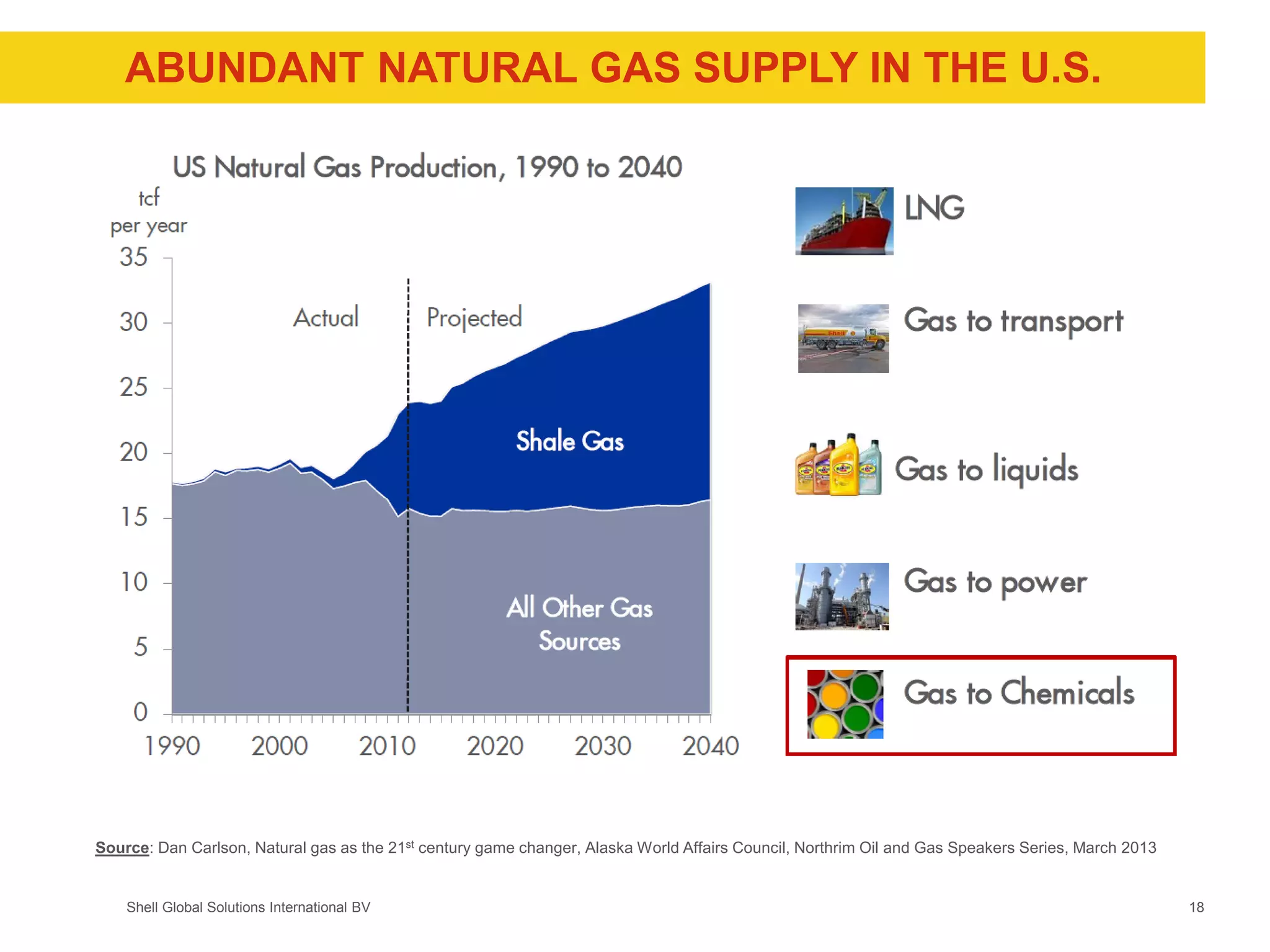

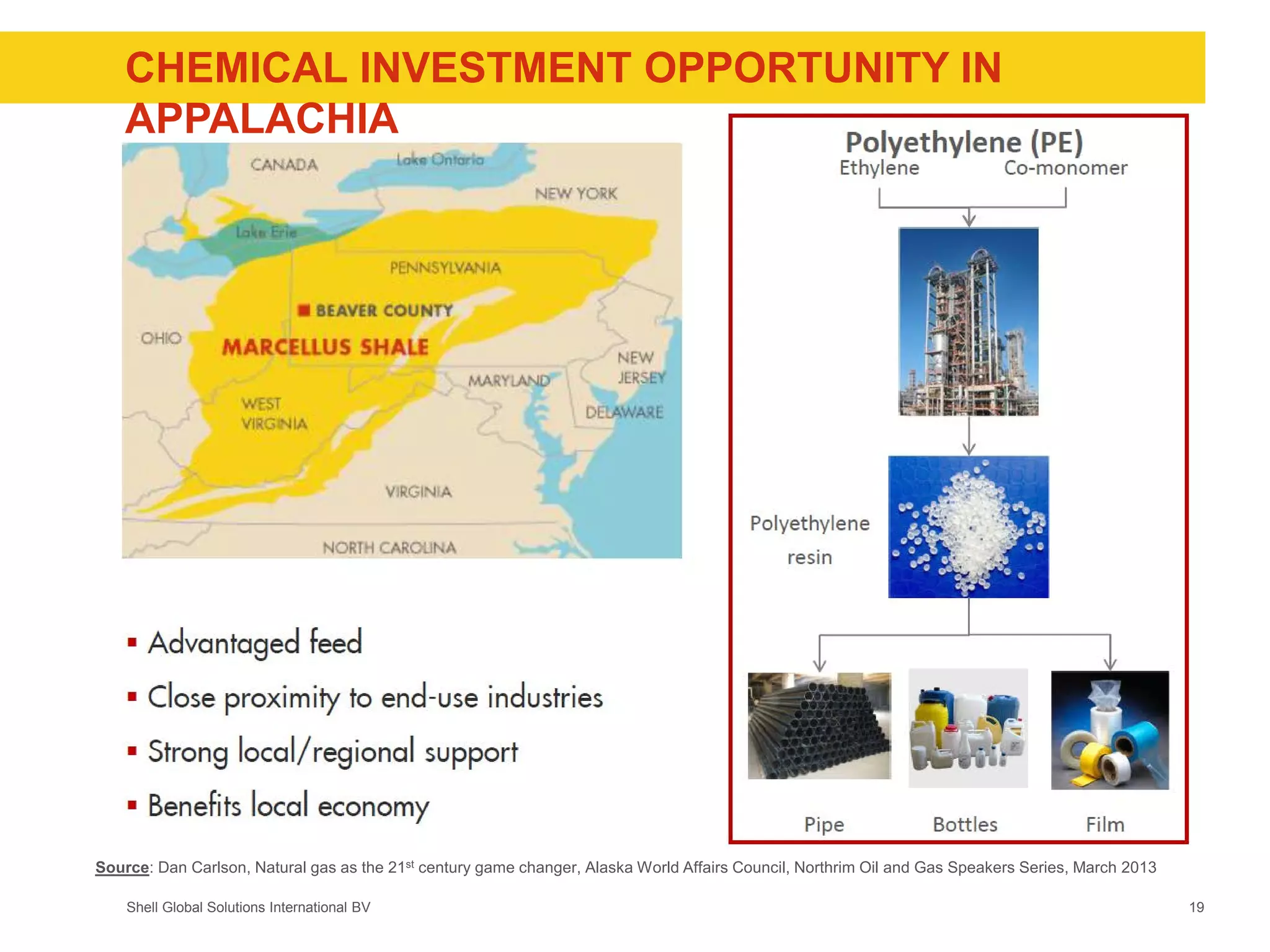

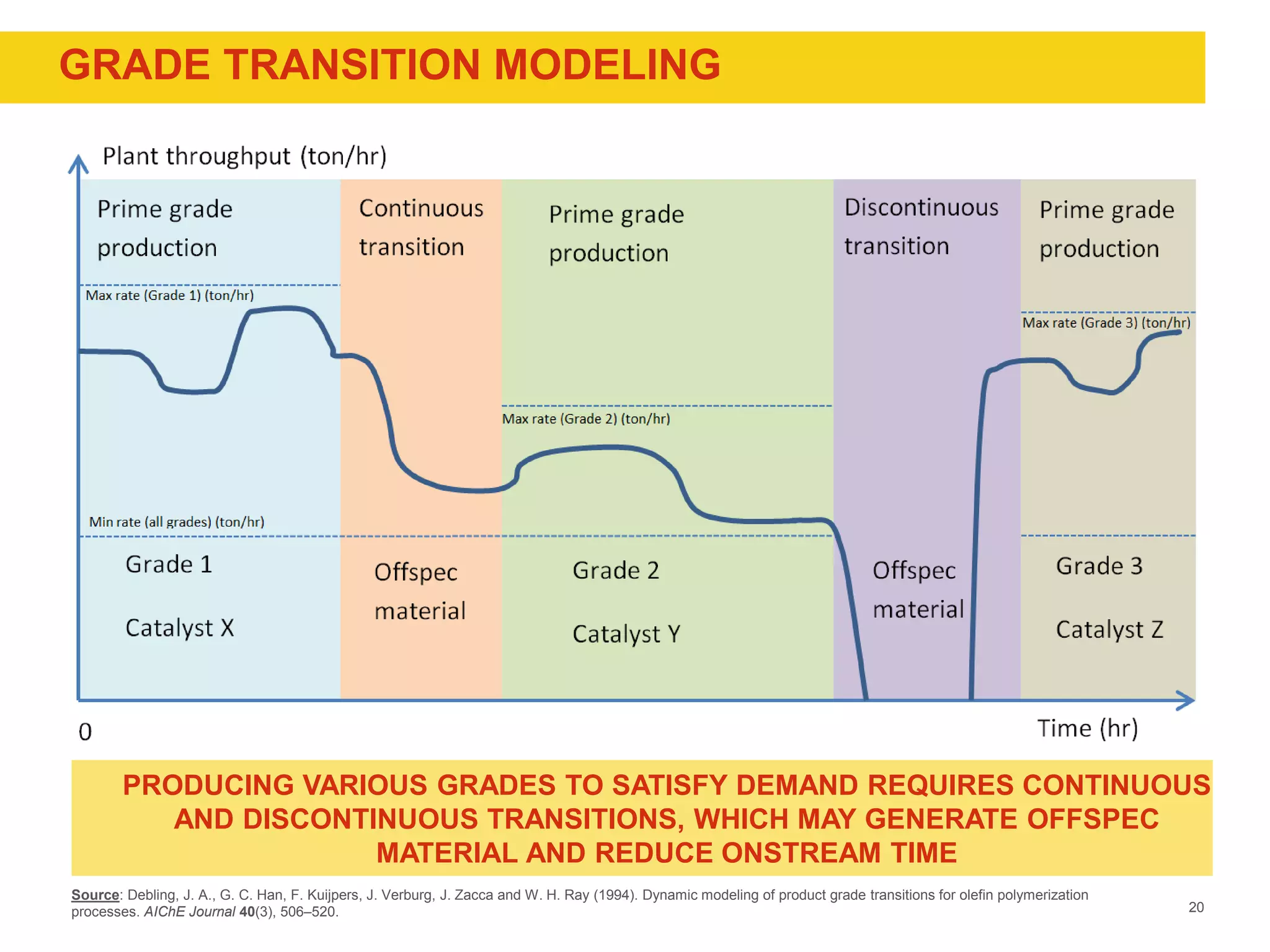

