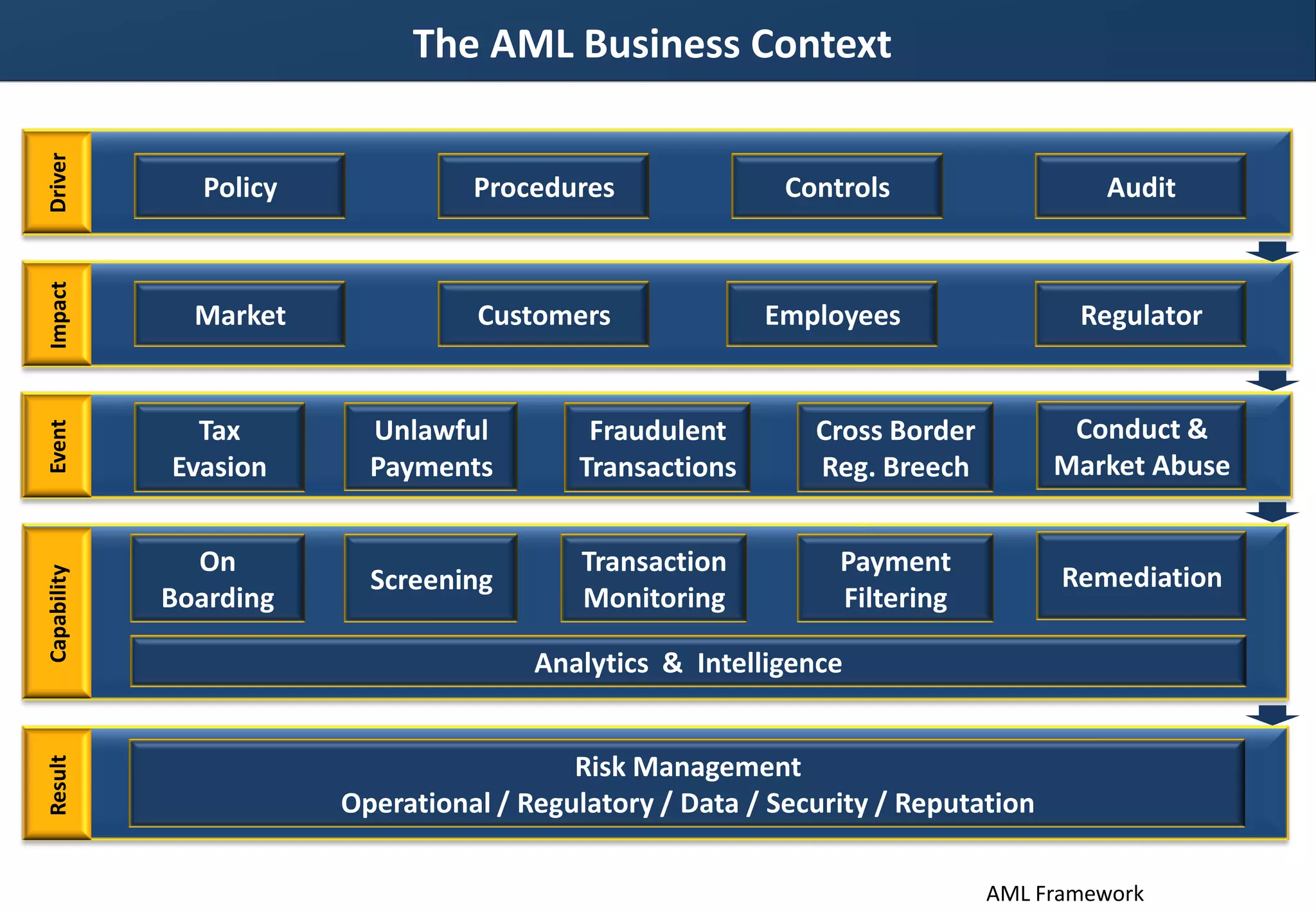

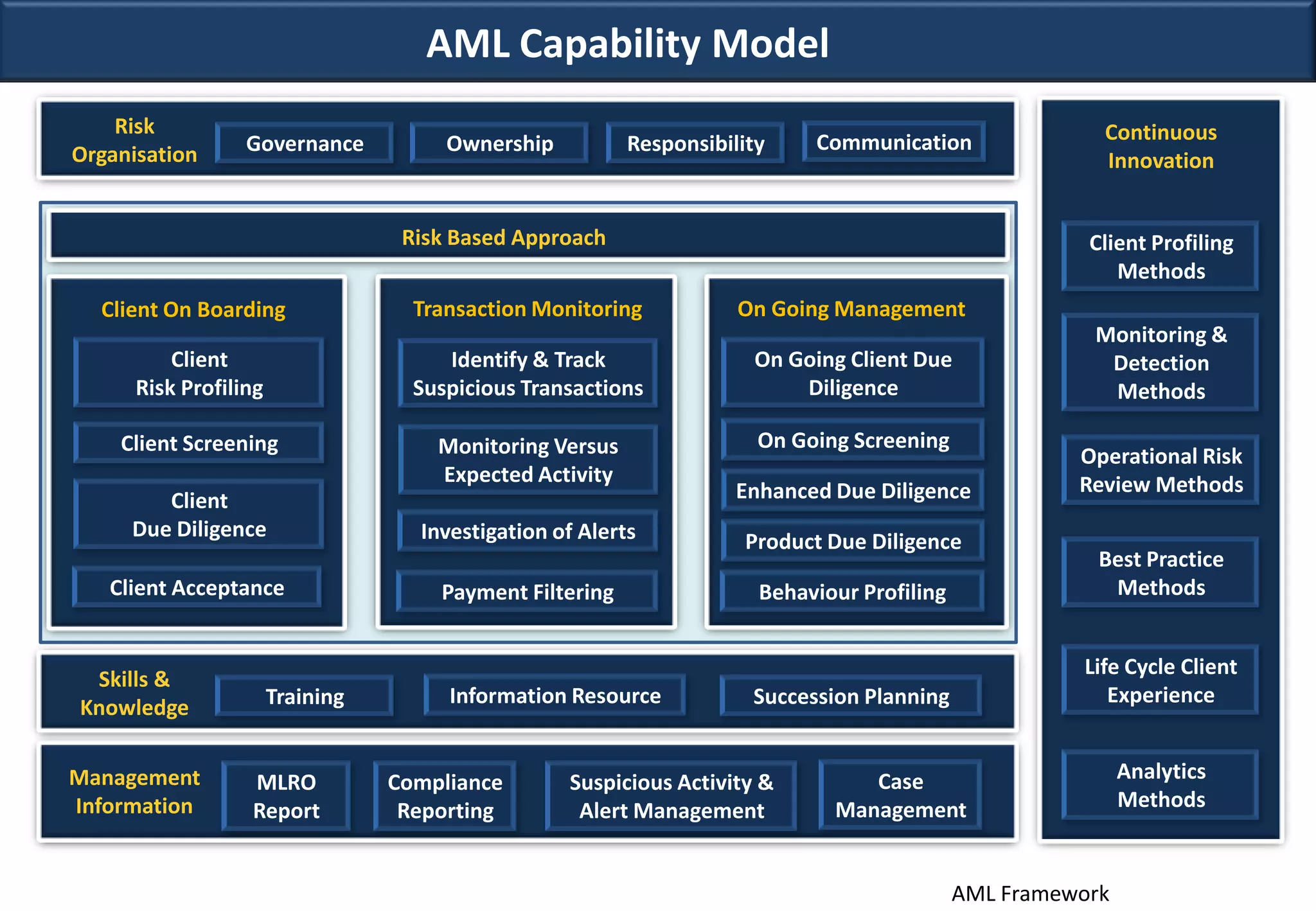

This document proposes an anti-money