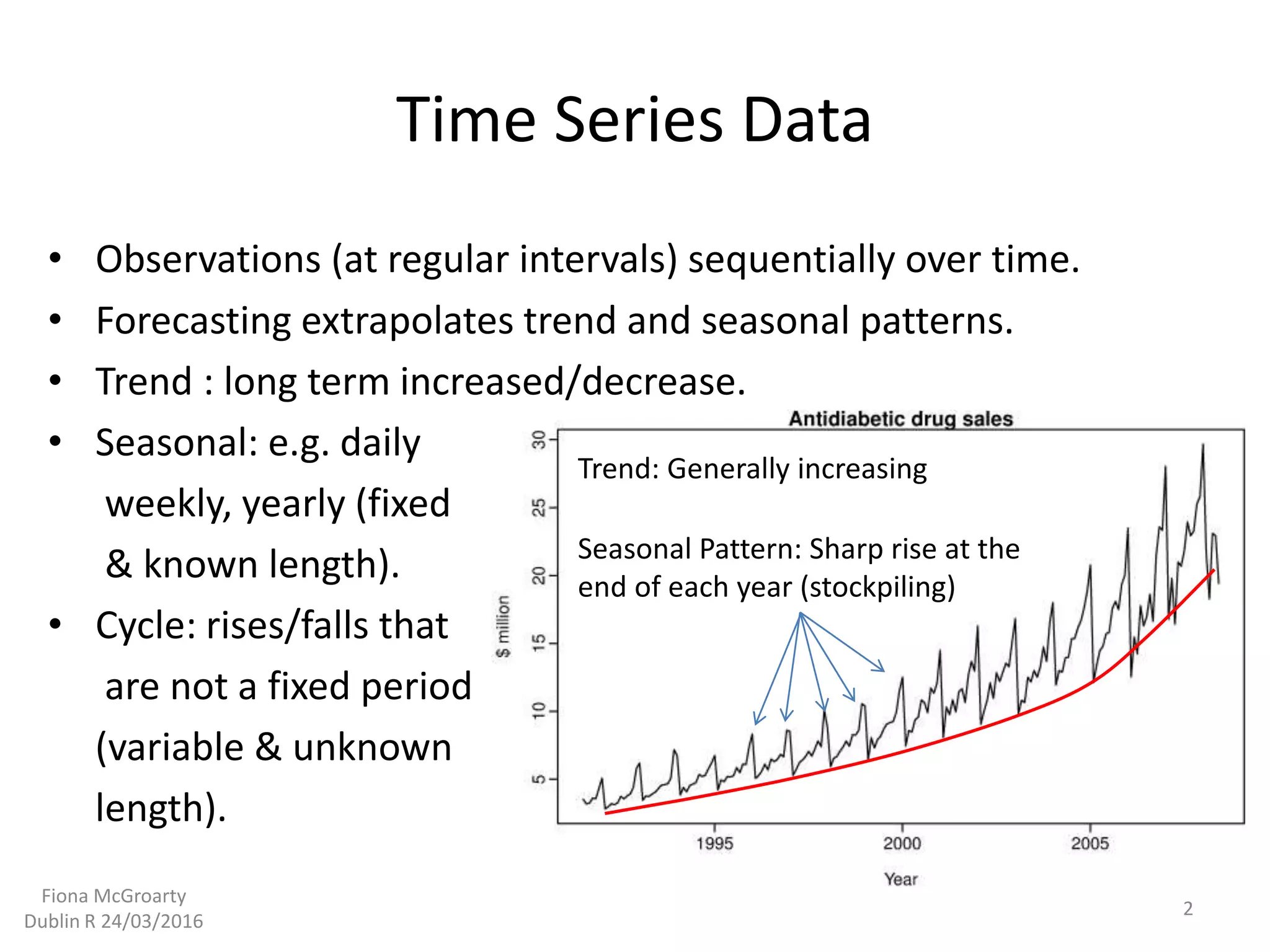

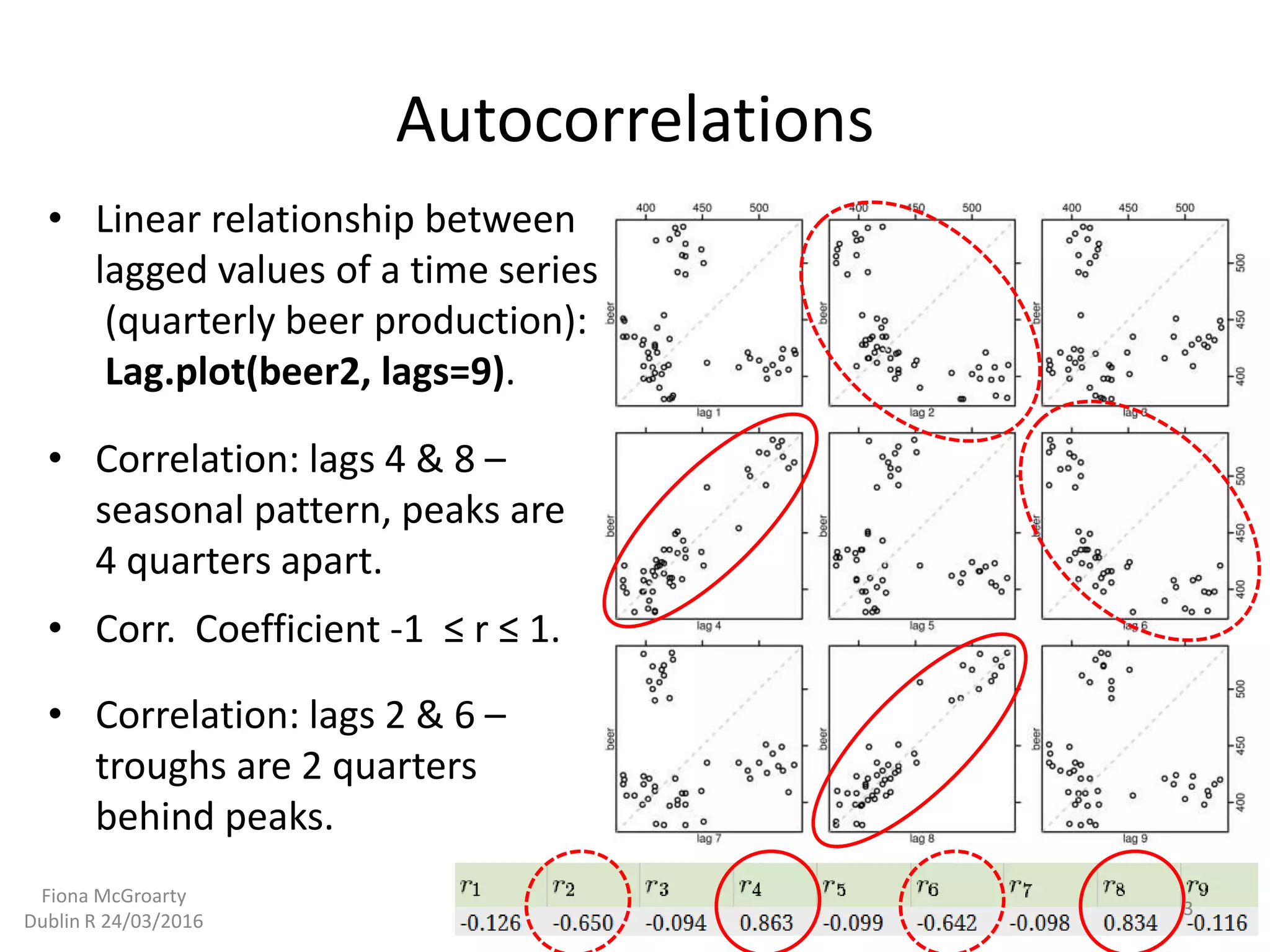

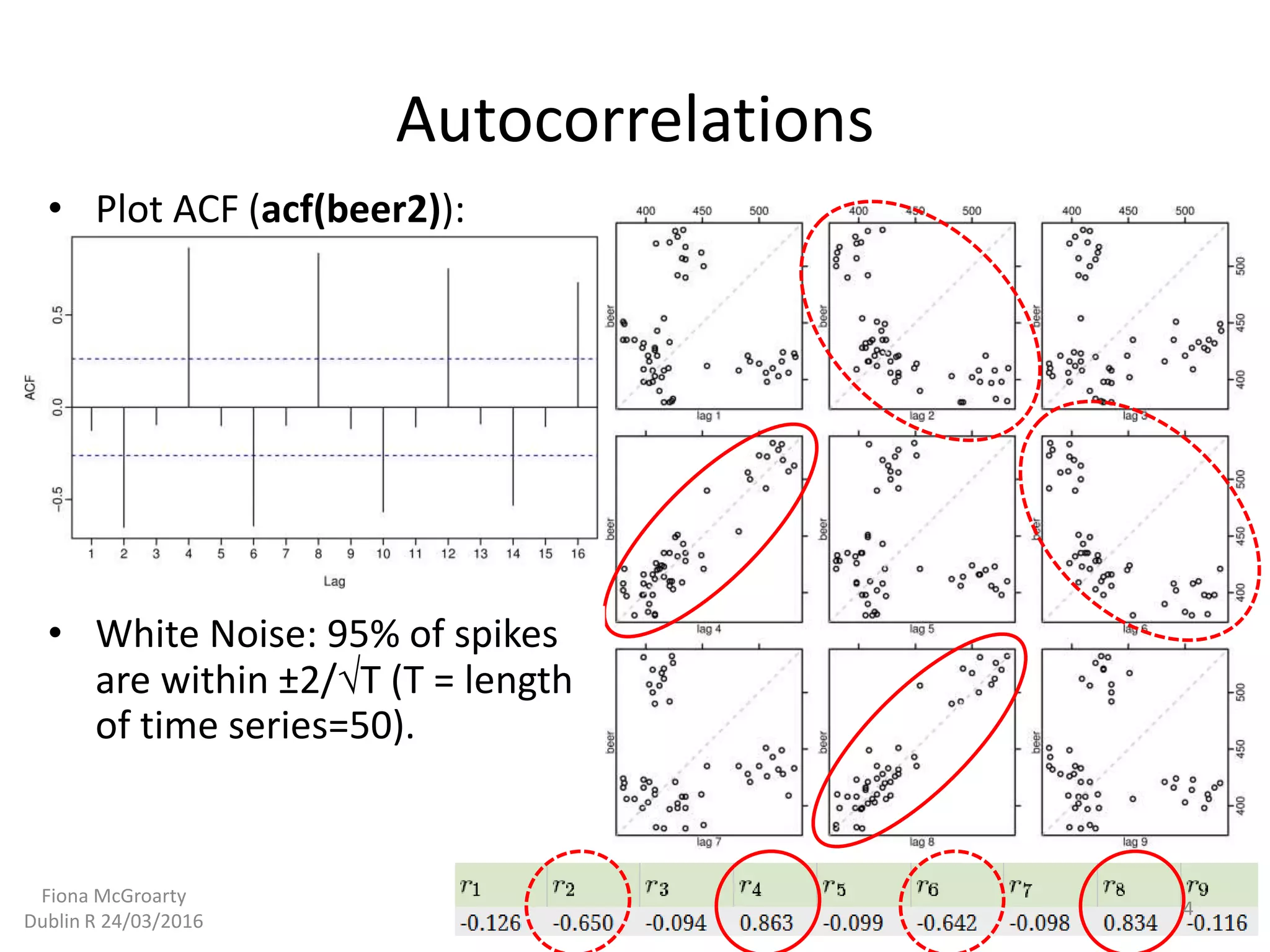

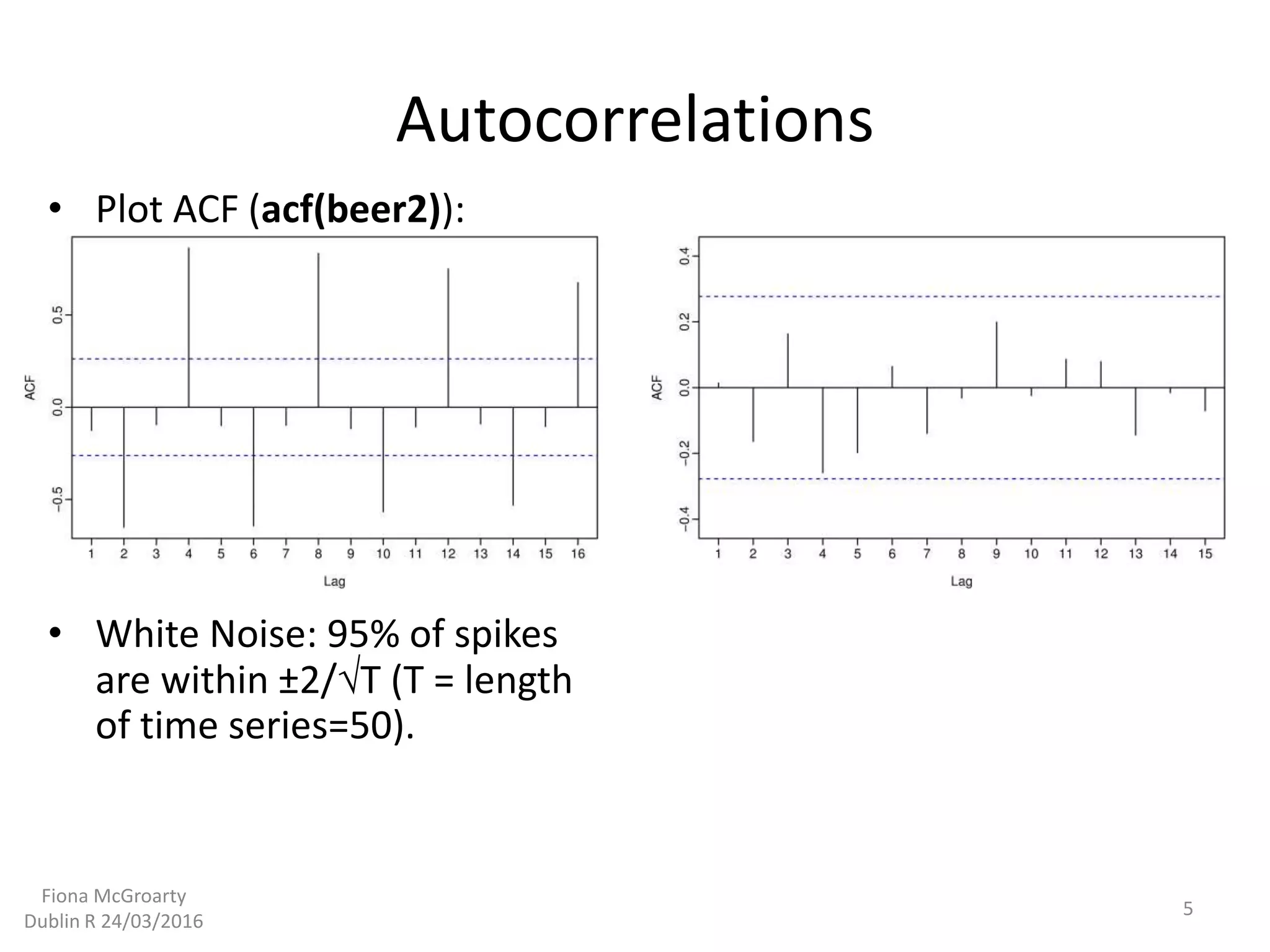

