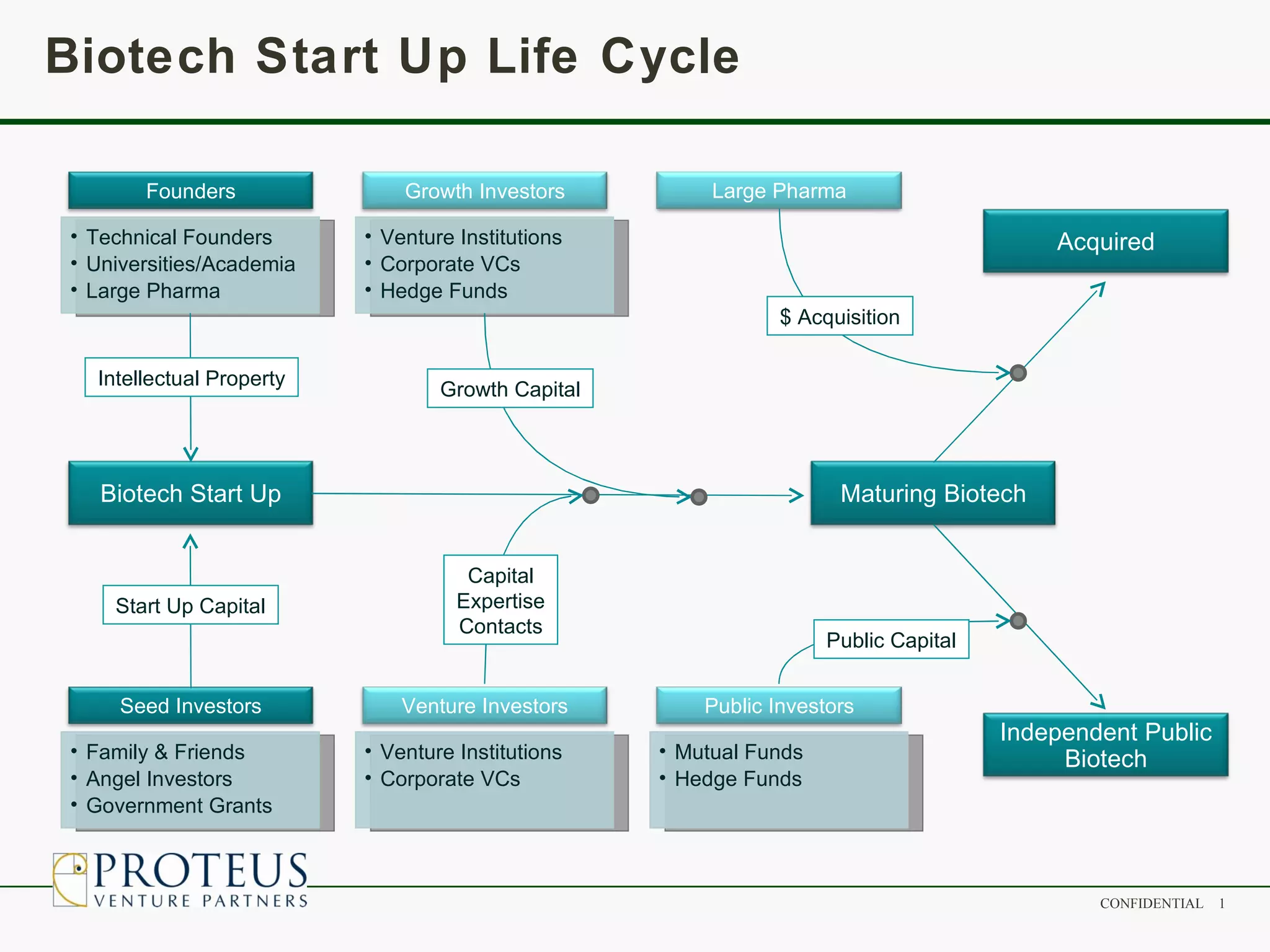

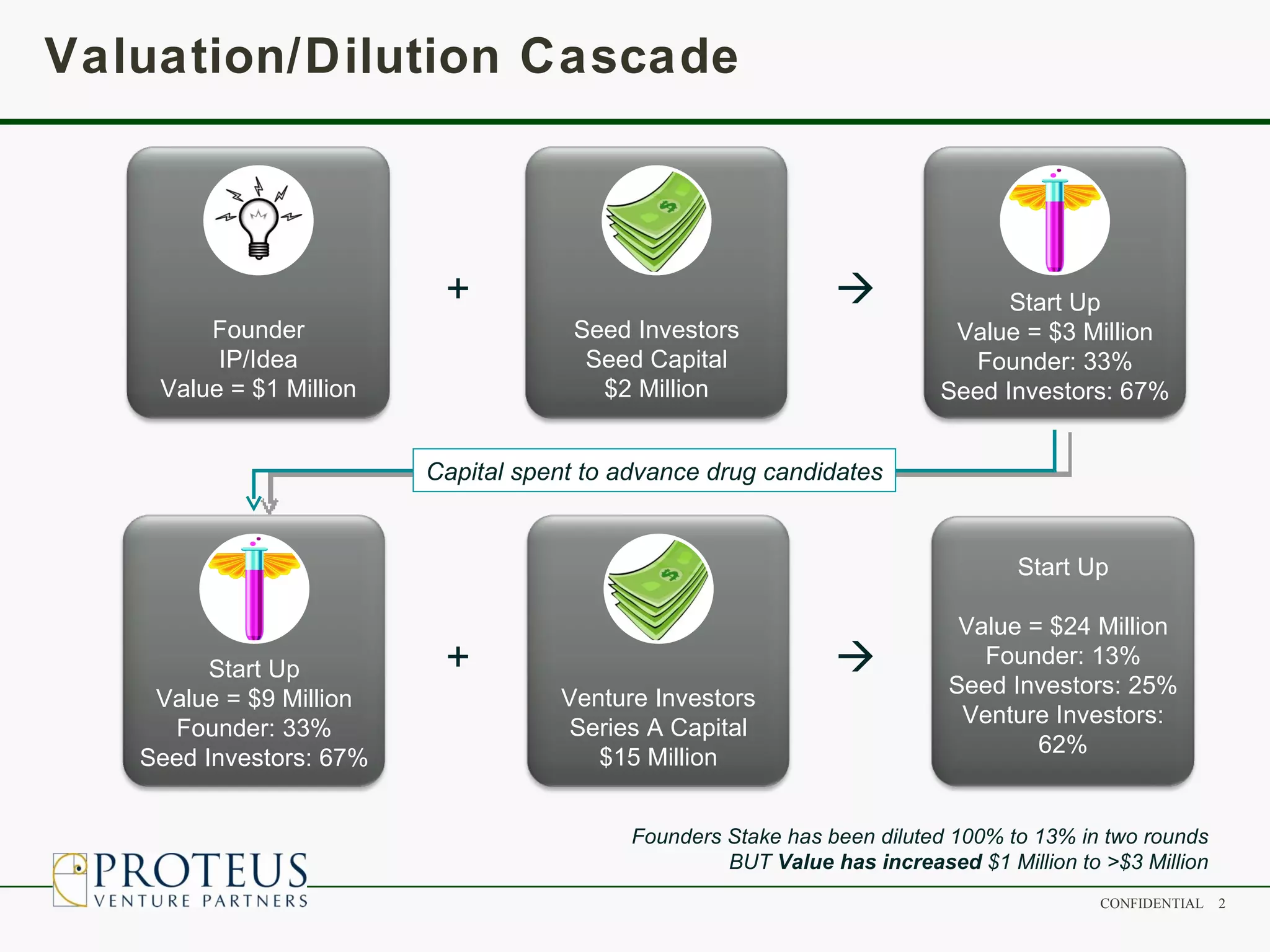

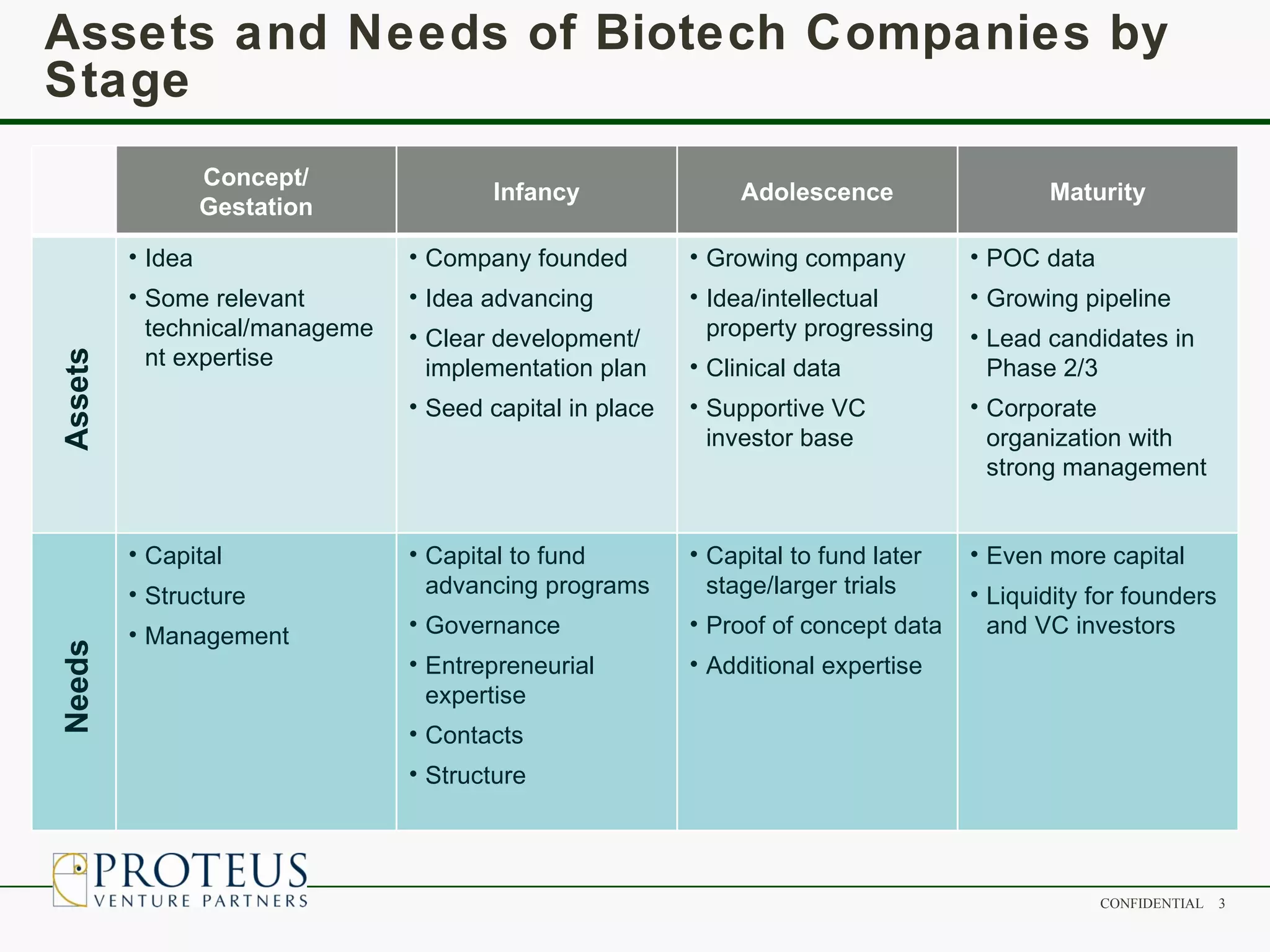

The document outlines the typical life cycle of a biotech startup company from founding through maturity. It shows how founders and early investors are initially involved at the startup stage when intellectual property is developed. As the company progresses, it requires growth capital from venture institutions and corporations to advance drug candidates. This results in dilution of the founders' stake but increases the overall valuation. Later in maturity, the company may pursue public capital or be acquired by large pharmaceutical companies once proof of concept data is established and a pipeline of candidates is in development.