laundering (AML) framework with the following components:

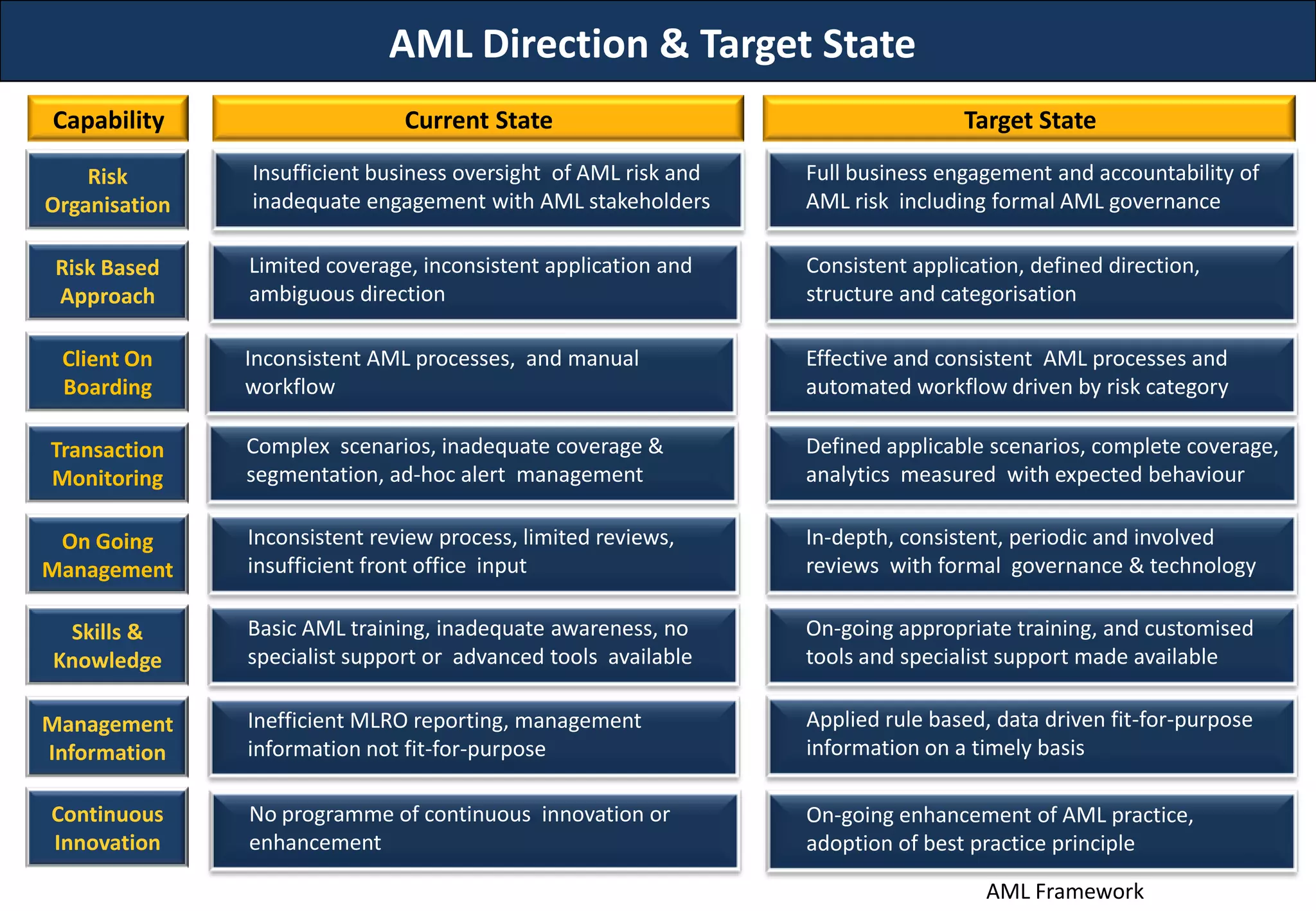

1. The current AML capability has inconsistencies and gaps that need to be addressed to improve risk management, compliance, and effectiveness.

