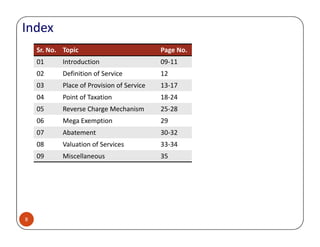

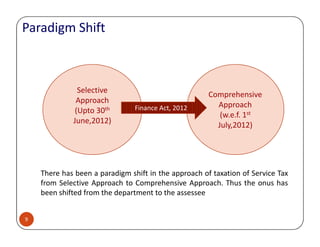

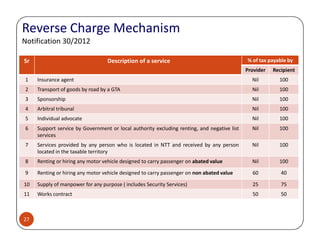

This document provides an overview of changes to India's service tax regulations introduced by the Finance Act of 2012. Some key points:

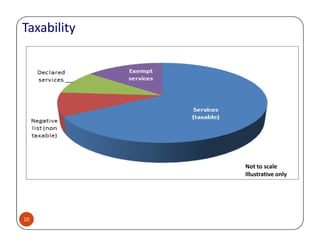

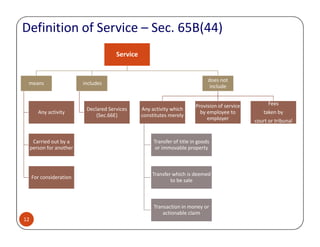

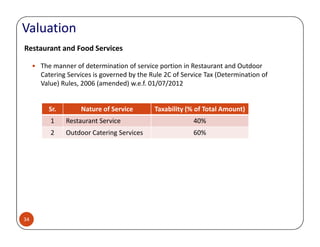

- The taxation approach shifted from selective to comprehensive, bringing more services into the tax net.

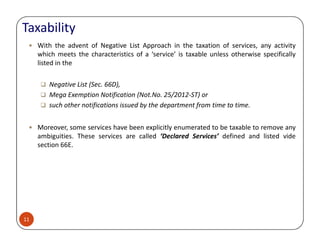

- A negative list was introduced, such that any service not explicitly listed as exempt would be taxable. Certain services were also explicitly declared as taxable.

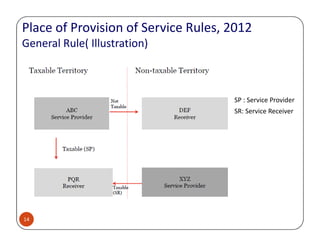

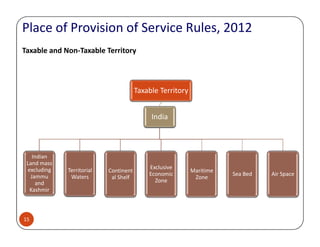

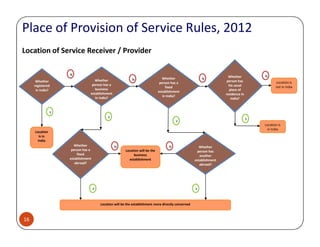

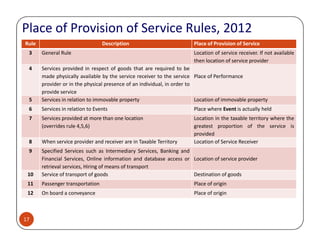

- New rules were introduced to determine the place of provision of a service, based on factors like the location of the service receiver or provider.

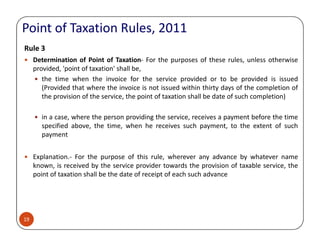

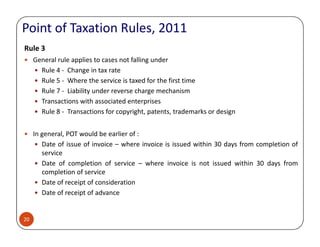

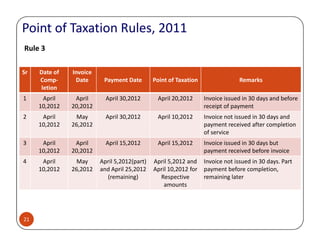

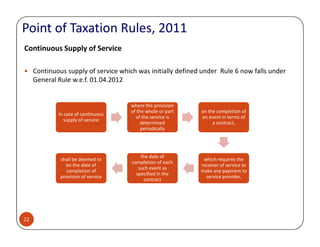

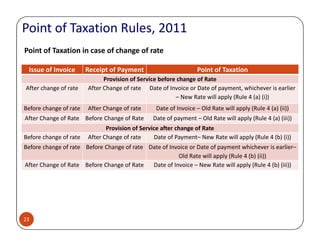

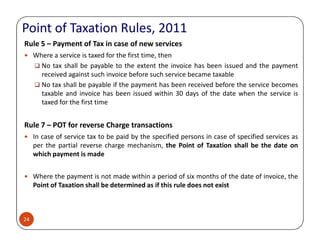

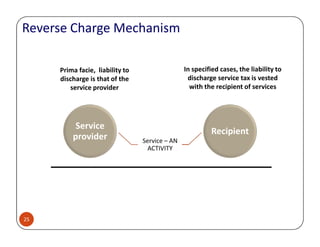

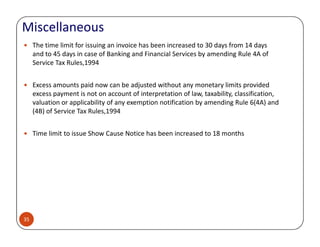

- Amendments were made to the point of taxation rules to align with the new regulatory framework and ensure tax is collected based on accrual rather than receipt of payment.