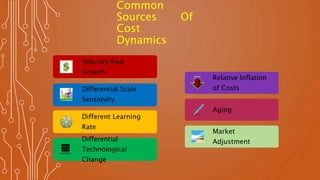

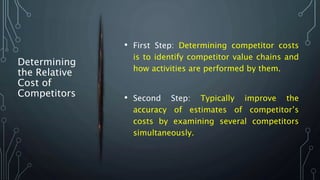

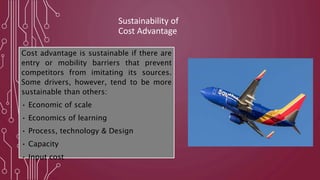

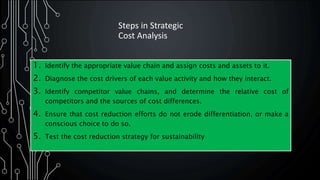

This document provides an overview of cost advantage and strategic cost analysis. It defines cost advantage as when a company can produce a product or service at a lower cost than competitors. Companies can gain cost advantage through access to low-cost materials, efficient processes/technologies, or low distribution/sales costs. The value chain framework is used to analyze a firm's costs and identify opportunities to lower the cumulative cost of activities versus competitors. Key aspects of cost analyzed include behavior, drivers, dynamics, and determining relative costs of competitors. Ways to gain and implement a sustainable cost advantage are controlling cost drivers, reconfiguring the value chain, and following steps for strategic cost analysis.