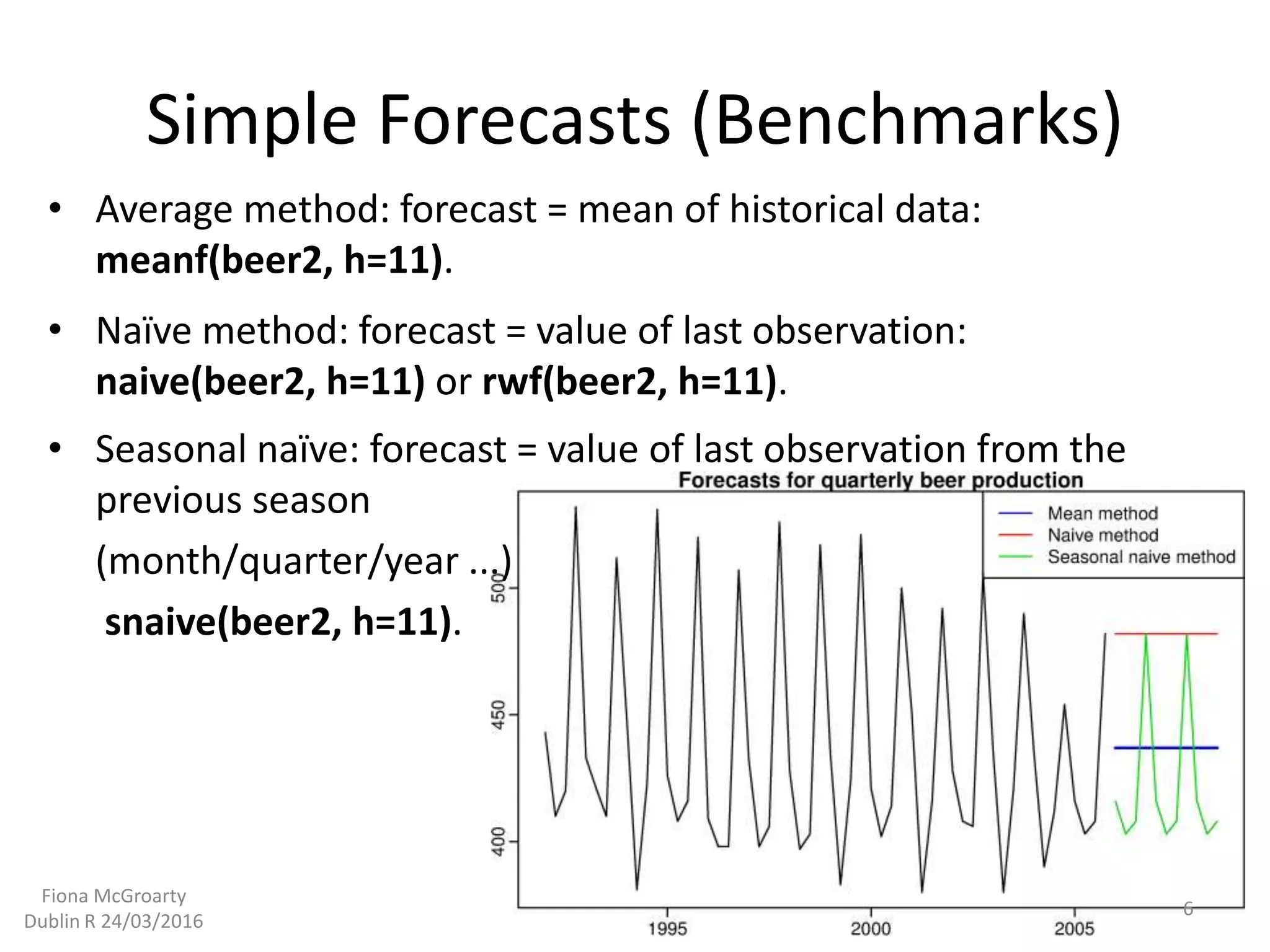

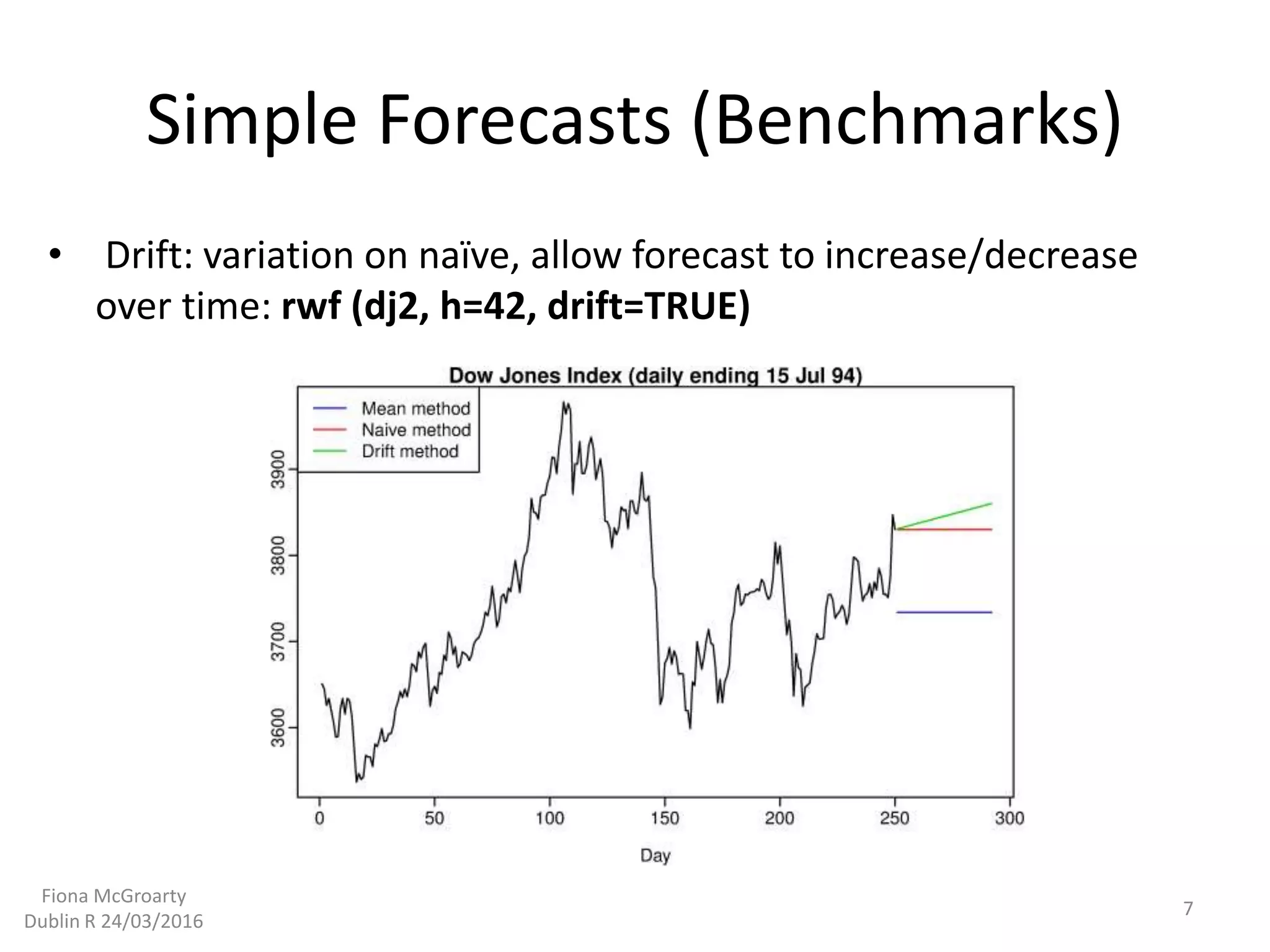

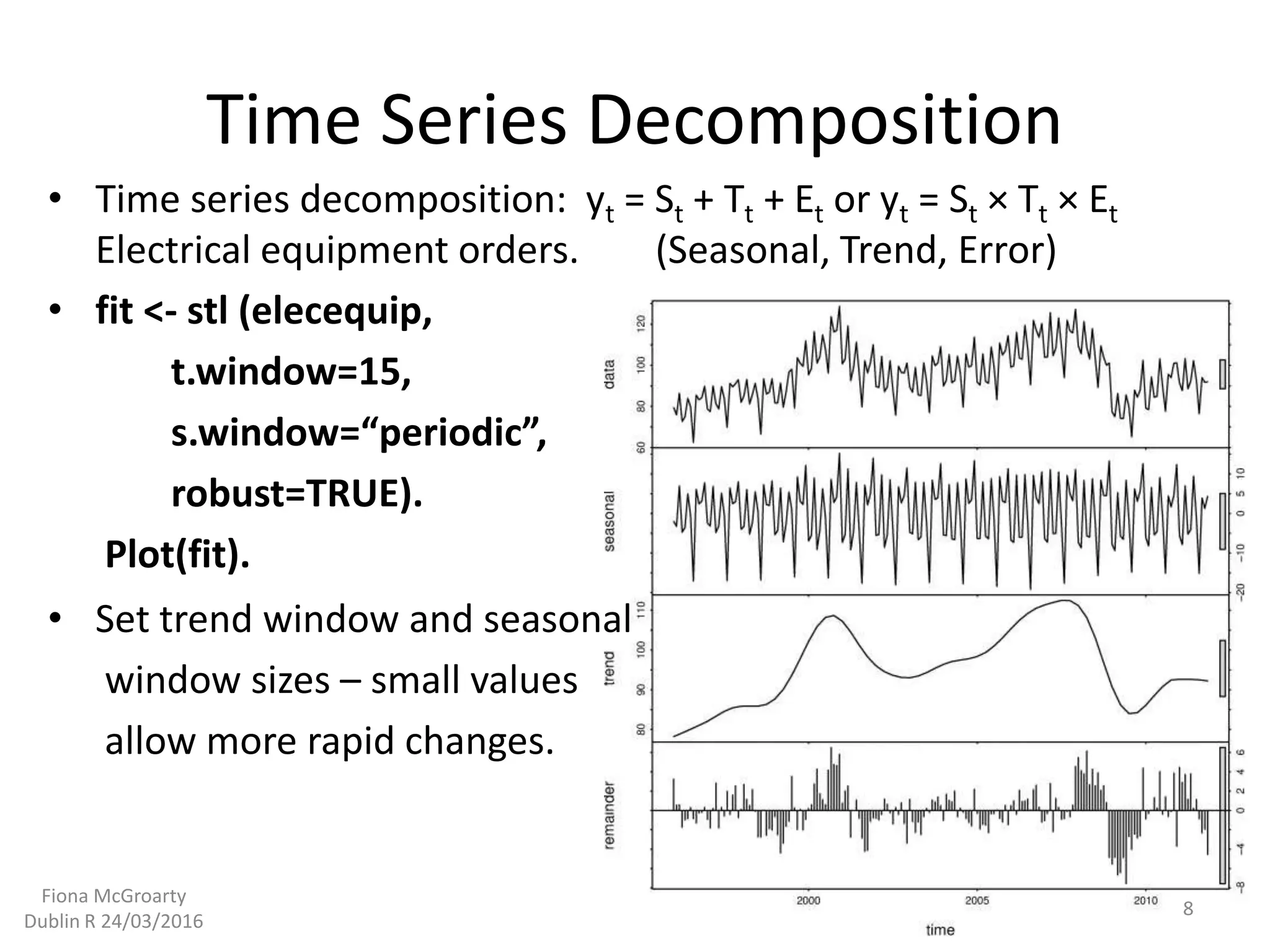

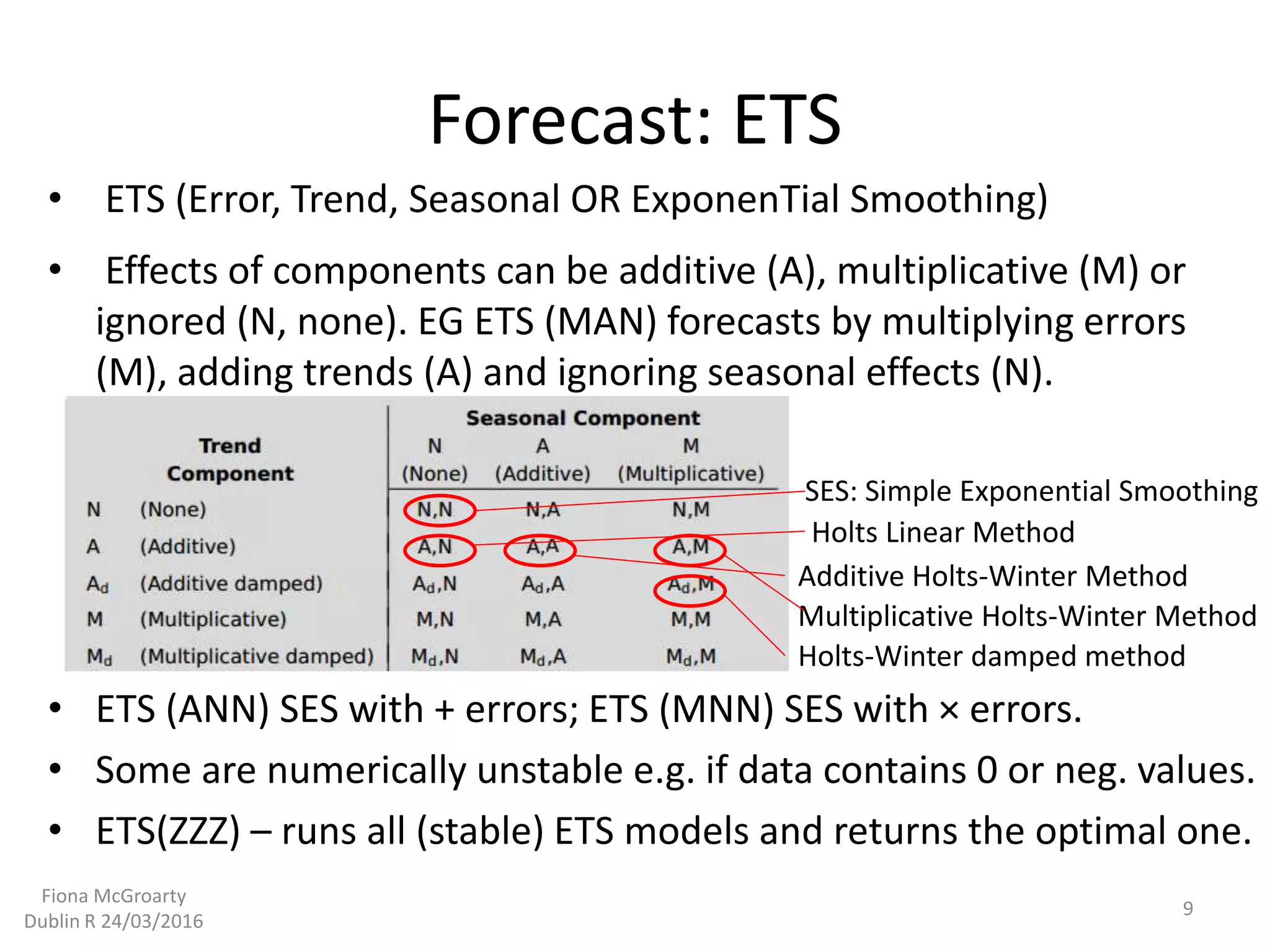

