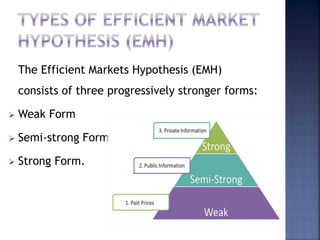

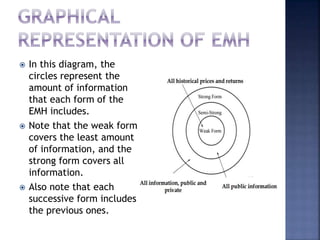

The Efficient Market Hypothesis (EMH) states that asset prices reflect all available information, with three forms: weak, semi-strong, and strong. Research primarily supports weak and semi-strong forms, suggesting that past prices and publicly available information cannot consistently predict future returns, while the strong form, stating that all information is reflected in prices, is not generally supported. Overall, markets are considered very efficient but not perfectly so, making it unlikely for any analysis method to consistently outperform the market over time.