Market Outlook - September 24, 2010

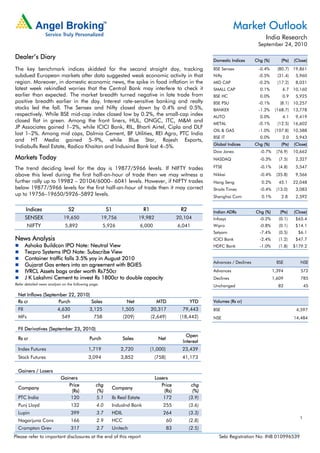

- 1. Market Outlook India Research September 24, 2010 Dealer’s Diary Domestic Indices Chg (%) (Pts) (Close) The key benchmark indices skidded for the second straight day, tracking BSE Sensex -0.4% (80.7) 19,861 subdued European markets after data suggested weak economic activity in that Nifty -0.5% (31.4) 5,960 region. Moreover, in domestic economic news, the spike in food inflation in the MID CAP -0.2% (17.2) 8,031 latest week rekindled worries that the Central Bank may interfere to check it SMALL CAP 0.1% 6.7 10,160 earlier than expected. The market breadth turned negative in late trade from BSE HC 0.0% 0.9 5,925 positive breadth earlier in the day. Interest rate-sensitive banking and realty BSE PSU -0.1% (8.1) 10,257 stocks led the fall. The Sensex and Nifty closed down by 0.4% and 0.5%, BANKEX -1.2% (168.7) 13,778 respectively. While BSE mid-cap index closed low by 0.2%, the small-cap index AUTO 0.0% 4.1 9,419 closed flat in green. Among the front liners, HUL, ONGC, ITC, M&M and METAL -0.1% (12.5) 16,602 JP Associates gained 1–2%, while ICICI Bank, RIL, Bharti Airtel, Cipla and DLF OIL & GAS -1.0% (107.8) 10,588 lost 1–2%. Among mid caps, Dalmia Cement, BF Utilities, REI Agro, PTC India BSE IT 0.0% 2.0 5,943 and HT Media gained 5–9%, while Blue Star, Rajesh Exports, Global Indices Chg (%) (Pts) (Close) Indiabulls Real Estate, Radico Khaitan and Indusind Bank lost 4–5%. Dow Jones -0.7% (76.9) 10,662 Markets Today NASDAQ -0.3% (7.5) 2,327 The trend deciding level for the day is 19877/5966 levels. If NIFTY trades FTSE -0.1% (4.8) 5,547 above this level during the first half-an-hour of trade then we may witness a Nikkei -0.4% (35.8) 9,566 further rally up to 19982 – 20104/6000– 6041 levels. However, if NIFTY trades Hang Seng 0.2% 45.1 22,048 below 19877/5966 levels for the first half-an-hour of trade then it may correct Straits Times -0.4% (13.0) 3,083 up to 19756–19650/5926–5892 levels. Shanghai Com 0.1% 2.8 2,592 Indices S2 S1 R1 R2 Indian ADRs Chg (%) (Pts) (Close) SENSEX 19,650 19,756 19,982 20,104 Infosys -0.2% (0.1) $65.4 NIFTY 5,892 5,926 6,000 6,041 Wipro -0.8% (0.1) $14.1 Satyam -7.4% (0.5) $6.1 News Analysis ICICI Bank -2.4% (1.2) $47.7 Ashoka Buildcon IPO Note: Neutral View HDFC Bank -1.0% (1.8) $179.2 Tecpro Systems IPO Note: Subscribe View Container traffic falls 3.5% yoy in August 2010 Advances / Declines BSE NSE Gujarat Gas enters into an agreement with BGIES IVRCL Assets bags order worth Rs750cr Advances 1,394 572 J K Lakshmi Cement to invest Rs 1800cr to double capacity Declines 1,609 785 Refer detailed news analysis on the following page. Unchanged 82 45 Net Inflows (September 22, 2010) Rs cr Purch Sales Net MTD YTD Volumes (Rs cr) FII 4,630 3,125 1,505 20,317 79,443 BSE 4,597 MFs 549 758 (209) (2,649) (18,442) NSE 14,484 FII Derivatives (September 23, 2010) Open Rs cr Purch Sales Net Interest Index Futures 1,719 2,720 (1,000) 23,439 Stock Futures 3,094 3,852 (758) 41,173 Gainers / Losers Gainers Losers Price chg Price chg Company Company (Rs) (%) (Rs) (%) PTC India 120 5.1 Ib Real Estate 172 (3.9) Punj Lloyd 132 4.0 IndusInd Bank 255 (3.6) Lupin 399 3.7 HDIL 264 (3.3) 1 Nagarjuna Cons 166 2.9 HCC 60 (2.8) Crompton Grev 317 2.7 Unitech 83 (2.5) Please refer to important disclosures at the end of this report Sebi Registration No: INB 010996539