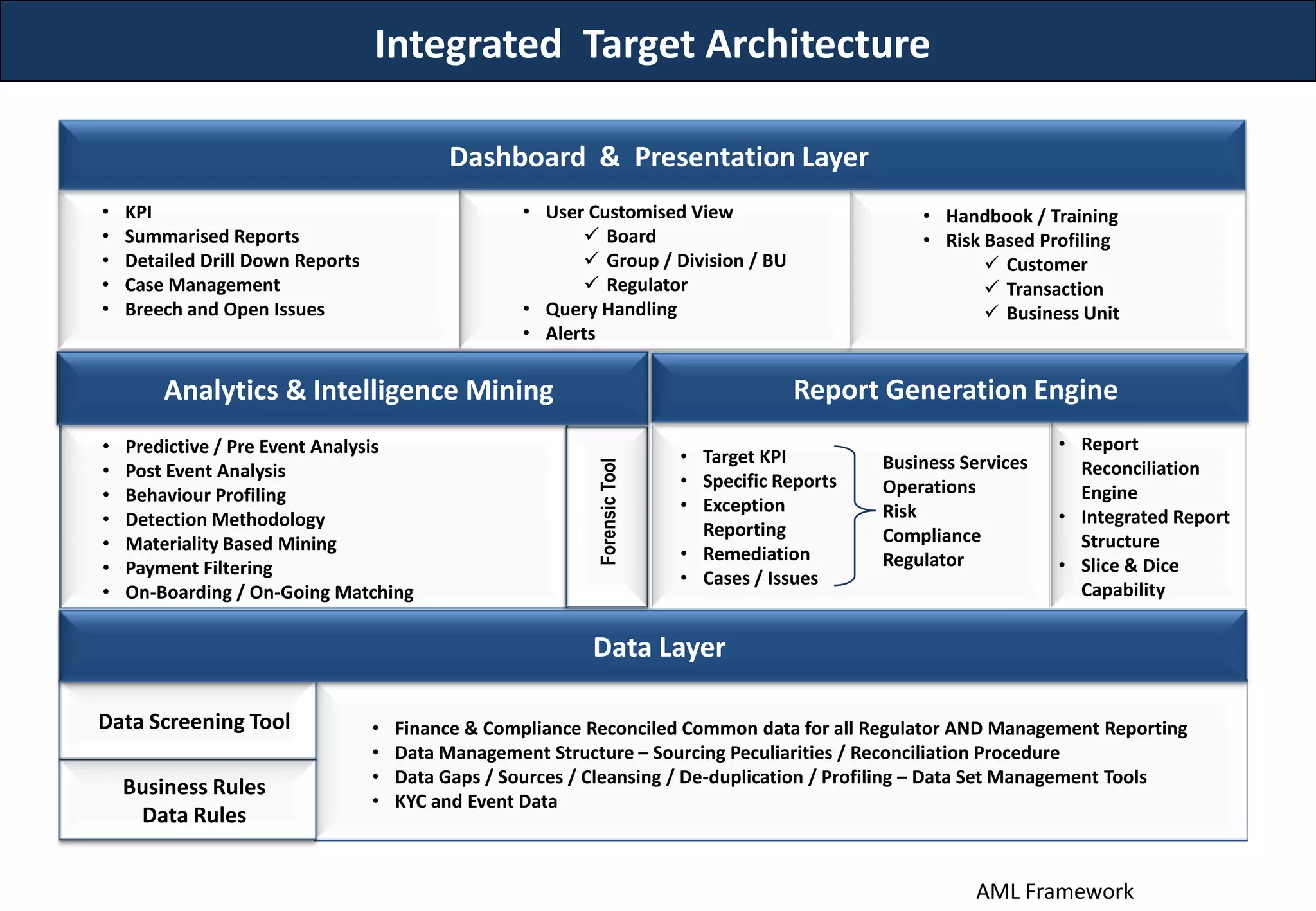

2. The target state aims to establish consistent AML processes, full business engagement, defined risk categorization, ongoing enhancement, and complex scenario coverage.

