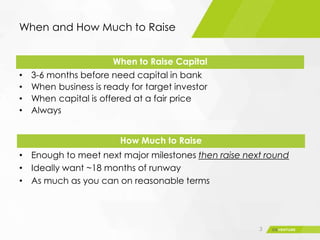

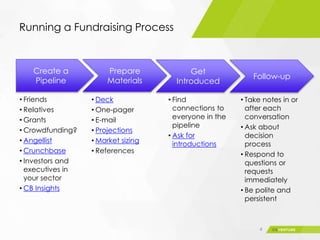

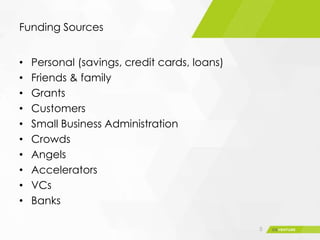

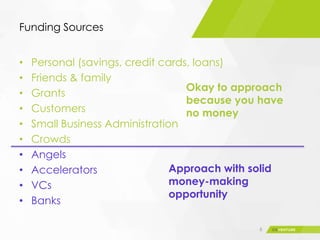

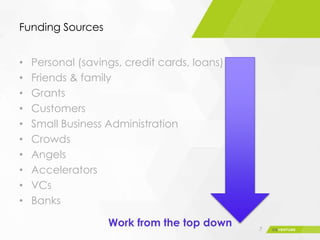

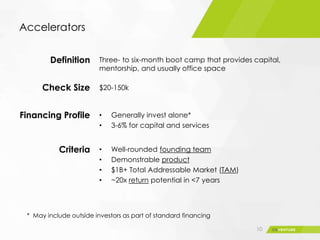

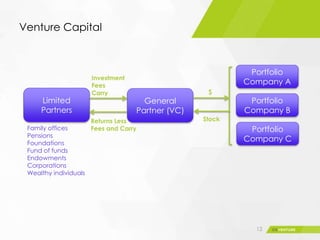

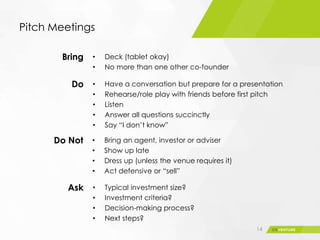

This document provides guidance for founders on fundraising. It recommends raising capital 3-6 months before needed, when the business is ready for investors and capital is available at a fair price. The optimal amount is enough to reach the next milestones, around 18 months of runway. Sources to consider include personal funds, friends/family, grants, crowdfunding, angels, accelerators, and VCs. Angels typically invest $25k-100k for 10-30% equity, while VCs invest $250k-2M for similar equity stakes. Founders should create a pipeline of potential investors and prepare a deck, financials, and pitch to secure funding.