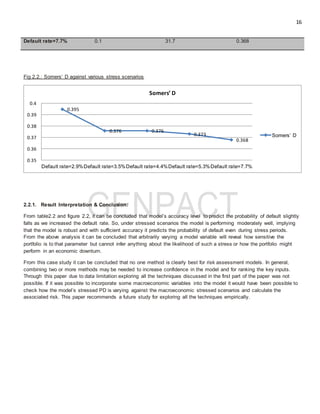

Stress testing and sensitivity analysis are important risk management tools required by regulators. Stress testing assesses the financial health of institutions under hypothetical stressful scenarios to determine if they remain solvent and liquid. It can test solvency by examining capital ratios or test liquidity by analyzing net cash flows. Sensitivity analysis varies inputs to risk models to determine the models' responses. This document discusses stress testing methods like scenario analysis and sensitivity analysis techniques and provides a case study applying these methods to a probability of default model.