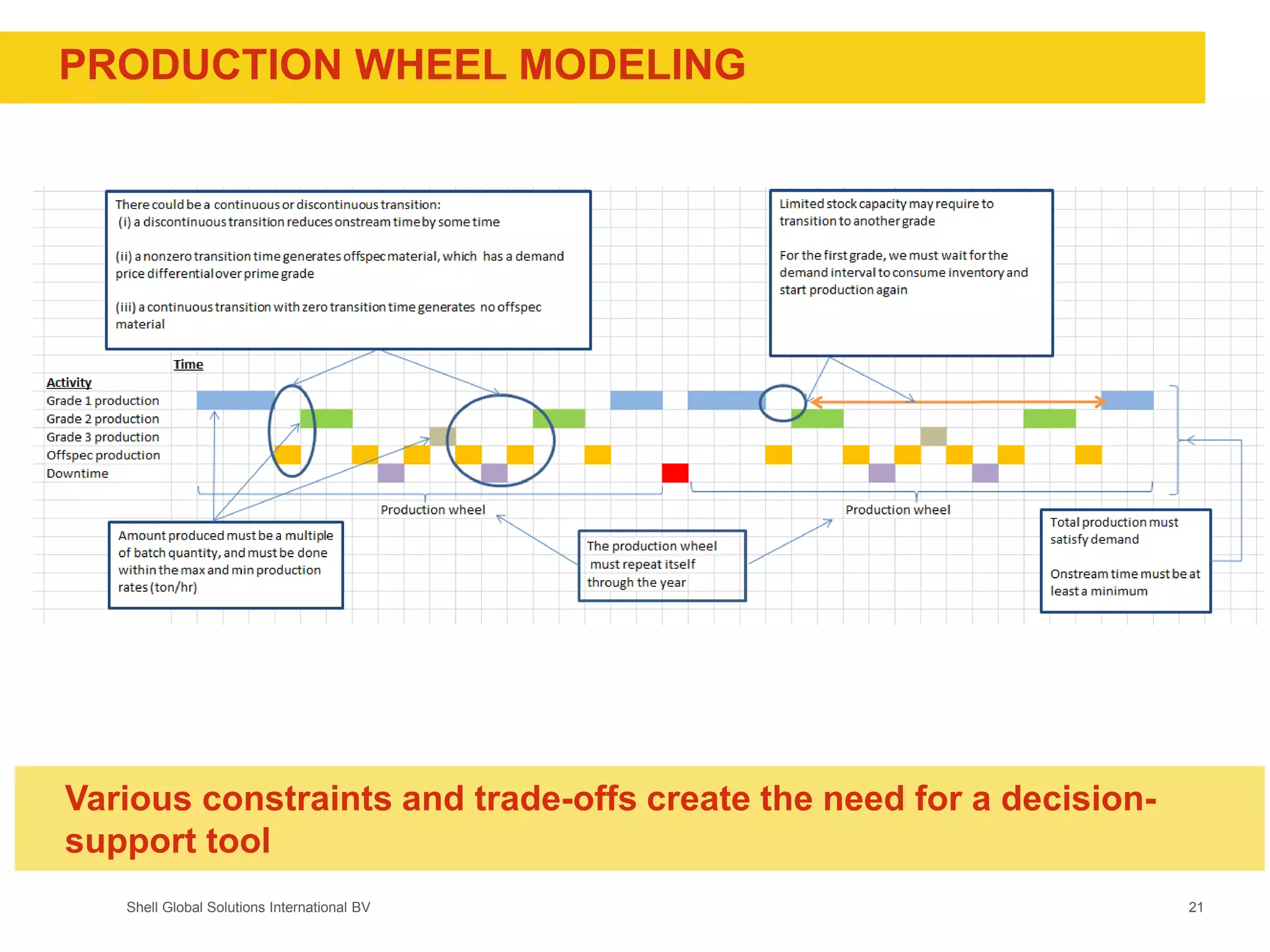

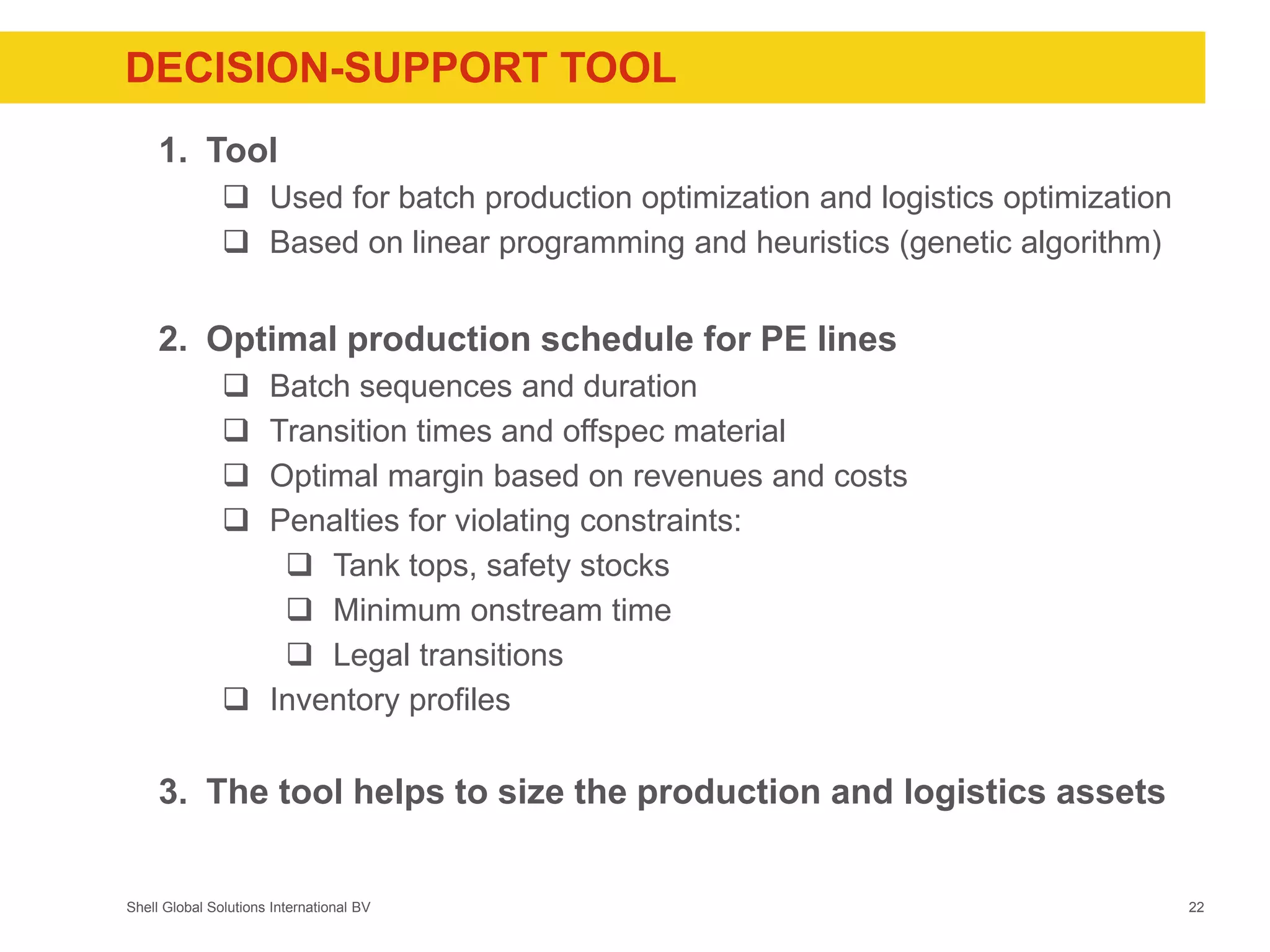

2) Production-logistics optimization tools are used to optimize batch production scheduling and logistics for gas-to-chemicals facilities to maximize margins within operational constraints.