- 2. Market Outlook | India Research Ashoka Buildcon IPO Note: Neutral View IPO details: Ashoka is tapping the IPO market with an issue size of Rs225cr in the price band of Rs297–324/share, resulting in a public issue of 0.69cr and 0.76cr equity shares at the upper and lower price band, respectively, of face value Rs10, resulting in a dilution of 13.2% and 14.2%. The company plans to use the IPO proceeds for investment in capital equipment, meet working capital requirements, repayment of loans and funding the subsidiaries for prepayment/repayment of their loans. Ashoka undertakes all activities related to a BOT road project right from tendering for the project till the collection of tolls. We believe that its integrated structure enables it to bid for BOT projects with confidence to complete and operate the project on a profitable basis. It also results in capturing the entire value in the BOT development business, including EPC margins, developer returns and operation and maintenance margins. Ashoka was one of the early entrants in the road BOT segment with its first project bagged in 1997, resulting in 13 years of experience in the road sector. We believe that this rich experience will allow Ashoka to further enhance its presence in the BOT space. The company is also credited with executing projects on time, which we believe is critical for maintaining the required IRRs as this offers extended period of toll collection, thereby increasing overall revenue. Ashoka’s outstanding order book, as on May 31, 2010, stood at ~Rs1,615cr or 2x FY2010 revenue. This excludes the two recently bagged road projects of Rs1,600cr, which are awaiting financial closure. Outlook and Valuation: Ashoka is a pure play on the road segment and, with the sector in sweet spot, the company is well placed to reap the benefits going ahead. However, we believe that the company is not comparable to market leaders IRB Infra and ITNL on account of having smaller scale of operations despite being an early entrant in the space. The IPO is available at 2.5x and 2.3x FY2012E P/BV on the upper and lower price bands, respectively, which again is at a premium to its peers, Sadbhav Engineering and NCC. Hence, on account of being fairly priced and with most positives factored in, we recommend a Neutral view to the IPO. Key risks to our recommendation: 1) Ashoka’s business model is vulnerable to interest rate fluctuations and traffic growth and 2) concentration of projects in Maharashtra and Madhya Pradesh. September 24, 2010 2

- 3. Market Outlook | India Research Tecpro Systems IPO Note: Subscribe View Tecpro Systems Ltd (Tecpro) will be accessing the capital market with an Initial Public Offering (IPO) of 75.5 lac equity shares of Rs 10 each at a price band of Rs340 – 355 each share. The IPO comprises of fresh issue of up to 62.5 lac equity shares and an offer for sale of up to 13 lacs equity shares by Metmin Investments Holdings Ltd. The issue opens on September 23, 2010 and closes on September 28, 2010. The issue proceeds would be utilized to fund working capital requirements and general corporate purposes. Incorporated in 1990, Tecpro was promoted by Ajay Kumar Bishnoi and Amul Gabrani, who have more than 25 years of experience in the material handling industry. The company designs, engineers, manufactures, sells, commissions and services a range of material handling systems and equipment for the core infrastructure related sectors like power, steel, cement and other industries. Leveraging its capabilities in coal and ash handling, the company has also taken up turnkey BoP contracts in the thermal power generation sector. At the upper price band, Tecpro is projected to trade at a P/E and EV/EBDITA of 16.5x and 8.3x its FY2010 earnings, respectively. When compared with its immediate competitors, viz., Mcnally Bharat and TRF, the scrip is available at a discount of ~10-15% on FY2010 earnings. In addition, over the past five years the company has grown at a scorching pace along with successfully entering the BoP-EPC segment. As and when Tecpro begins to accumulate and execute larger size BoP projects going ahead, it will be able to command premium valuations on superior growth and profitability margins. The successful execution of few BoP projects over the next couple of years may also result in Tecpro exploring the feasibility of taking up complete EPC for power plants (ie BTG + BoP), which would place it in league with BGR Energy. We recommend a Subscribe view on the IPO. Container traffic falls 3.5% yoy in August 2010 As per data released by the Indian Port Association, container volumes fell by 3.5% yoy in August 2010. Among major ports, the JNPT port, which handles around 60% of the country’s container volumes, witnessed substantial fall of 14.8% yoy in volumes during the month. The drop in container volumes can mainly be attributed to complete closure of JNPT port for five days and operations at ~60% capacity for nearly 10 days thereafter, due to an oil spill from an accident between two cargo vessels on August 7, 2010. However, volumes at the Chennai port, which handles around 16% of the country’s container traffic, continued to witness a sharp rise, up by 32.1% yoy. Consequently, we expect container traffic to grow by 10–12% for FY2011E at major ports. Company wise, we estimate Concor to witness a ~3.0% yoy decline in Exim volumes and GDL to register a 6.9% yoy decline in CFS volumes for 2QFY2011E, given the high volume contribution from JNPT. We continue to remain Neutral on the logistics sector. Gujarat Gas enters into an agreement with BGIES Gujarat Gas Company has entered into an agreement with BG India Energy Solutions (BGIES) for the purchase of 0.50mmscmd of RLNG on a firm basis from October 1, 2010, to December 31, 2013 (i.e., for a period of 39 months). The aforesaid agreement is to enable the company to meet natural gas requirements in its markets. The agreement is a positive step as it improves visibility of gas supply availability. However, the company has not disclosed the price at which gas is being procured; however, it remains confident of maintaining its margins. Currently, we recommend Neutral on the stock. September 24, 2010 3

