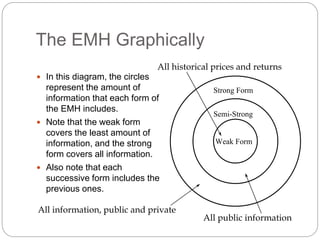

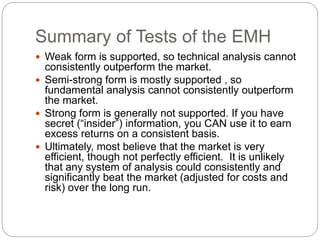

The document discusses the efficient market hypothesis (EMH), which states that market prices fully reflect all available public information and adjust quickly to new information. The EMH has three forms - weak, semi-strong, and strong. The weak form suggests past prices cannot predict future prices, while the semi-strong form suggests fundamental analysis cannot beat the market. The strong form believes even insider information cannot provide advantages. Most research supports the weak and semi-strong forms, showing technical and fundamental analysis are unlikely to consistently outperform the overall market.