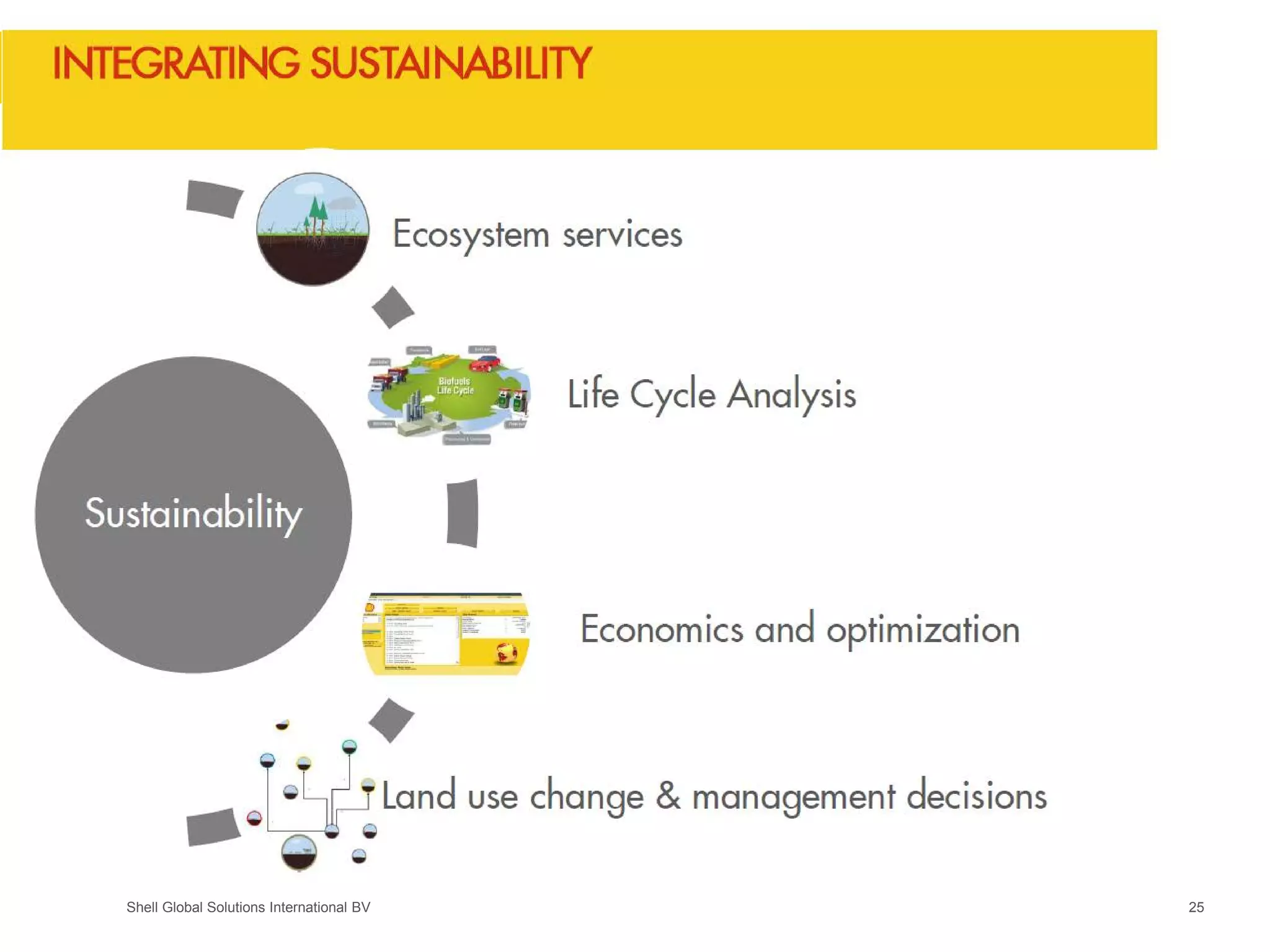

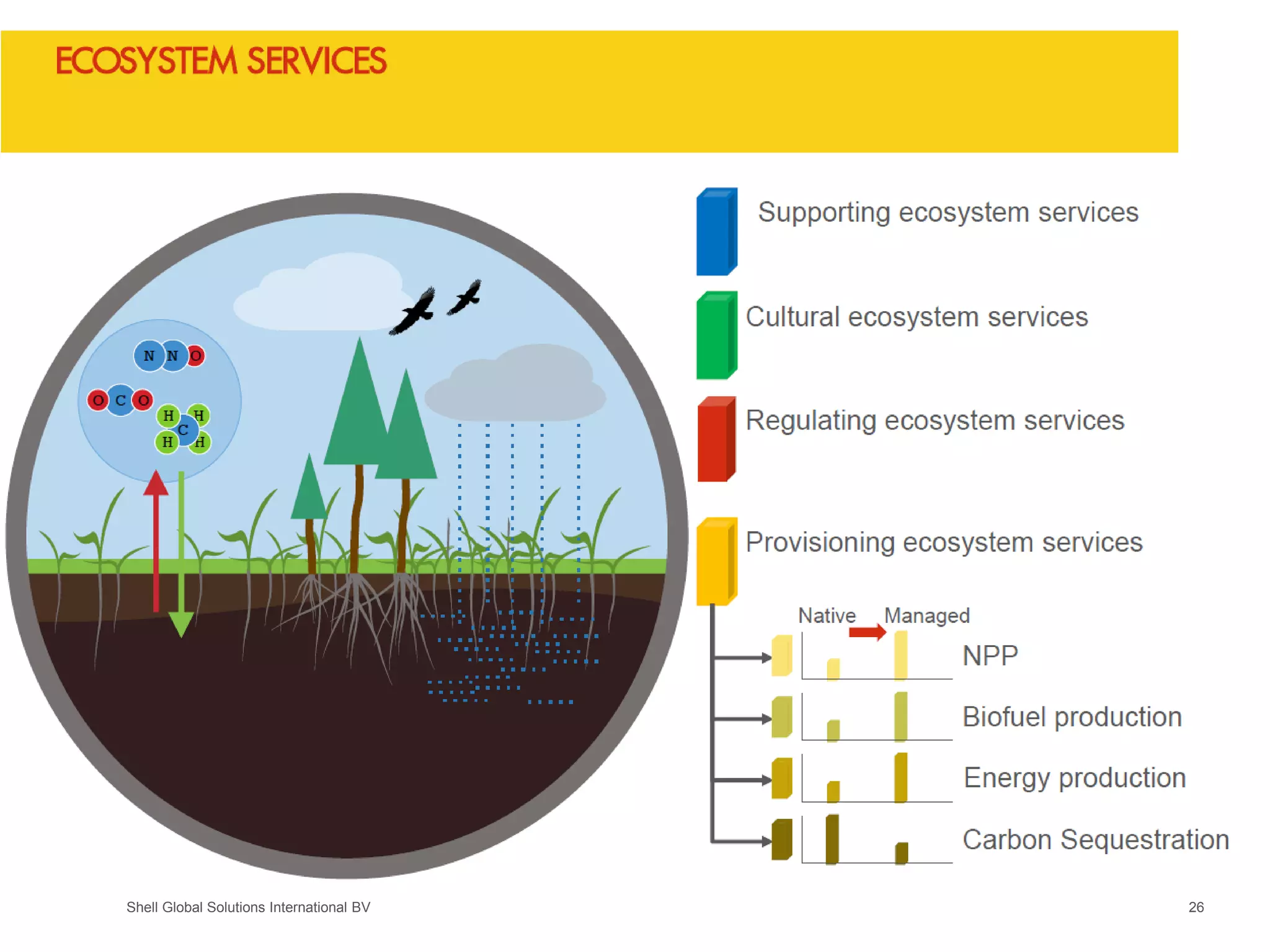

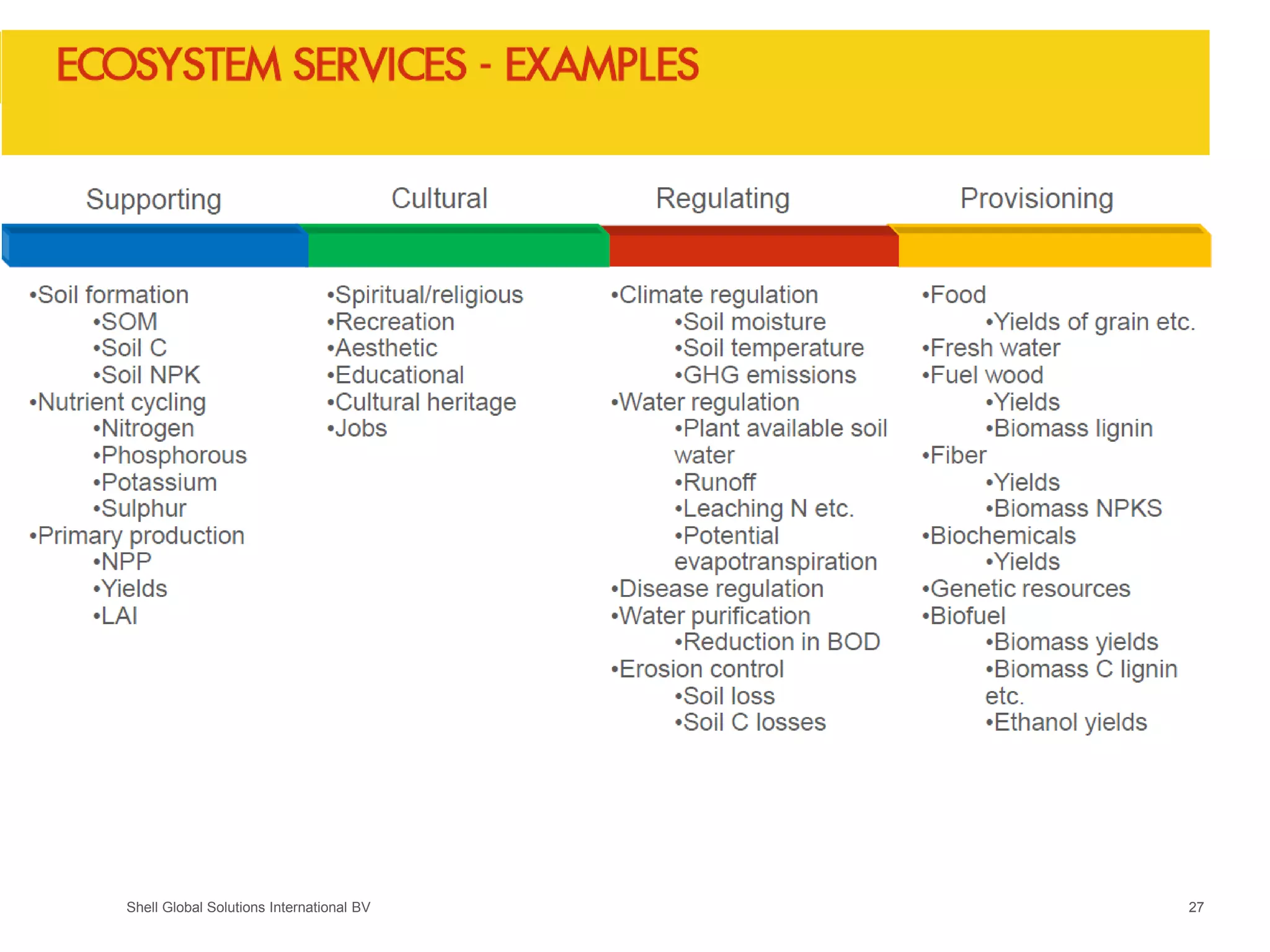

