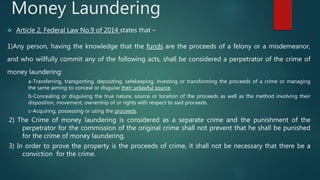

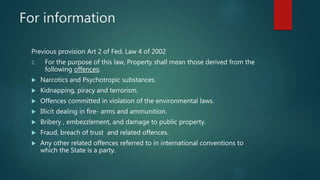

The document provides an overview of anti-money laundering (AML) regulations and issues in the UAE, defining money laundering as the process of legitimizing criminal proceeds through three stages: placement, layering, and integration. It also outlines relevant federal laws, international treaties, and the obligations of financial institutions and designated non-financial businesses to report suspicious activities. Recommendations from the MENA Financial Action Task Force (FATF) further delineate requirements for customer due diligence and record-keeping in various professions.