- 4. Market Outlook | India Research IVRCL Assets bags order worth Rs750cr IVRCL’s subsidiary, IVRCL Assets & Holdings Ltd. has bagged an order worth Rs750cr for four laning and improvement of Karanji-Wani-Ghuggus-Chandrapur Road, Maharashtra State Highway – 6&7 on DBFOT basis. The project has a concession period of 30 years, including a construction period of 24 months. The project involves viability gap funding of Rs231.8cr provided by the state government. This is positive for the company as the project’s construction will be undertaken by IVRCL itself, which adds to its revenue visibility. We have valued IVRCL on an SOTP basis. The company’s core construction business is valued at a P/E multiple of 14x FY2012E EPS of Rs10.9 (Rs153/share), whereas its stake in its subsidiaries, IVR Prime (Rs49/share) and Hindustan Dorr-Oliver (Rs14/share), has been valued on an Mcap basis, post assigning a 30% holding company discount. At the CMP of Rs169, the stock is trading at P/E of 15.5x FY2012E EPS and 2.0x FY2012E P/BV on a standalone basis and adjusting for its subsidiaries at P/E of 9.7x FY2012E EPS and 1.2x FY2012E P/BV, which we believe is at attractive valuations. Therefore, on the back of the company’s excellent execution track record, robust order book to sales ratio and attractive valuations, we maintain a Buy rating on the stock with a Target Price of Rs216. J K Lakshmi Cement to invest Rs 1800cr to double capacity J K Lakshmi Cement (JKLC) has said that it would invest Rs1,800cr over the next three-four years to double its cement production capacity to 10mtpa. The company, which currently has a capacity of 5.4mtpa, is setting up a 2.7mtpa Greenfield plant at a cost of Rs1,200cr in Chattisgarh. The company also plans to spend additional Rs600cr to increase its capacity by about 2.3mtpa at its existing plants. At the CMP, the stock is trading at an EV/EBITDA of 3x and EV/tonne of US $43 based on its FY2012E estimates. We have valued JKLC at an average target EV/EBITDA of 4.5x and EV/tonne of US $60 to arrive at a fair value of Rs92, which is still at a discount to its replacement cost. We maintain a Buy rating on the stock. Economic and Political News Food grain output looks comfortable in kharif 2010, says Pawar Food inflation rises to 15.46%; rains, floods push up prices Govt. clears 24 FDI proposals worth Rs2,727cr Corporate News EIH to raise Rs1,300cr via rights issue; gets board nod KEC Intl. completes acquisition of SAE Towers L&T to foray into South Africa's power sector; to form a JV RCOM moves TDSAT challenging disconnection notice by BSNL Source: Economic Times, Business Standard, Business Line, Financial Express, Mint September 24, 2010 4

- 5. Market Outlook | India Research Research Team Tel: 022-4040 3800 E-mail: research@angeltrade.com Website: www.angeltrade.com DISCLAIMER This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report. Address: Acme Plaza, ‘A’ Wing, 3rd Floor, M.V. Road, Opp. Sangam Cinema, Andheri (E), Mumbai - 400 059. Tel: (022) 3952 4568 / 4040 3800 Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP000001546 Angel Capital & Debt Market Ltd: INB 231279838 / NSE FNO: INF 231279838 / NSE Member code -12798 Angel Commodities Broking (P) Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302 September 24, 2010 5