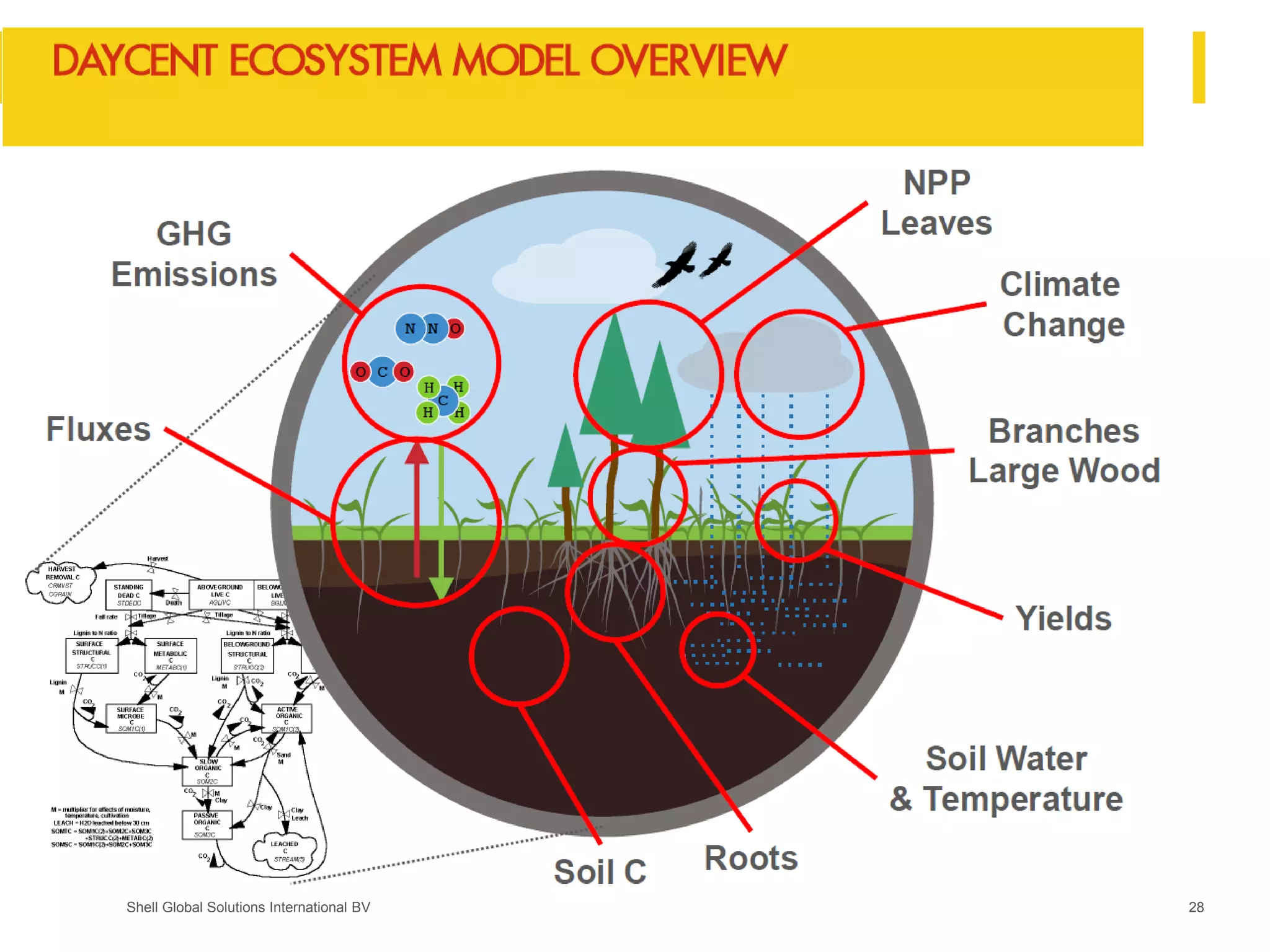

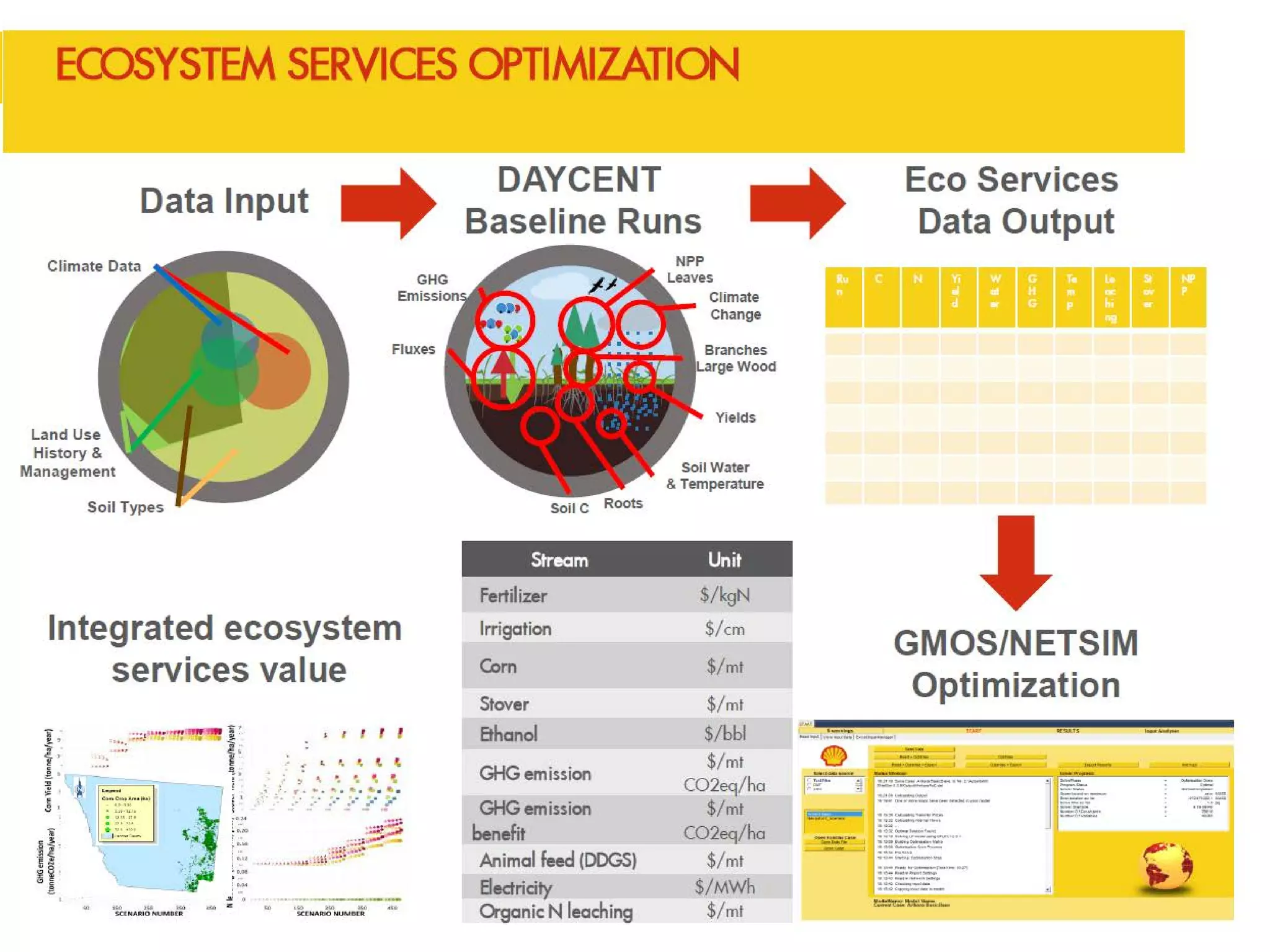

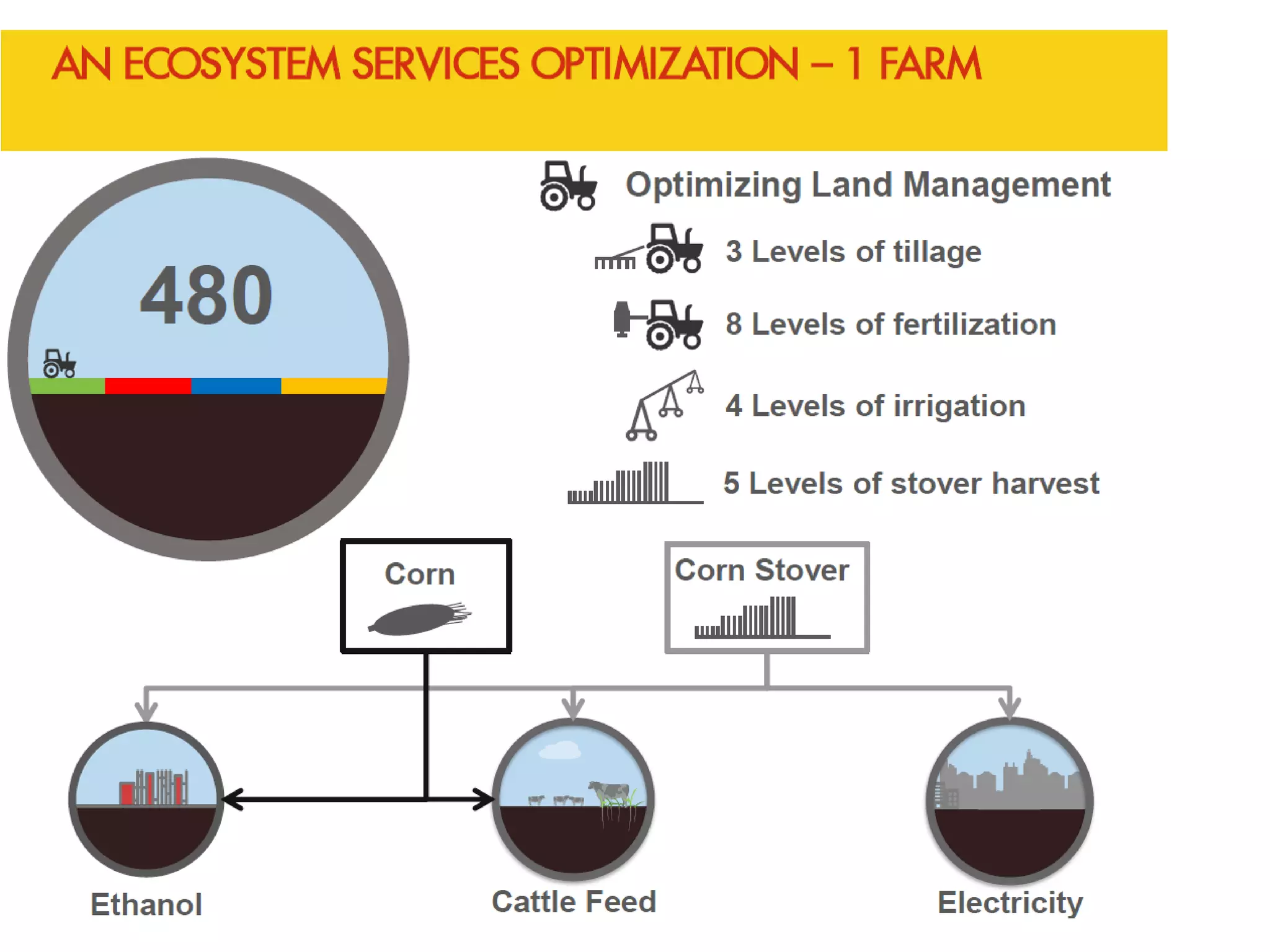