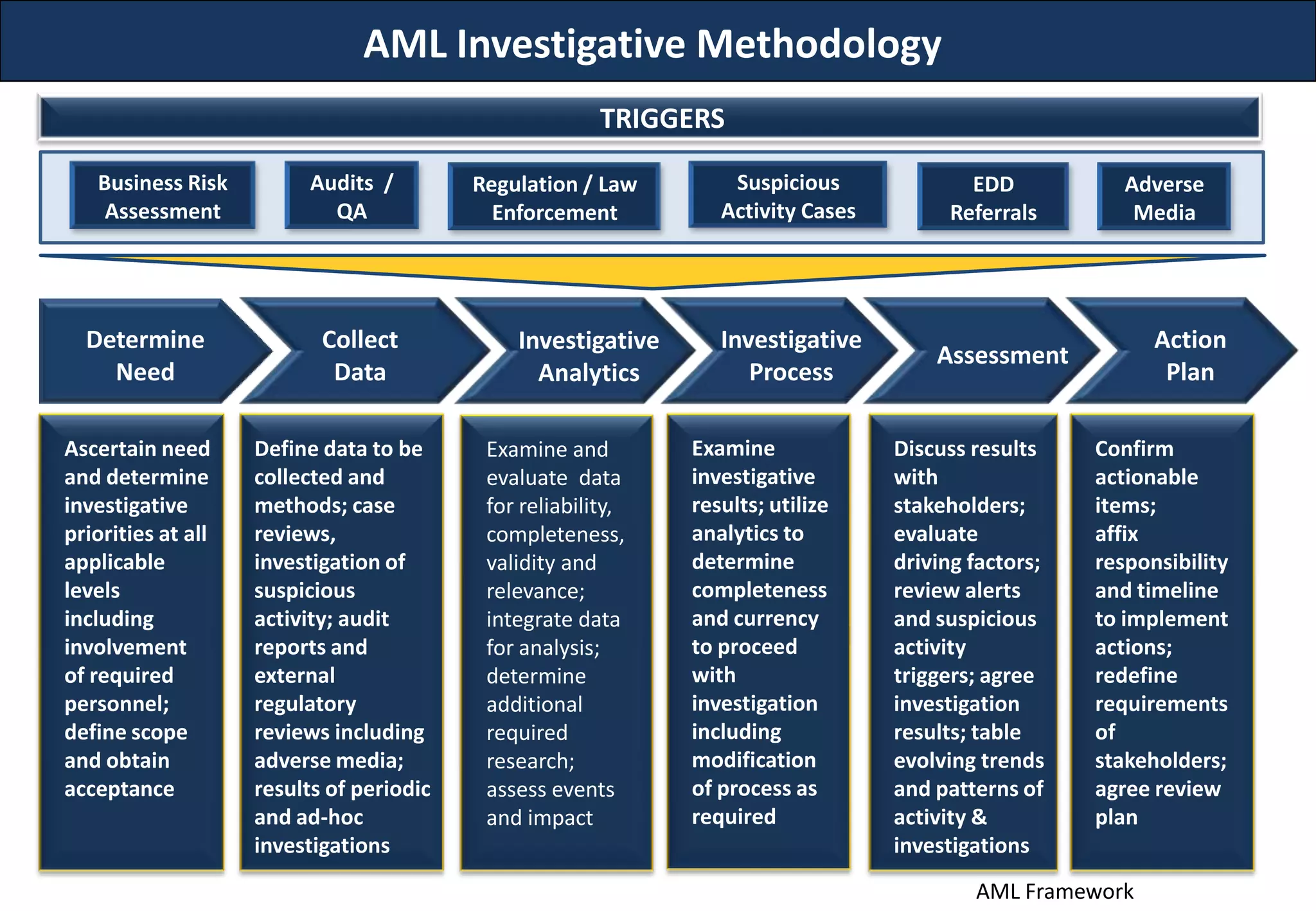

3. An investigative methodology is outlined involving determining needs, collecting data, examining results, and agreeing on action plans to address triggers like suspicious activity cases.