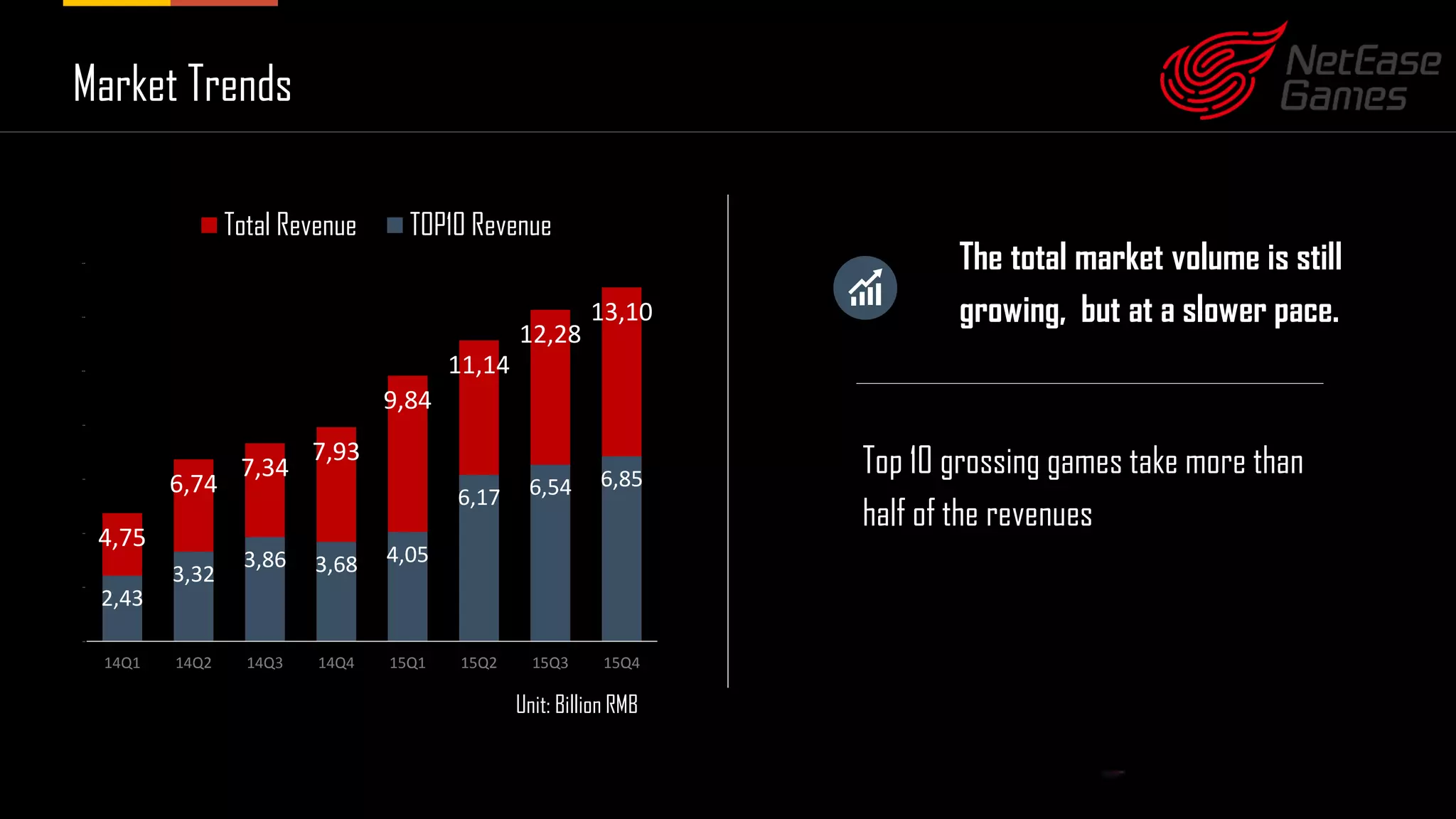

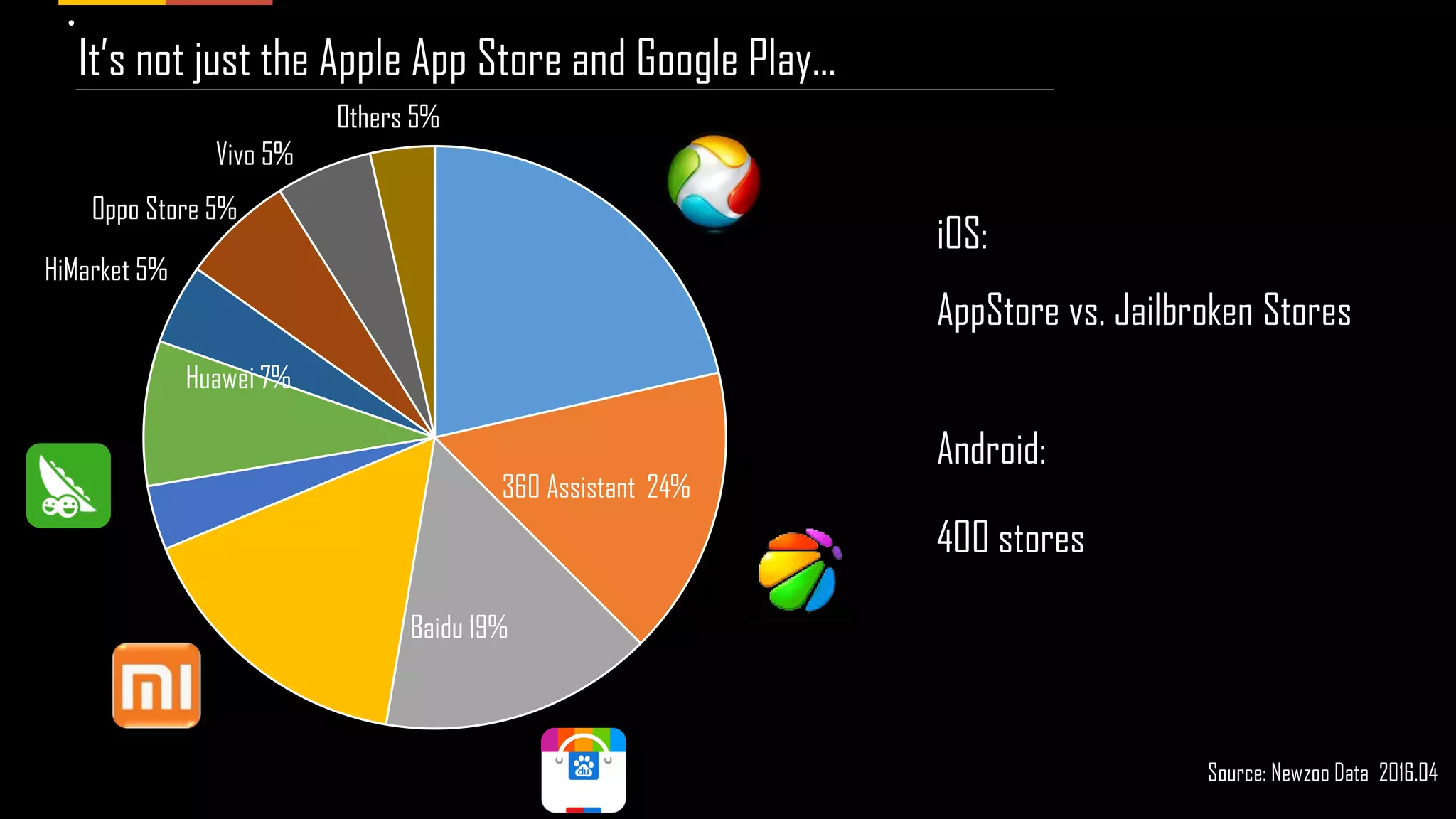

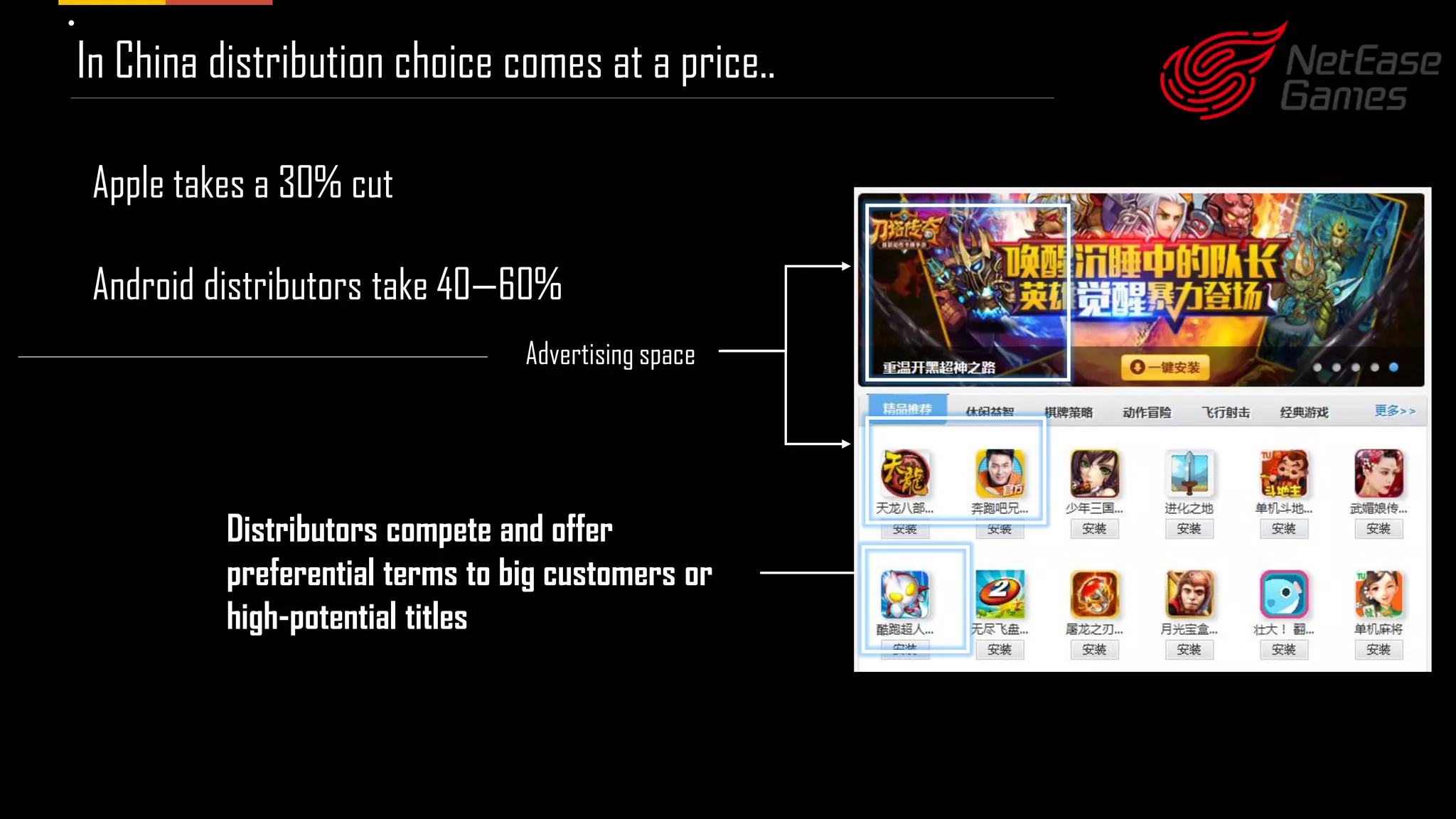

This document discusses entering the Chinese mobile game market. It notes that the market is massive, with mobile gaming leading and growing rapidly. The top 10 grossing games take over half of revenues, and genres like shooting and MOBA are growing. Distribution is fragmented across hundreds of Android app stores and a single iOS store. Non-Apple stores take a large revenue share. The document provides advice on how to enter the market, including choosing a local partner and using proven gameplay with Chinese-style art and stories. It emphasizes focusing on engagement over monetization.