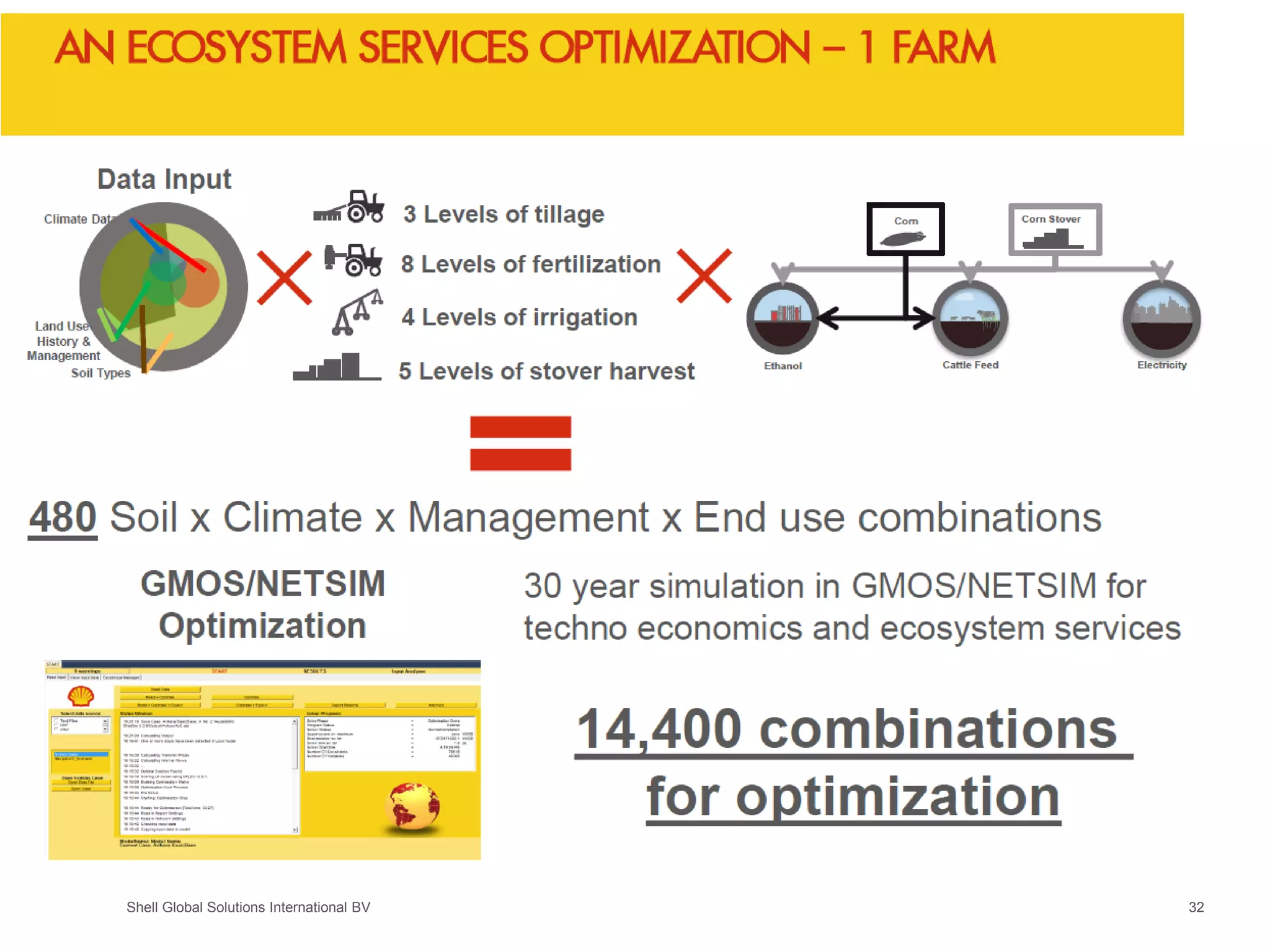

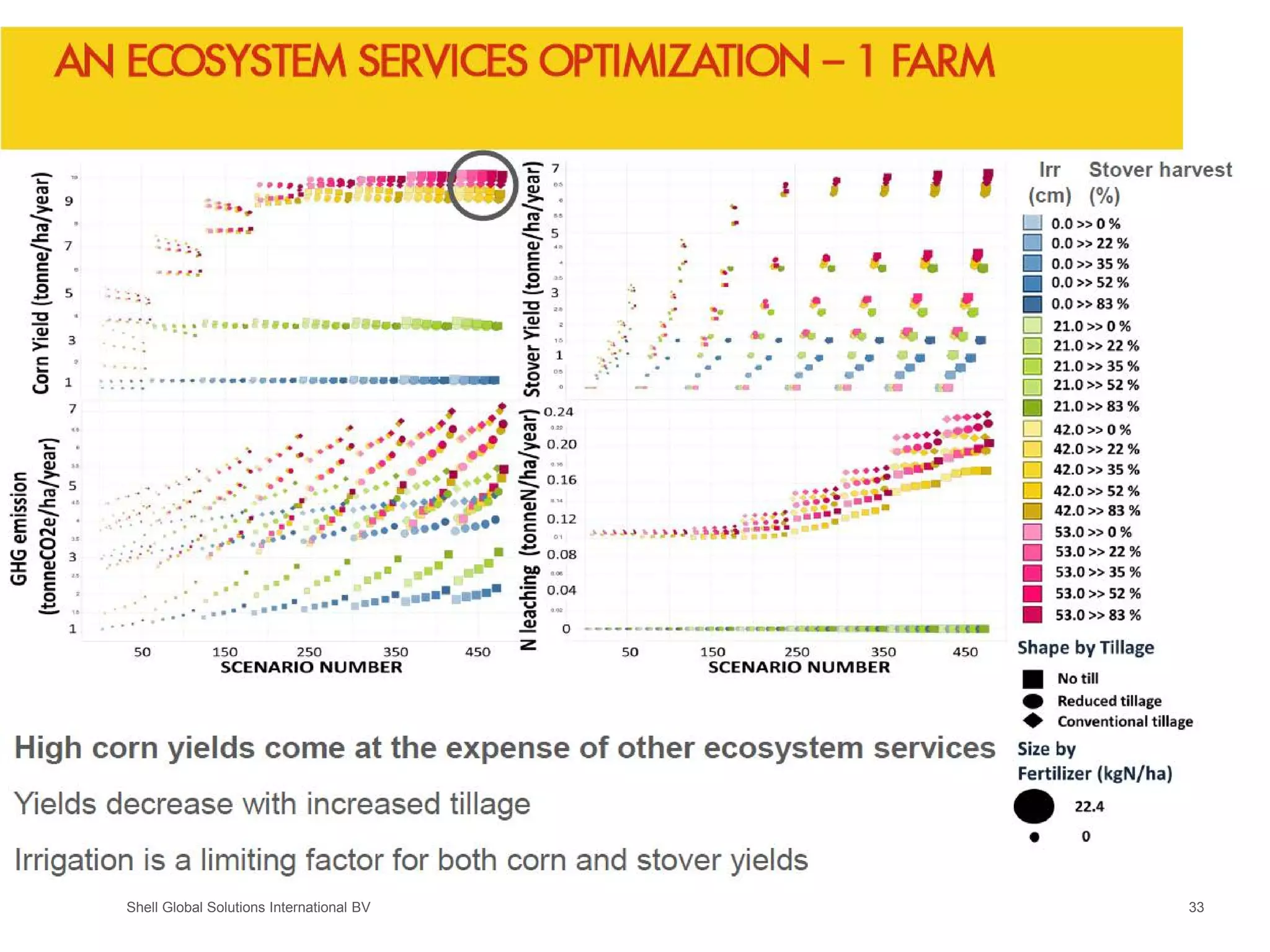