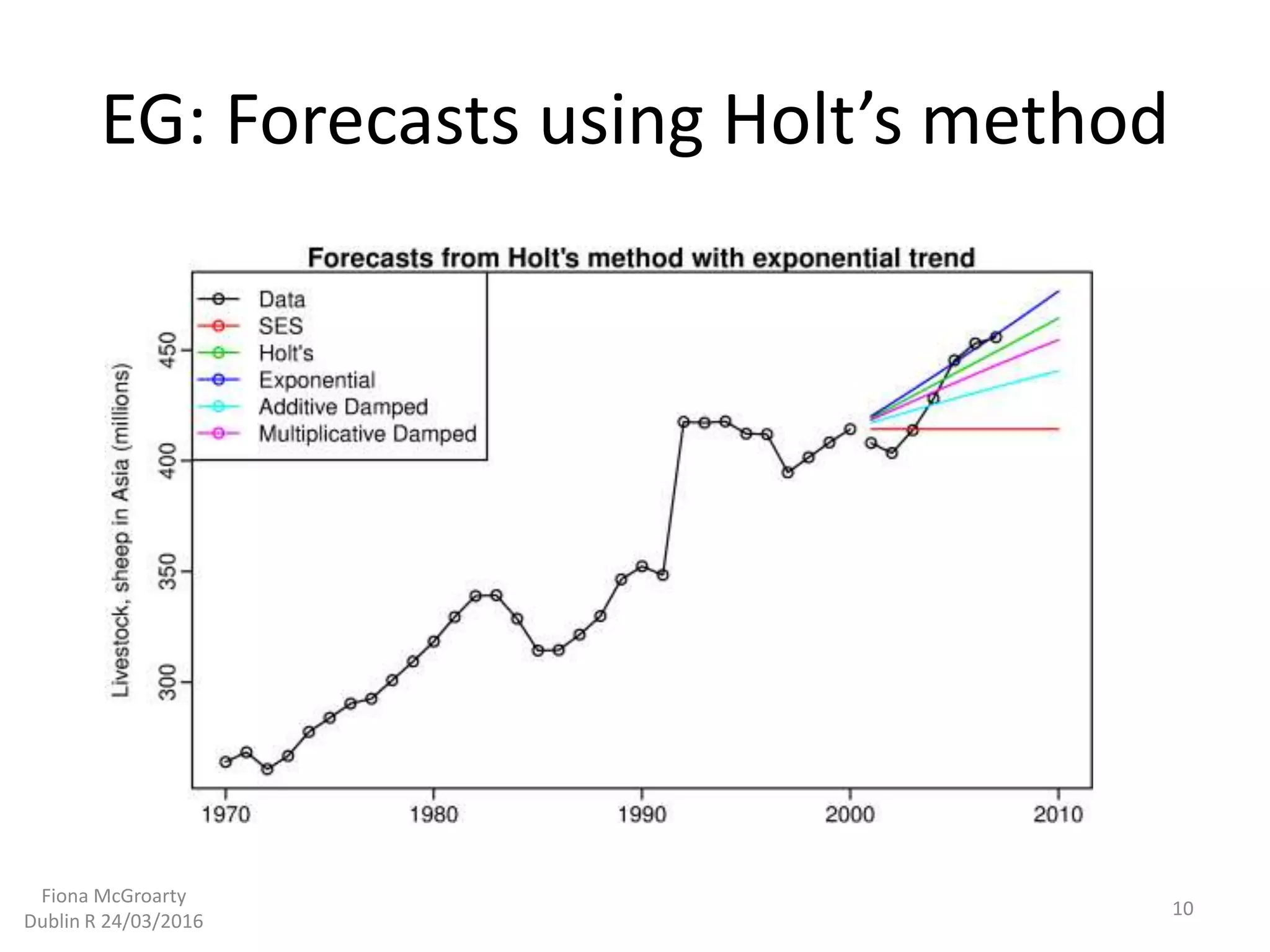

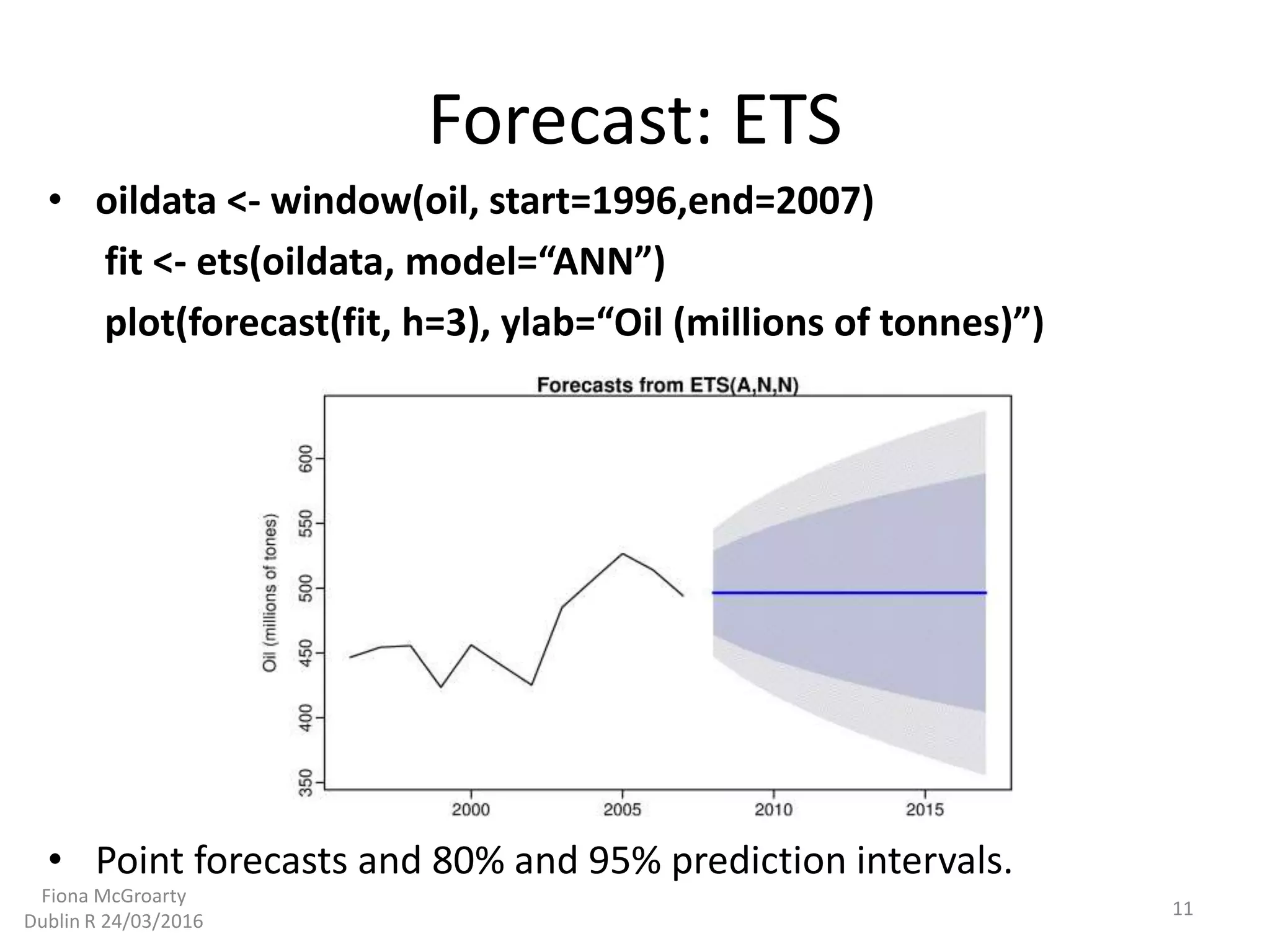

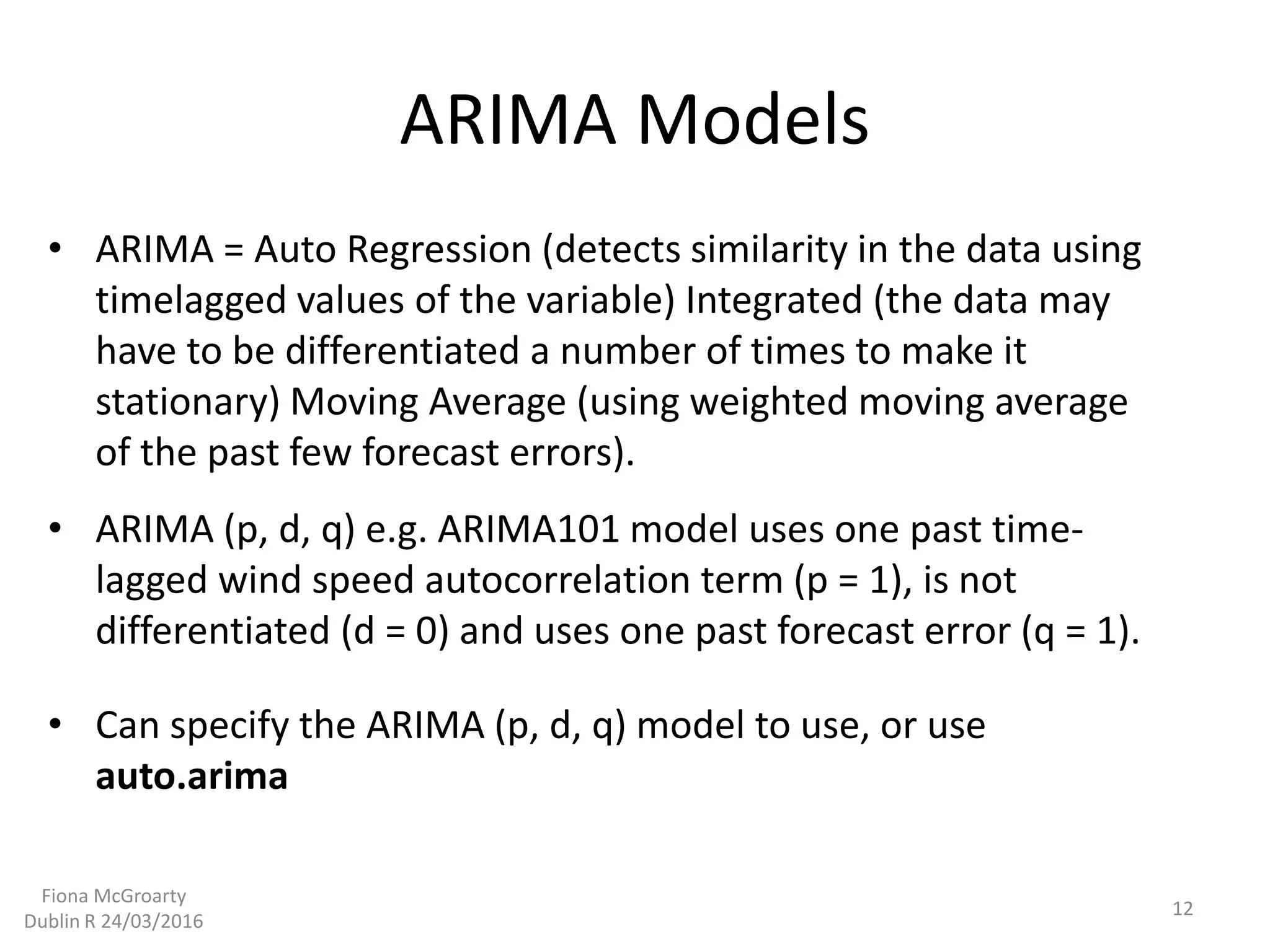

- The document discusses techniques for time series forecasting including exponential smoothing (ETS) and ARIMA models. It provides examples of using the forecast package in R to predict values based on historical time series data, decompose time series into seasonal, trend and error components, and select the best fitting ETS or ARIMA model. The goal is to predict things like wind speed or energy demand at various forecast horizons like hours or days ahead.

![ARIMA Models

• fit <- auto.arima (usconsumption[,1], seasonal=FALSE

plot(forecast(fit, h=10), include=80)

• Best ARIMA model is returned, in this case it’s ARIMA(0,0,3).

• fit <- Arima(usconsumption[,1], order=c(0,0,3))

13

Fiona McGroarty

Dublin R 24/03/2016](https://image.slidesharecdn.com/timeseriesrtalk-160329213057/75/Time-series-Analysis-fpp-package-13-2048.jpg)