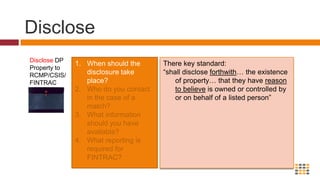

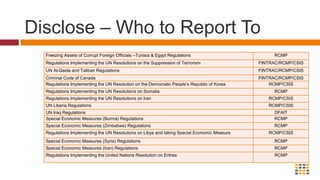

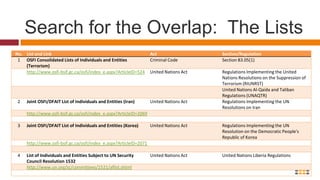

This document discusses trade and financial sanctions and their implications for organizations. It covers topics such as what sanctions are, determining if an organization possesses property owned by designated persons, preventing transactions involving sanctioned entities, and reporting requirements. The document provides guidance on searching client lists against sanctions lists, resolving potential matches, freezing identified property, and exceptions to freezing rules.

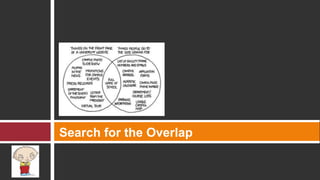

![Includes: Third Parties, Beneficial Owners, Beneficial Owners (to the extent reasonably possible), Trust Settlors and Trustees. [silent on transactions]Search for the OverlapSearching obligations generally relate to FIs – some regulations require MSB searching also – such as UN Libya Regulations](https://image.slidesharecdn.com/20110714sanctionspresentation-110901104205-phpapp01/85/AML-Sanctions-Presentation-12-320.jpg)

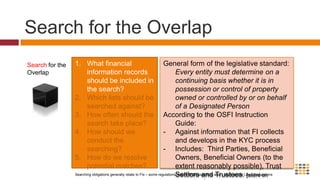

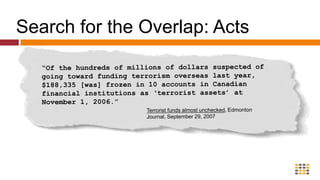

![Search for the Overlap: Acts“Of 513 entries on the [UN Security Council Terrorist] list, 38 people are reported or believed to be dead... A third of the entries are missing basic information, such as full names, dates of birth and other particulars.”Dead People on U.N. terrorism sanctions list: envoy, Reuters, July 14, 2009](https://image.slidesharecdn.com/20110714sanctionspresentation-110901104205-phpapp01/85/AML-Sanctions-Presentation-18-320.jpg)

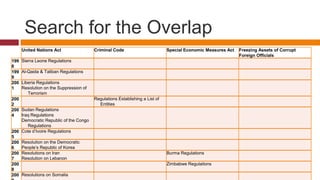

![Search for the Overlap: Acts“Of the hundreds of millions of dollars suspected of going toward funding terrorism overseas last year, $188,335 [was] frozen in 10 accounts in Canadian financial institutions as ‘terrorist assets’ at November 1, 2006.”Terrorist funds almost unchecked, Edmonton Journal, September 29, 2007](https://image.slidesharecdn.com/20110714sanctionspresentation-110901104205-phpapp01/85/AML-Sanctions-Presentation-19-320.jpg)

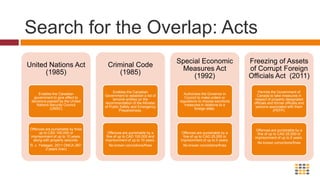

![Search for the OverlapWhat financial information records should be included in the search? Which lists should be searched against?How often should the search take place? How should we conduct the searching?How do we resolve potential matches?There key standard:“shall disclose… the existence of property… that they have reason to believe is owned or controlled by or on behalf of a listed person”OSFI recommends that the assessment be made “…based on all the information available to it [including]… “know your client” information and the determination may require the use of enhanced due diligence measures in the event of uncertainty”. Search for the Overlap](https://image.slidesharecdn.com/20110714sanctionspresentation-110901104205-phpapp01/85/AML-Sanctions-Presentation-27-320.jpg)