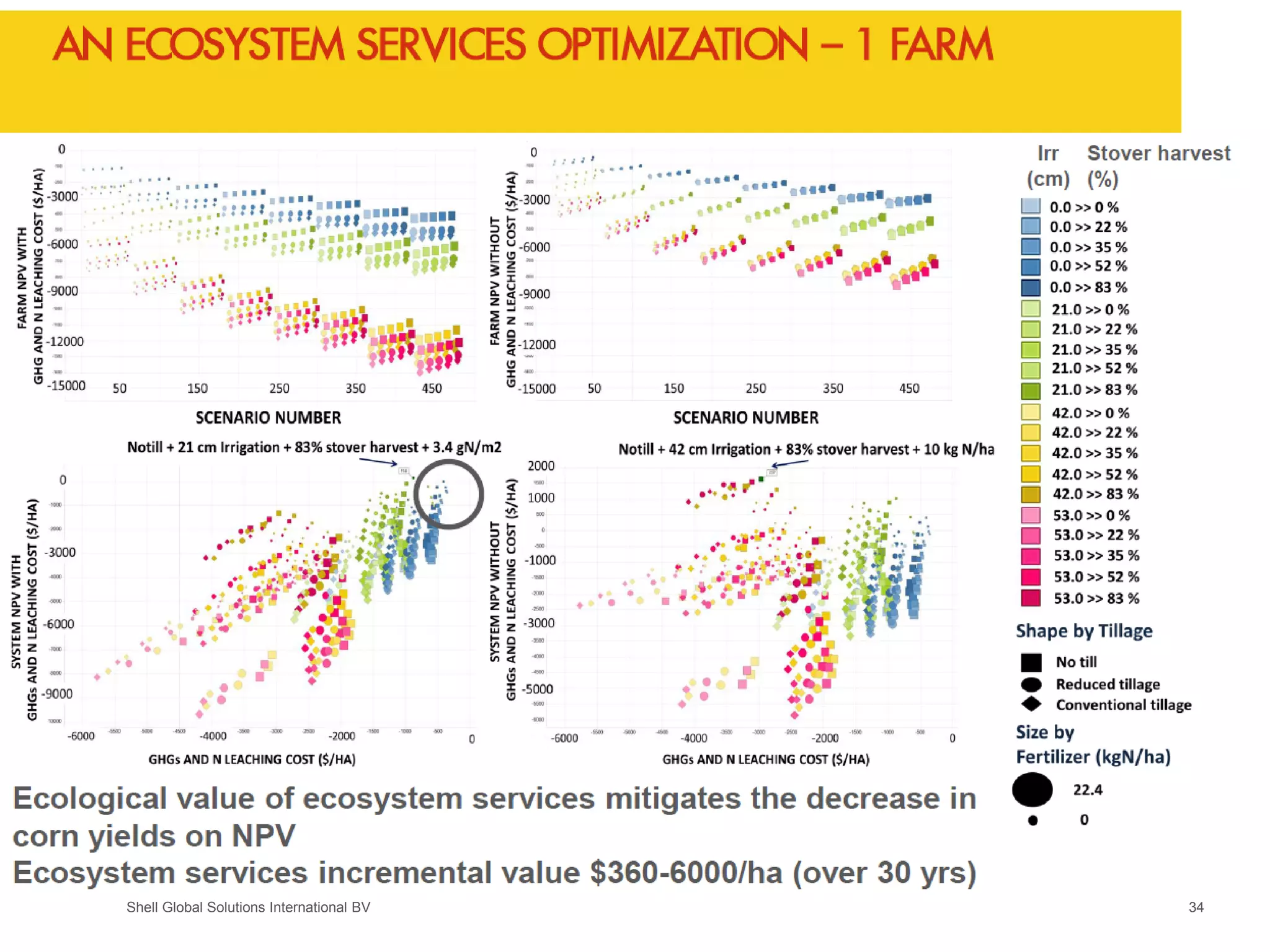

3) An integrated modeling approach combines ecosystem modeling like Daycent with energy modeling to optimize technical and environmental flows and capture the value of ecosystem services for decision-making.